North Carolina Shoring Services Contract - Self-Employed

Description

How to fill out Shoring Services Contract - Self-Employed?

Are you currently in a circumstance where you require documents for various business or personal purposes frequently? There are many legitimate document templates available online, but finding those you can trust is challenging. US Legal Forms offers a vast selection of form templates, such as the North Carolina Shoring Services Contract - Self-Employed, tailored to meet federal and state requirements.

If you are already familiar with the US Legal Forms website and have an account, just Log In. After that, you can download the North Carolina Shoring Services Contract - Self-Employed template.

If you do not have an account and want to start using US Legal Forms, follow these steps.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the North Carolina Shoring Services Contract - Self-Employed at any time. Just click the required form to download or print the document template.

Make use of US Legal Forms, the most extensive collection of legitimate forms, to conserve time and minimize mistakes. The service provides professionally crafted legal document templates suitable for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- Find the form you need and ensure it is for the correct city/county.

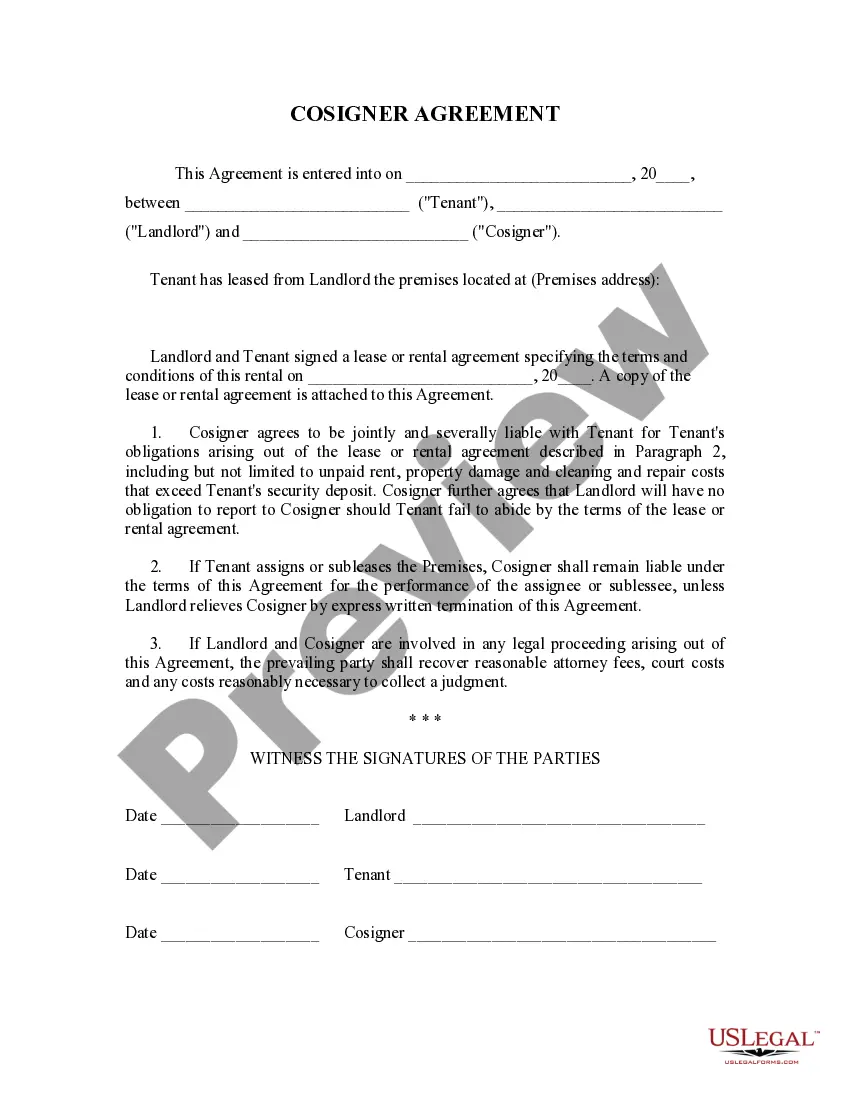

- Utilize the Preview button to review the document.

- Review the details to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to locate the form that fits your needs and requirements.

- Once you identify the appropriate form, click Get now.

- Select the pricing plan you require, fill in the necessary information to create your account, and complete the transaction using PayPal or a credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

In North Carolina, for a contract to be legally binding, it must include an offer, acceptance, and consideration, which refers to something of value exchanged. Additionally, the parties involved must have the capacity to contract and must agree on all essential terms. When entering into a North Carolina Shoring Services Contract - Self-Employed, ensure that all these elements are met for the contract to hold legal weight. To simplify this process, consider using US Legal Forms, which provides templates to help you craft effective contracts.

In North Carolina, individuals can perform certain types of work without a contractor license, including jobs valued at less than $30,000, unless the work requires a specific license. However, it's important to be aware that unlicensed contractors may face legal consequences, especially in the context of a North Carolina Shoring Services Contract - Self-Employed. To ensure compliance and understand your limits, consult the resources available on the US Legal Forms platform.

While North Carolina does not legally require LLCs to have an operating agreement, it is highly advisable to draft one. An operating agreement specifies the management structure and operating procedures, thus providing clarity and protection for members. This can be particularly useful for those engaging in a North Carolina Shoring Services Contract - Self-Employed to mitigate disputes. For assistance and templates, consider exploring the offerings from US Legal Forms.

In North Carolina, independent contractors must comply with local and federal tax regulations, including reporting and paying their own taxes. They should also have a clear North Carolina Shoring Services Contract - Self-Employed that outlines terms, deliverables, and payment arrangements. It's essential to understand that independent contractors do not receive employee benefits and have different liabilities. For comprehensive guidance, US Legal Forms offers a variety of resources to help you navigate these requirements effectively.

Writing an independent contractor agreement starts with defining the roles and responsibilities of each party involved. Clearly articulate the terms of payment, deliverables, and timelines. This clarity helps prevent misunderstandings, especially for a North Carolina Shoring Services Contract - Self-Employed. Consider using templates from USLegalForms to ensure you cover all necessary aspects effectively.

Filling out an independent contractor agreement involves detailing the scope of work, payment terms, and performance expectations. Be sure to include any relevant deadlines and conditions for termination. It’s important that this document reflects the needs of both parties, particularly in contexts like a North Carolina Shoring Services Contract - Self-Employed. Using resources from USLegalForms can guide you in drafting a comprehensive agreement.

To fill out an independent contractor form, begin by entering your personal information, such as your name and contact details. Next, specify the nature of services you provide and the terms of payment. Ensure accuracy throughout; an organized approach will streamline your North Carolina Shoring Services Contract - Self-Employed. USLegalForms offers templates that can make this task much easier.

To write a self-employed contract, start by clearly stating the names of the parties involved and the services to be provided. Include specific terms, such as payment rates, deadlines, and any other obligations. It’s essential to ensure that the contract complies with state laws, especially for a North Carolina Shoring Services Contract - Self-Employed. Consulting a legal expert or using platforms like USLegalForms can simplify this process.

Personal service contracts in North Carolina are usually subject to sales tax, depending on the nature of the services rendered. However, if these services are performed under a North Carolina Shoring Services Contract - Self-Employed, you might find certain exemptions applicable. It is advisable to review your contract and consult a tax expert for clarity.

Service contracts in North Carolina are generally taxable unless they meet specific criteria for exemption. For example, if your service contract involves personal labor not tied to goods sold, it may qualify for exemption. Always confirm the tax status of your North Carolina Shoring Services Contract - Self-Employed to avoid unexpected tax liabilities.