North Carolina Translator And Interpreter Agreement - Self-Employed Independent Contractor

Description

How to fill out Translator And Interpreter Agreement - Self-Employed Independent Contractor?

If you wish to finalize, download, or create authentic document templates, utilize US Legal Forms, the largest collection of legal forms, which are accessible online.

Take advantage of the site’s straightforward and convenient search to locate the documents you need.

Numerous templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to find the North Carolina Translator And Interpreter Agreement - Self-Employed Independent Contractor in just a few clicks.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the purchase.

Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the North Carolina Translator And Interpreter Agreement - Self-Employed Independent Contractor. Every legal document template you obtain is yours forever. You have access to every form you downloaded in your account. Click on the My documents section and choose a form to print or download again. Finalize and download, and print the North Carolina Translator And Interpreter Agreement - Self-Employed Independent Contractor with US Legal Forms. There are numerous professional and state-specific forms you can use for your personal business or personal needs.

- If you are currently a US Legal Forms customer, Log In to your account and click the Acquire button to obtain the North Carolina Translator And Interpreter Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Don’t forget to read the overview.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Select the pricing plan you prefer and enter your credentials to register for an account.

Form popularity

FAQ

In North Carolina, certain agreements do not have to be in writing to be enforceable, particularly verbal contracts under specific conditions. However, for clarity and protection, it's advisable to document agreements, especially those related to services like those covered by the North Carolina Translator And Interpreter Agreement - Self-Employed Independent Contractor. Keeping a written record can help resolve disputes and confirm terms before starting the work.

Billing insurance for interpreter services can be straightforward but requires attention to detail. You should always check if the insurance provider covers interpretation services, and then submit your invoices following their guidelines. Utilize proper documentation, including the North Carolina Translator And Interpreter Agreement - Self-Employed Independent Contractor, to support your claims and ensure timely payments.

In North Carolina, independent contractors enjoy flexibility but also face specific challenges. As part of the North Carolina Translator And Interpreter Agreement - Self-Employed Independent Contractor, you will need to handle your own taxes, which includes self-employment tax. Additionally, independent contractors typically do not receive benefits such as health insurance or retirement plans, so it’s crucial to plan accordingly.

Yes, an interpreter often works as an independent contractor, especially under the North Carolina Translator And Interpreter Agreement - Self-Employed Independent Contractor. This status allows interpreters the freedom to select their clients and manage their schedules, which can lead to more fulfilling work. However, it’s essential to understand the implications of this status, including tax responsibilities and the lack of employee benefits.

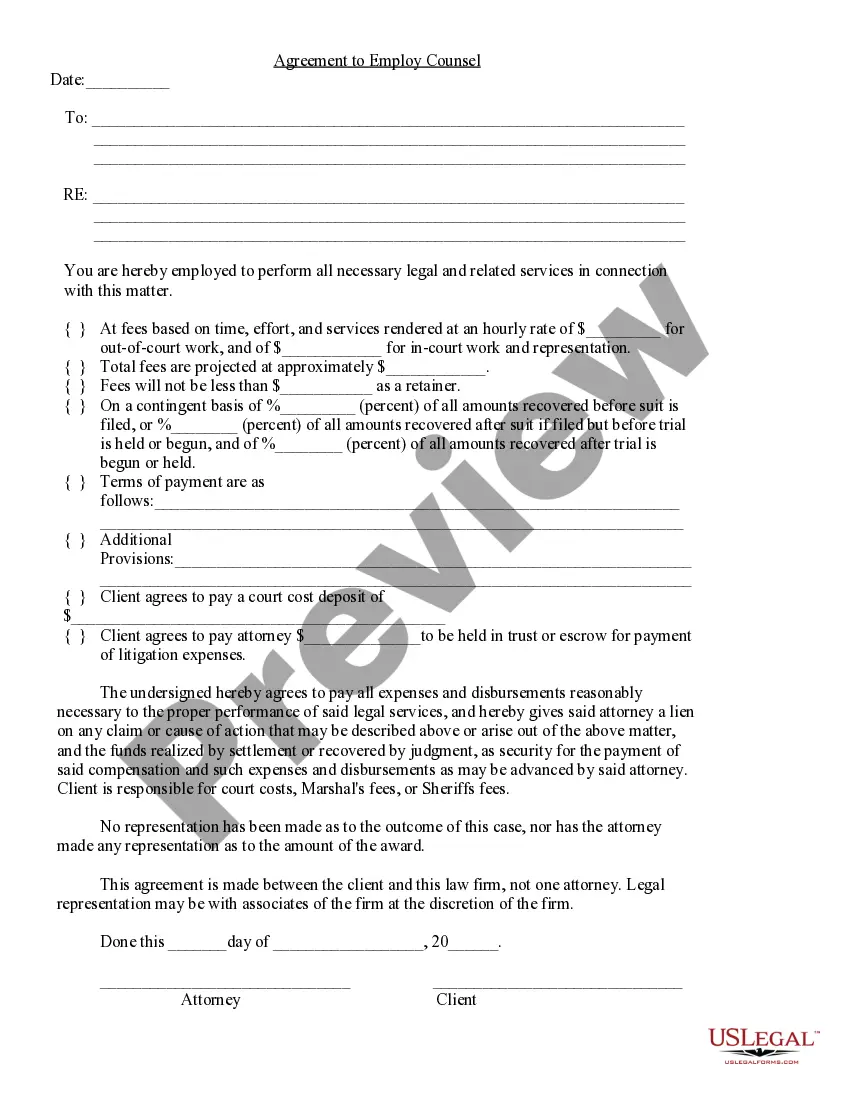

To write an independent contractor agreement, begin with a clear introductory statement that identifies the parties and the purpose of the agreement. Follow with sections detailing the services provided, payment structure, and any specific requirements associated with the North Carolina Translator And Interpreter Agreement - Self-Employed Independent Contractor. Include a section on dispute resolution and signing procedures to ensure the agreement is legally binding. You can utilize platforms like US Legal Forms to access templates that simplify this process.

Filling out an independent contractor agreement involves several steps, starting with entering the effective date and the parties’ names. Clearly define the scope of work, compensation structure, and payment terms based on the North Carolina Translator And Interpreter Agreement - Self-Employed Independent Contractor. Be sure to include confidentiality clauses and termination conditions to protect both parties. Lastly, review the agreement thoroughly to ensure all terms are clear and understood.

To fill out an independent contractor form effectively, begin by gathering your personal information, including your name, address, and contact details. Next, include your business details, such as your business name and tax identification number, if applicable. After that, outline the services you will provide as stated in the North Carolina Translator And Interpreter Agreement - Self-Employed Independent Contractor. This will ensure clarity and compliance throughout the process.

In North Carolina, a contract is legally binding when it meets certain criteria. Both parties must agree to the terms, which typically involves an offer and acceptance. Additionally, the agreement must include consideration, meaning something of value is exchanged. To ensure clarity and protection, using a North Carolina Translator And Interpreter Agreement - Self-Employed Independent Contractor can help outline expectations and obligations, making the contract enforceable.