North Carolina Cable Disconnect Service Contract - Self-Employed Independent Contractor

Description

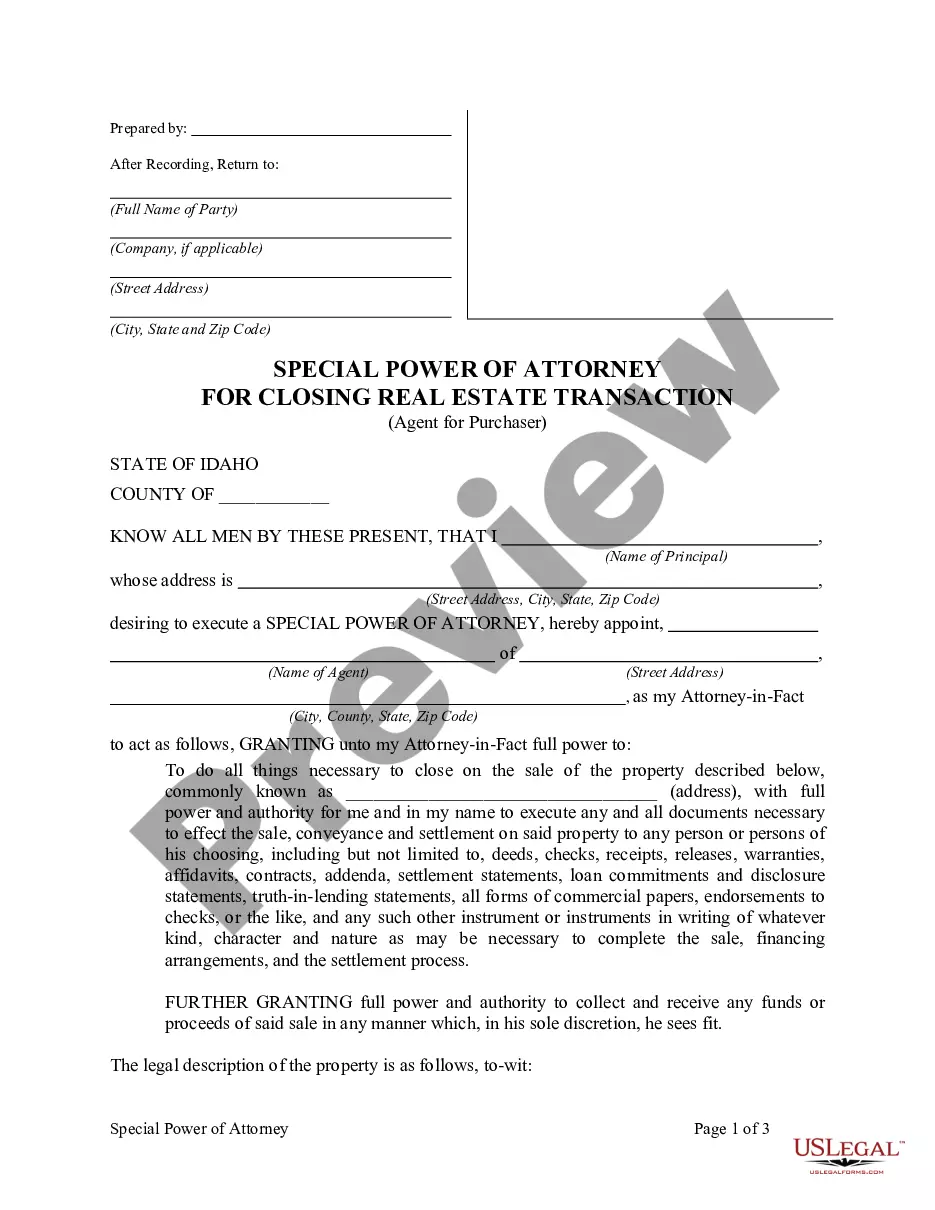

How to fill out Cable Disconnect Service Contract - Self-Employed Independent Contractor?

Are you presently in a scenario where you need paperwork for either corporate or personal reasons almost every day? There are numerous legal document templates accessible online, but finding reliable ones is not simple.

