North Carolina Self-Employed Lifeguard Services Contract

Description

How to fill out Self-Employed Lifeguard Services Contract?

You can spend time online looking for the legal document format that meets the state and federal requirements you need.

US Legal Forms offers a vast array of legal documents that have been reviewed by experts.

It is easy to obtain or print the North Carolina Self-Employed Lifeguard Services Contract from the service.

- If you possess a US Legal Forms account, you can sign in and press the Download button.

- Subsequently, you can complete, alter, print, or sign the North Carolina Self-Employed Lifeguard Services Contract.

- Each legal document format you acquire is yours indefinitely.

- To obtain another copy of a purchased form, visit the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct format for the area/city of your choice. Check the form details to confirm you have chosen the right document.

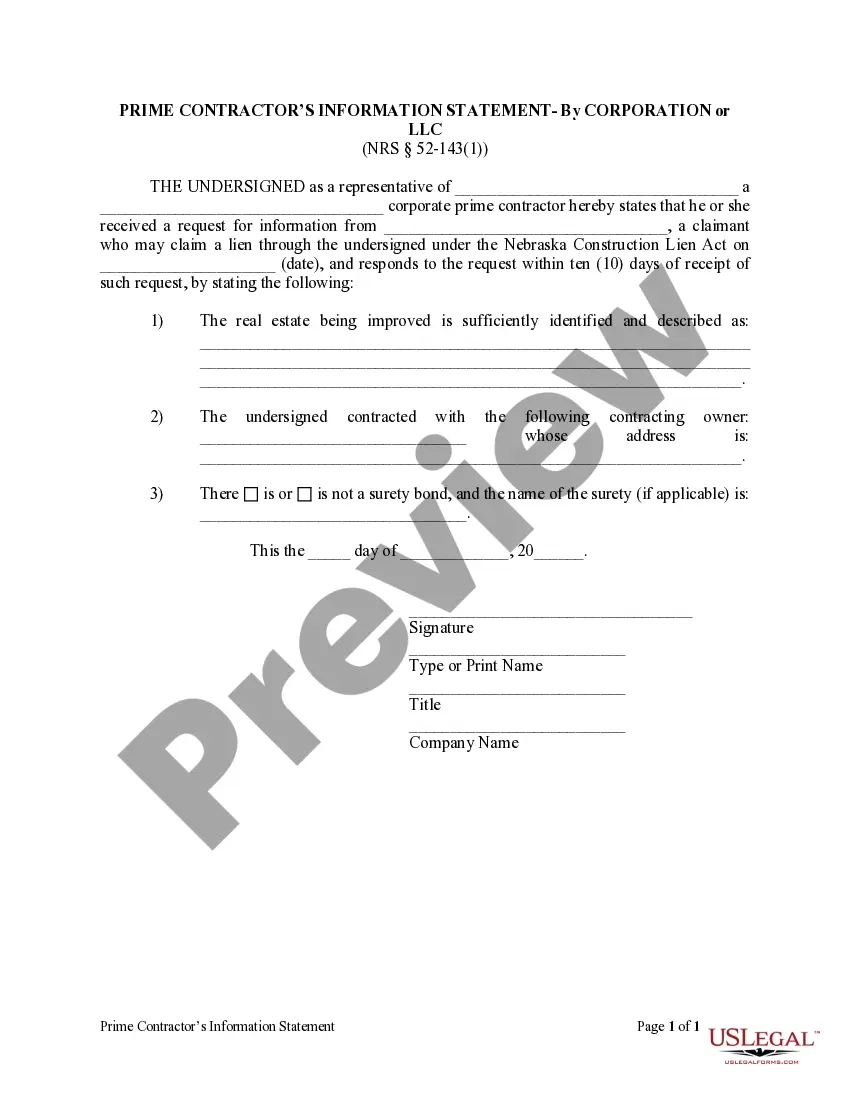

- If available, utilize the Preview button to review the document format as well.

- If you want to find another version of the form, use the Search field to locate the format that fulfills your requirements.

- Once you have found the format you need, click Purchase now to proceed.

- Select your pricing plan, enter your details, and register for a free account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal document.

- Choose the format of the file and download it to your device.

- Make modifications to the file if necessary. You can fill out, change, sign, and print the North Carolina Self-Employed Lifeguard Services Contract.

- Download and print thousands of document templates using the US Legal Forms Website, which provides the largest compilation of legal documents.

- Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

A contract that is used for appointing a genuinely self-employed individual such as a consultant (or a profession or business run by that individual) to carry out services for another party where the relationship between the parties is not that of employer and employee or worker.

If you have a 1099-NEC that is not self-employment income subject to self-employment taxes, you need to enter the income in Box 3 of a 1099-MISC instead of Box 1 of the 1099-NEC. If your income is not self-employment income, you do not need to use Schedule C to report business income.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

If payment for services you provided is listed on Form 1099-NEC, Nonemployee Compensation, the payer is treating you as a self-employed worker, also referred to as an independent contractor. You don't necessarily have to have a business for payments for your services to be reported on Form 1099-NEC.

There are three easy steps to take when beginning an independent contractor business:Pick a name for your business. The name of your business should shed a little light on what it is you do and who your target clients may be.Get yourself a contracting license.Make sure you figure out your recordkeeping and taxes.

Contract for service. A contract of service is an agreement between an employer and an employee. In a contract for service, an independent contractor, such as a self-employed person or vendor, is engaged for a fee to carry out an assignment or project.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

The IRS says that someone is self-employed if they meet one of these conditions: Someone who carries on a trade or business as a sole proprietor or independent contractor, A member of a partnership that carries on a trade or business, or. Someone who is otherwise in business for themselves, including part-time business