North Carolina Auctioneer Services Contract - Self-Employed Independent Contractor

Description

How to fill out Auctioneer Services Contract - Self-Employed Independent Contractor?

If you seek thorough, acquire, or producing sanctioned document templates, utilize US Legal Forms, the largest assortment of legal forms, available online.

Employ the site's user-friendly and efficient search feature to find the documents you need.

Different templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you desire, click the Buy now button. Choose the payment plan you prefer and enter your details to create an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to obtain the North Carolina Auctioneer Services Contract - Self-Employed Independent Contractor with just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to retrieve the North Carolina Auctioneer Services Contract - Self-Employed Independent Contractor.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

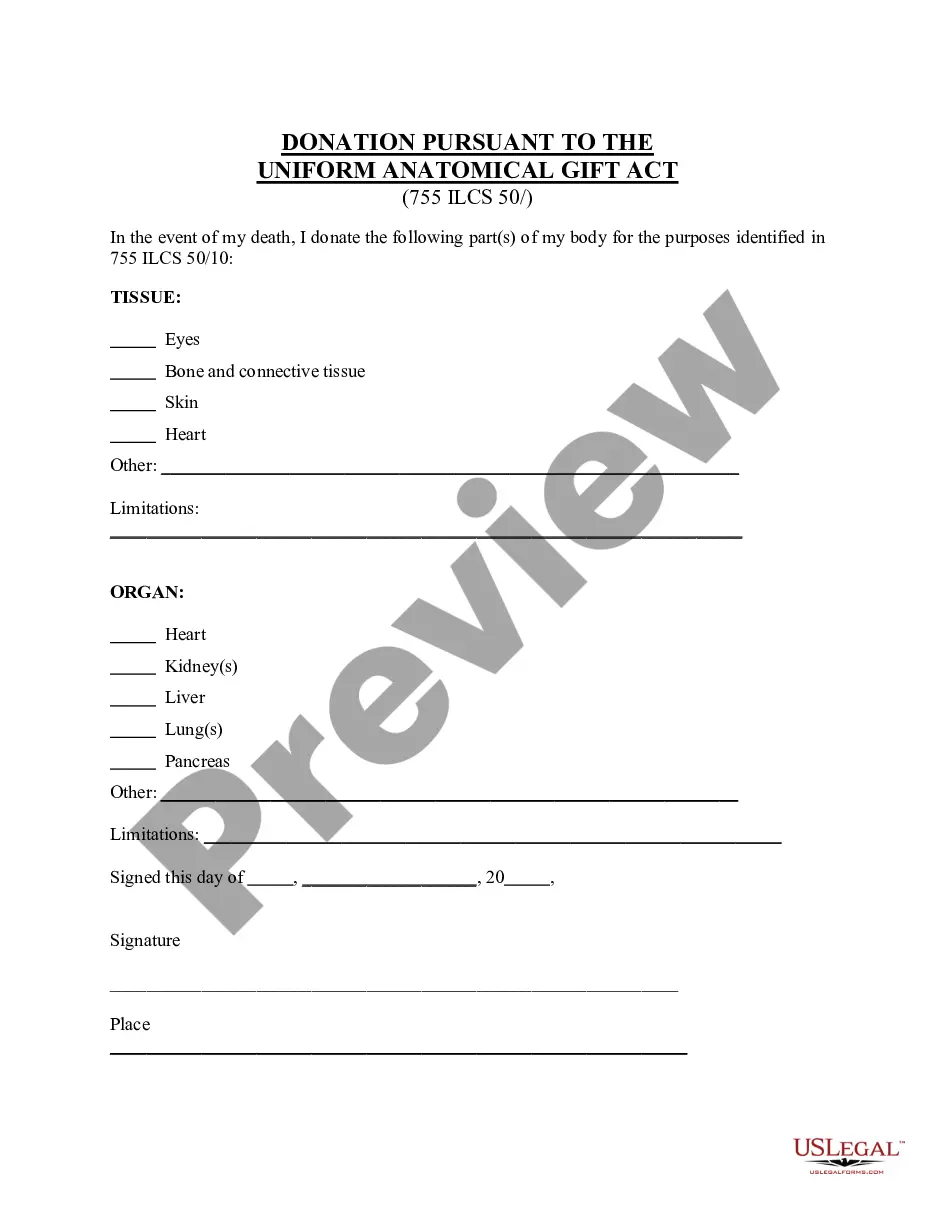

- Step 2. Use the Preview option to view the form's details. Remember to read the description.

- Step 3. If you are dissatisfied with the form, use the Search area at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

Writing a self-employed contract involves detailing the services you will provide and the terms of your work. Start by clearly outlining the scope of work, payment terms, and deadlines. Include relevant legal provisions, such as confidentiality and dispute resolution. For your North Carolina Auctioneer Services Contract - Self-Employed Independent Contractor, consider using a platform like US Legal Forms to ensure you have a comprehensive and compliant agreement.

Independent contractors in North Carolina do not usually require workers' compensation insurance unless they have employees. However, obtaining this insurance can be a smart move to protect yourself against potential job-related injuries. Ensuring you're informed about these requirements is vital when working on the North Carolina Auctioneer Services Contract, helping you mitigate risks.

In North Carolina, you can perform a limited amount of work without a contractor license, typically up to $30,000 for residential projects. For larger projects, or commercial work, you will need the appropriate licenses. This understanding is crucial for those operating under the North Carolina Auctioneer Services Contract and can affect your workflow.

To become an independent contractor in North Carolina, start by registering your business and obtaining any necessary licenses. You should also consider establishing a business bank account and keeping thorough financial records. Familiarizing yourself with the North Carolina Auctioneer Services Contract will help you understand specific requirements in your field.

Typically, if you only work with 1099 employees, you are not required to obtain workers' compensation in North Carolina. However, it’s wise to have clear contracts that define your relationship to avoid any legal complications. Being informed about your responsibilities under the North Carolina Auctioneer Services Contract can protect you from unexpected issues.

In North Carolina, several groups are exempt from workers' compensation requirements. This includes independent contractors and certain types of businesses like sole proprietorships with no employees. Understanding these exemptions can help you manage your responsibilities effectively as a North Carolina Auctioneer Services Contract - Self-Employed Independent Contractor.

In North Carolina, you generally do not need to carry workers' compensation for 1099 employees. However, if you have employees who meet certain criteria, you must provide coverage. Therefore, it’s essential to evaluate your workforce structure carefully to ensure compliance with the North Carolina Auctioneer Services Contract requirements.

As a self-employed independent contractor in North Carolina, you may need general liability insurance to protect against potential claims. Depending on your specific services, you might also consider professional liability insurance to cover errors or omissions. Additionally, having a business owner’s policy can provide a comprehensive package that includes multiple types of coverage tailored for your needs under the North Carolina Auctioneer Services Contract.

In North Carolina, independent contractors must comply with specific legal requirements to ensure they operate within the law. You need to have a clear contract, such as the North Carolina Auctioneer Services Contract - Self-Employed Independent Contractor, to outline the terms of your service. Additionally, you must obtain necessary licenses and permits pertinent to your trade, and manage your taxes appropriately as a self-employed individual. Using platforms like USLegalForms can streamline this process, providing you with tailored legal documents that meet your needs.

The new federal rule for independent contractors aims to clarify the classification of workers in various industries. This rule emphasizes the importance of determining the core aspects of a worker's role, focusing on their independence and entrepreneurial opportunities. For auctioneers, understanding these changes is crucial for compliance. The North Carolina Auctioneer Services Contract - Self-Employed Independent Contractor can provide guidance in navigating these regulations.