North Carolina Self-Employed Independent Contractor Chemist Agreement

Description

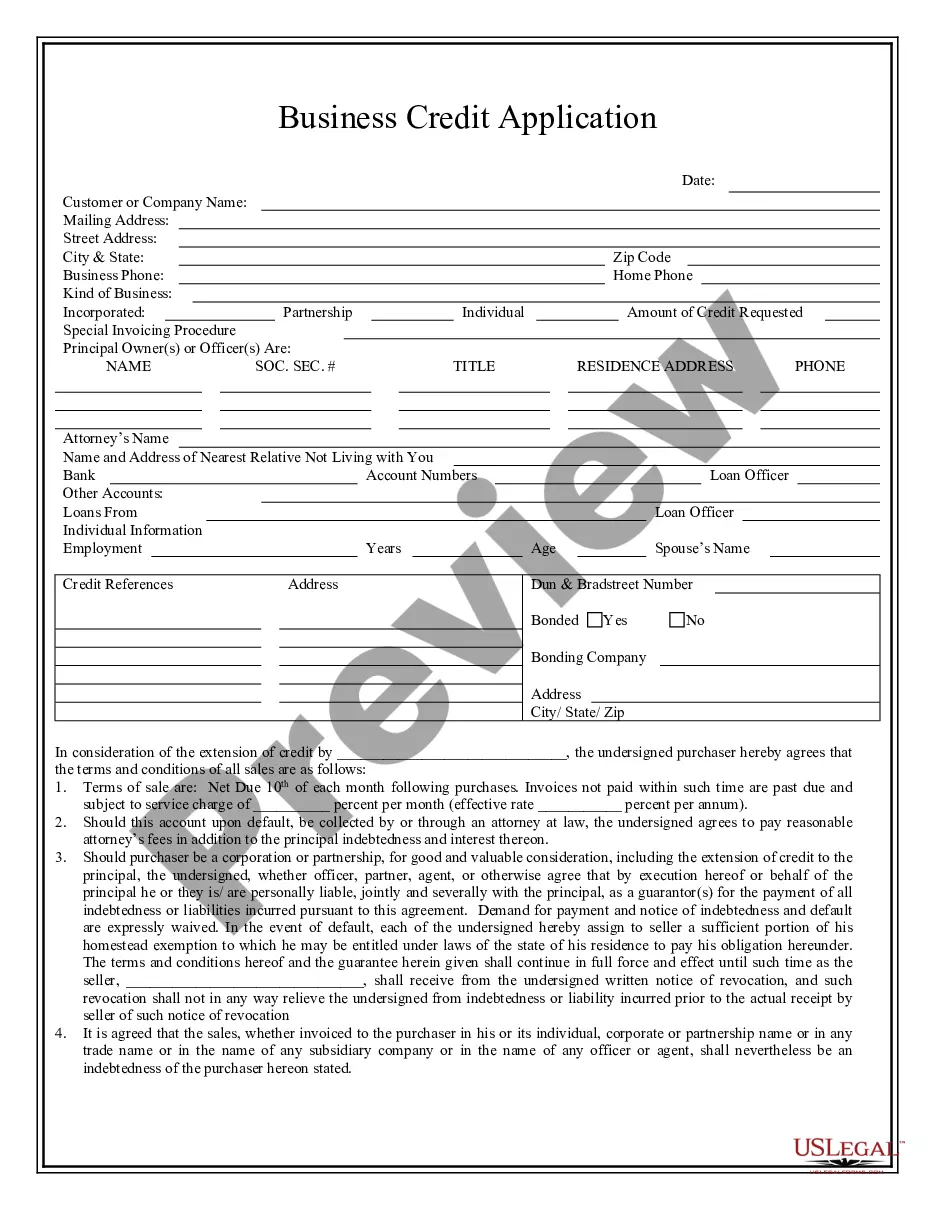

How to fill out Self-Employed Independent Contractor Chemist Agreement?

