North Carolina Agreement for Sales of Data Processing Equipment

Description

How to fill out Agreement For Sales Of Data Processing Equipment?

Locating the correct legal document template can be a challenge. Of course, there are numerous templates available online, but how do you find the legal form you require? Utilize the US Legal Forms website. This service offers thousands of templates, including the North Carolina Agreement for Sale of Data Processing Equipment, that can be utilized for business and personal purposes. All forms are reviewed by experts and comply with federal and state regulations.

If you are already a registered user, sign in to your account and click on the Download button to acquire the North Carolina Agreement for Sale of Data Processing Equipment. Use your account to browse through the legal forms you have previously obtained. Navigate to the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps you can follow: First, ensure you have chosen the correct form for your city/state. You can view the form using the Preview button and read the form description to confirm it is the right one for you. If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are confident that the form is correct, click the Purchase now button to obtain the form. Select the pricing plan you prefer and enter the required information. Create your account and pay for your order using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained North Carolina Agreement for Sale of Data Processing Equipment.

The US Legal Forms website is an invaluable resource for anyone in need of legal documents, providing a straightforward method to obtain the necessary paperwork.

- US Legal Forms is the largest collection of legal templates where you can find a variety of document forms.

- Utilize the service to download properly crafted documents that adhere to state regulations.

- Ensure you select the correct document type for your needs.

- All templates are verified for compliance with legal standards.

- Easily navigate through your account to access and manage your previously downloaded forms.

- Follow simple steps to create your account and make your purchase.

Form popularity

FAQ

The D-400V is a payment voucher for individuals who need to send a payment along with their NC D-400 tax return. It is important for ensuring that your payment is properly processed and credited to your account. If you are engaged in activities, like negotiating the North Carolina Agreement for Sales of Data Processing Equipment, being meticulous with tax documents like the D-400 and D-400V is essential for maintaining compliance. Utilizing uslegalforms can help streamline this process for you.

Claiming the NC standard deduction can be a beneficial strategy for many taxpayers in North Carolina. It can simplify your tax filing process by allowing you to reduce your taxable income without itemizing deductions. If your business activities involve agreements, such as the North Carolina Agreement for Sales of Data Processing Equipment, it might make sense to evaluate your eligibility for this deduction. This decision can significantly impact your overall tax liability.

Failing to submit an NC 4 form can lead to under-withholding of state income tax from your paycheck, which may result in tax-related challenges later. This can also increase your tax liability when you file your D-400. If your business involves agreements like the North Carolina Agreement for Sales of Data Processing Equipment, proper documentation is crucial for accurate tax reporting. Consider using the uslegalforms platform to guide you through these requirements.

The NC D-400 form is the official income tax return used by North Carolina residents to file their annual income taxes. It includes sections for reporting income, deductions, and credits. If you're dealing with business transactions, such as the North Carolina Agreement for Sales of Data Processing Equipment, it's essential to properly fill out the D-400. This helps you manage your tax liability effectively.

The NC tax filing D-400 is the primary income tax return form used by residents of North Carolina. It allows individuals to report their income, claim deductions, and calculate their tax liability. If you transact in any agreements, like the North Carolina Agreement for Sales of Data Processing Equipment, you must report any related income on this form. Utilizing this form helps ensure that you comply with state tax obligations.

To obtain a sales permit in North Carolina, you must first register your business with the state, which can often be done online. Following registration, you will need to apply for the appropriate sales and use tax permit through the North Carolina Department of Revenue. This process typically requires you to provide necessary documentation and possibly the North Carolina Agreement for Sales of Data Processing Equipment to clarify your intent and services. Uslegalforms offers resources to guide you through permit applications, ensuring you meet all requirements.

North Carolina offers significant incentives for data centers, such as tax credits and exemptions that make it an attractive location for businesses. The state has a competitive utility rate structure and ample access to renewable energy, which is crucial for data processing operations. Moreover, the strategic location provides access to major markets, enhancing logistics and connectivity. Utilizing a North Carolina Agreement for Sales of Data Processing Equipment can help data centers formalize their transactions and maximize operational benefits.

