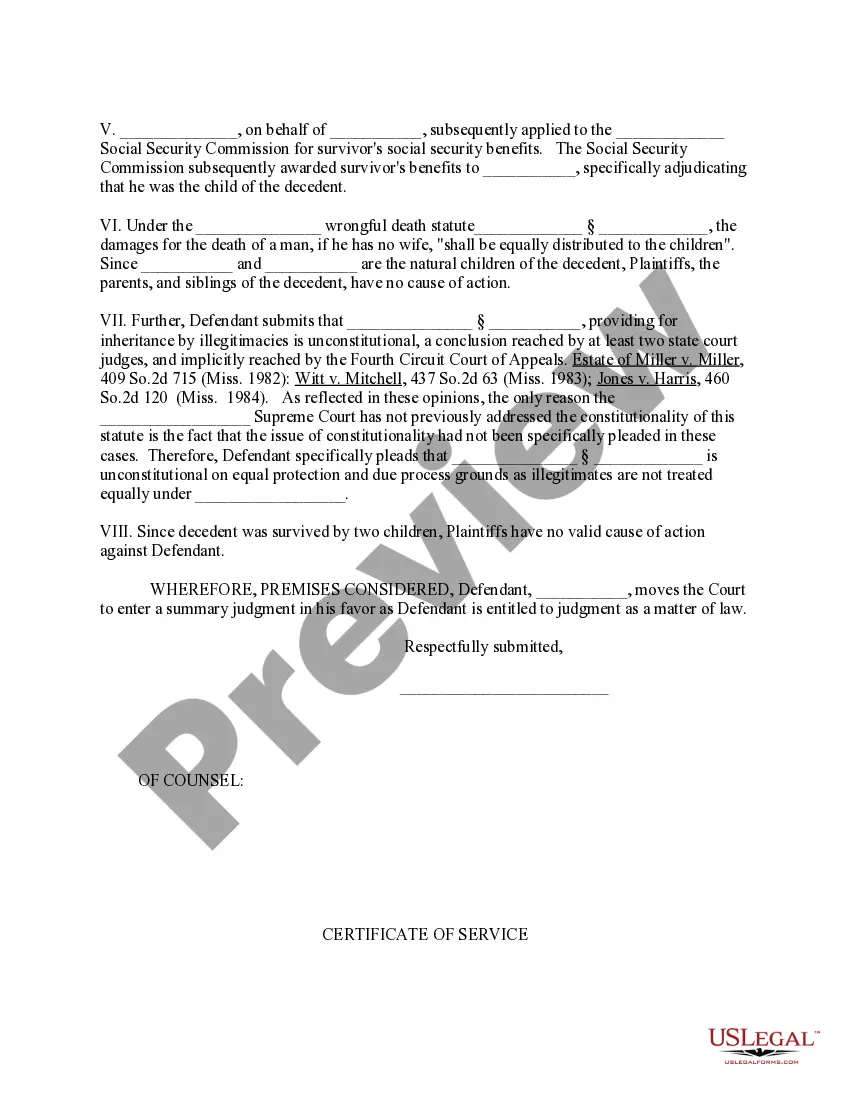

North Carolina Motion for Summary Judgment - Heirship - Wrongful Death Case for Failure of Valid Cause of Action

Description

How to fill out Motion For Summary Judgment - Heirship - Wrongful Death Case For Failure Of Valid Cause Of Action?

Choosing the best authorized file template might be a battle. Needless to say, there are a variety of themes available online, but how will you find the authorized develop you want? Make use of the US Legal Forms site. The support delivers a large number of themes, including the North Carolina Motion for Summary Judgment - Heirship - Wrongful Death Case for Failure of Valid Cause of Action, that can be used for business and personal needs. All the forms are examined by professionals and meet up with state and federal requirements.

If you are currently signed up, log in to your bank account and then click the Obtain button to find the North Carolina Motion for Summary Judgment - Heirship - Wrongful Death Case for Failure of Valid Cause of Action. Make use of bank account to look from the authorized forms you might have purchased in the past. Go to the My Forms tab of your own bank account and have yet another version from the file you want.

If you are a fresh customer of US Legal Forms, here are simple instructions so that you can comply with:

- Very first, be sure you have selected the appropriate develop to your city/county. You are able to check out the shape while using Preview button and look at the shape description to ensure it will be the right one for you.

- In case the develop does not meet up with your preferences, take advantage of the Seach discipline to get the right develop.

- When you are certain the shape is acceptable, select the Acquire now button to find the develop.

- Opt for the costs plan you desire and type in the needed details. Build your bank account and pay for the order utilizing your PayPal bank account or bank card.

- Opt for the file structure and acquire the authorized file template to your device.

- Full, change and printing and indicator the obtained North Carolina Motion for Summary Judgment - Heirship - Wrongful Death Case for Failure of Valid Cause of Action.

US Legal Forms is the biggest collection of authorized forms that you can see different file themes. Make use of the company to acquire professionally-produced papers that comply with express requirements.

Form popularity

FAQ

Statute of Limitations in North Carolina In North Carolina, the statute of limitations for debt is three years from the last activity on your account. That is how much time a debt collector has to file a lawsuit to recover the debt through the court system,. It's one of the shortest such limits in the country.

NC Specifics If the executor has faithfully fulfilled the notification duties in Task: Publish Notice of Death, then creditors will have only 90 days from the date of the first publication of notice to creditors, or 90 days from an individual notification, whichever comes later.

The statute of limitations for contesting a will in North Carolina is three years from the date of the decedent's death. This means that an individual must file a claim to contest the will within three years of the decedent's passing, or they will lose the right to challenge the will.

Elective Share Based on Length of Marriage The following percentages apply in North Carolina: If the couple was married for less than 5 years, the surviving spouse gets 15% of total net assets. 25% if the couple was married for more than 5 years, but less than 10 years.

This Form (AOC-E-201) is used to start the process of settling a person's estate after they die (Probate). It's a request to make the Will and appointment of the Executor official and should be filled out by the Personal Representative.

§ 28A-19-6. (a) After payment of costs and expenses of administration, the claims against the estate of a decedent must be paid in the following order: First class. Claims which by law have a specific lien on property to an amount not exceeding the value of such property.

Notices to creditors must be published once a week for four (4) consecutive weeks and should state that claims must be filed by a date certain, which date is at least three (3) months from the date of first publication of the notice.

Rights Afforded to Creditors During Estate Administration Creditors must pursue legal action within two years of the date the estate enters probate. Once the deadline passes, they can't try to collect on the debt owed to them.