If you're looking to be thorough, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site’s simple and efficient search feature to find the documents you need. Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Leverage US Legal Forms to locate the North Carolina Self-Employed Independent Contractor Chemist Agreement with just a few clicks.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the North Carolina Self-Employed Independent Contractor Chemist Agreement. Each legal document template you purchase is yours forever. You will have access to every form you downloaded through your account. Go to the My documents section and select a form to print or download again. Compete and obtain, and print the North Carolina Self-Employed Independent Contractor Chemist Agreement with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal requirements.

- If you are already a US Legal Forms user, Log In to your account and click the Purchase button to obtain the North Carolina Self-Employed Independent Contractor Chemist Agreement.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you've selected the form for your specific city/state.

- Step 2. Use the Preview option to review the form's content. Don’t forget to read the overview.

- Step 3. If you're not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you've found the form you need, click the Purchase now button. Choose your preferred pricing plan and enter your information to register for an account.

Form popularity

FAQ

In North Carolina, independent contractors are typically not required to carry workers' compensation insurance. However, depending on your work and clients, having it can offer protection against workplace injuries. It’s wise to evaluate your situation and consider including such clauses in your North Carolina Self-Employed Independent Contractor Chemist Agreement. This proactive approach can save you from potential liabilities.

If you find yourself working without a contract, your rights can be ambiguous. Generally, you may have fewer protections regarding payment and work scope. Therefore, it is advisable to seek a North Carolina Self-Employed Independent Contractor Chemist Agreement to establish your rights clearly. This contract can provide reassurance and legal backing should disputes arise.

Even if you are self-employed, having a contract is highly advisable. A North Carolina Self-Employed Independent Contractor Chemist Agreement allows you to outline the terms of your work with clients. It not only clarifies your responsibilities but also establishes a legal framework in case of any disputes. Thus, securing a well-structured agreement is a smart step toward success.

Yes, having a contract is essential for independent contractors. A North Carolina Self-Employed Independent Contractor Chemist Agreement provides clear boundaries and expectations for both you and your client. It helps protect your rights, defines the scope of work, and ensures that payment terms are understood. Ultimately, a contract can prevent misunderstandings and disputes in your working relationship.

For independent contractors in North Carolina, it is crucial to understand your legal obligations. As a self-employed independent contractor, you must comply with state and federal tax regulations. This includes reporting income and may require obtaining an Employer Identification Number (EIN). A properly drafted North Carolina Self-Employed Independent Contractor Chemist Agreement can help clarify these requirements.

An independent contractor typically fills out several key documents, including the independent contractor agreement and any tax forms required by the IRS. They may also need to provide proof of insurance and business licenses applicable to their field. Using the North Carolina Self-Employed Independent Contractor Chemist Agreement from uslegalforms can simplify this process, ensuring you include all necessary paperwork for compliance.

To write an independent contractor agreement, start by identifying the parties involved and outlining the scope of work. Be sure to specify payment terms, deadlines, and the duration of the agreement. Additionally, include clauses that address confidentiality and termination. For a comprehensive template, consider the North Carolina Self-Employed Independent Contractor Chemist Agreement offered by uslegalforms, which can guide you through the essential elements.

To become a 1099 independent contractor, find clients who need your services and agree on payment terms. It's crucial to keep track of your earnings and expenses, as you will report this income on your tax return. A North Carolina Self-Employed Independent Contractor Chemist Agreement can help formalize your working relationship and clarify your status, making tax season much easier.

Creating an independent contractor agreement involves outlining the scope of work, payment terms, and duration of the contract. Start by including details such as the names of both parties, descriptions of services, and confidentiality clauses. Utilizing a template for a North Carolina Self-Employed Independent Contractor Chemist Agreement can simplify this process and ensure you cover all essential aspects.

To become an independent contractor in North Carolina, start by defining your skills and services. Then, register your business with the state to make it official. You'll also need to understand tax obligations associated with being an independent contractor. Lastly, consider using a North Carolina Self-Employed Independent Contractor Chemist Agreement to set clear terms with clients and protect your interests.