US Legal Forms provides thousands of template options, including the North Carolina Cable Disconnect Service Contract - Self-Employed Independent Contractor, which are created to satisfy federal and state requirements.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the North Carolina Cable Disconnect Service Contract - Self-Employed Independent Contractor template.

Choose a convenient file format and download your version.

Find all the document templates you have purchased in the My documents list. You can obtain another copy of the North Carolina Cable Disconnect Service Contract - Self-Employed Independent Contractor at any time if needed. Just select the desired form to download or print the document format. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers professionally created legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you don't have an account and wish to utilize US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your specific locality/region.

- Use the Preview button to review the document.

- Read the description to confirm that you have selected the correct form.

- If the document isn't what you're looking for, utilize the Search area to find the form that suits your requirements.

- Once you find the correct form, click Buy now.

- Select the pricing plan you want, complete the necessary details to create your account, and purchase the transaction using your PayPal or credit card.

Form popularity

FAQ

Writing an independent contractor agreement requires clarity and specificity. Start by including key information such as the contractor's details, the project description linked to the North Carolina Cable Disconnect Service Contract - Self-Employed Independent Contractor, payment specifications, and deadlines. Ensure you highlight termination clauses and dispute resolution methods. Utilizing resources like uslegalforms can help streamline this process, providing templates that cover standard legal requirements.

Yes, you can write your own service agreement. When drafting it, ensure it includes all essential elements related to the North Carolina Cable Disconnect Service Contract - Self-Employed Independent Contractor, such as services provided, payment terms, and duration. However, consider using templates from trusted platforms like uslegalforms to ensure that you cover all legal aspects and avoid any pitfalls.

To fill out an independent contractor agreement, start with the contractor's details and scope of work specifically aligned with the North Carolina Cable Disconnect Service Contract - Self-Employed Independent Contractor. Clearly outline payment terms, deadlines, and any project milestones. Ensure both parties review the agreement for clarity and mutual understanding before signing, creating a solid foundation for your working relationship.

Filling out an independent contractor form is straightforward. Begin by entering your personal information, such as your name and address, then specify your services related to the North Carolina Cable Disconnect Service Contract - Self-Employed Independent Contractor. Make sure to include relevant payment terms and work details. Finally, review the form for accuracy before submitting, ensuring all required fields are completed.

In North Carolina, independent contractors generally do not require workers' compensation insurance under normal circumstances. However, if you work under a North Carolina Cable Disconnect Service Contract - Self-Employed Independent Contractor and have employees, you may need to secure coverage. It is crucial to evaluate your specific work situation and risk exposure. Using a platform like uslegalforms can provide you with the resources and guidance to ensure compliance and make informed decisions.

Independent contractor status in North Carolina carries several implications, particularly regarding taxes and benefits. As a self-employed individual, you are responsible for your tax obligations without employer contributions. This classification affects how you approach contracts like the North Carolina Cable Disconnect Service Contract - Self-Employed Independent Contractor, influencing your rights and responsibilities in the business relationship.

To terminate a contract with an independent contractor, check the agreement for specific termination procedures. Write a formal notice stating your decision and any reasons applicable. This ensures clarity and keeps the process professional, especially in the context of the North Carolina Cable Disconnect Service Contract - Self-Employed Independent Contractor.

No, it is not illegal to terminate a 1099 contract. However, you must follow the terms outlined within the North Carolina Cable Disconnect Service Contract - Self-Employed Independent Contractor. Properly adhering to the termination process, such as providing notice, can help avoid potential disputes and maintain a positive working relationship.

To terminate a contract with an independent contractor, begin by reviewing the contract for any termination clauses. Clearly document your reasons for termination, and communicate this in writing to the contractor. Ensure you address any outstanding payments or duties to uphold your obligations under the North Carolina Cable Disconnect Service Contract - Self-Employed Independent Contractor.

To politely terminate a contract with a contractor, you should communicate clearly and respectfully. Begin by expressing appreciation for their work, then state your intention to end the contract, citing any relevant terms. This approach helps maintain professionalism and can be beneficial if you seek to work with them in the future, particularly concerning the North Carolina Cable Disconnect Service Contract - Self-Employed Independent Contractor.