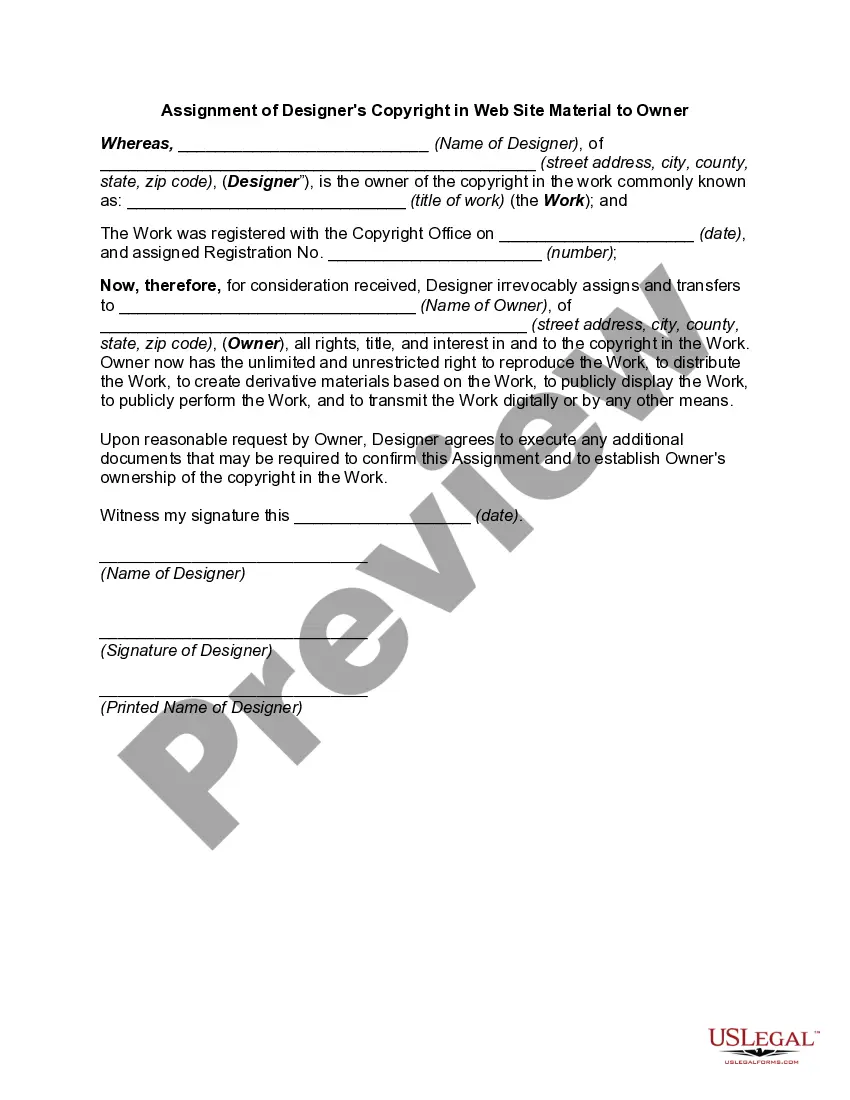

For a North Carolina Agreement for Sales of Data Processing Equipment to have legal effect, it must include clear terms, mutual agreement between the parties, and a lawful objective. It's essential to ensure that both the buyer and seller understand the rights and responsibilities involved. Additionally, any necessary signatures from all parties must be obtained to validate the agreement. By using a reliable platform like uslegalforms, you can obtain templates that streamline this process and help ensure compliance with state laws.

North Carolina data center legislation includes laws that facilitate the growth of this industry while ensuring responsible practices. Important provisions often relate to tax incentives, infrastructure support, and the North Carolina Agreement for Sales of Data Processing Equipment. Staying informed about this legislation can provide you with the tools necessary to maximize your operation’s potential in this dynamic environment.

Data centers face various legal challenges, including data privacy, cybersecurity, and compliance with state regulations. A key concern involves the North Carolina Agreement for Sales of Data Processing Equipment, which impacts how data centers acquire essential equipment. It is crucial for operators to address these legal aspects to avoid costly penalties and maintain operational efficiency.