North Carolina Electronic Services Form

Description

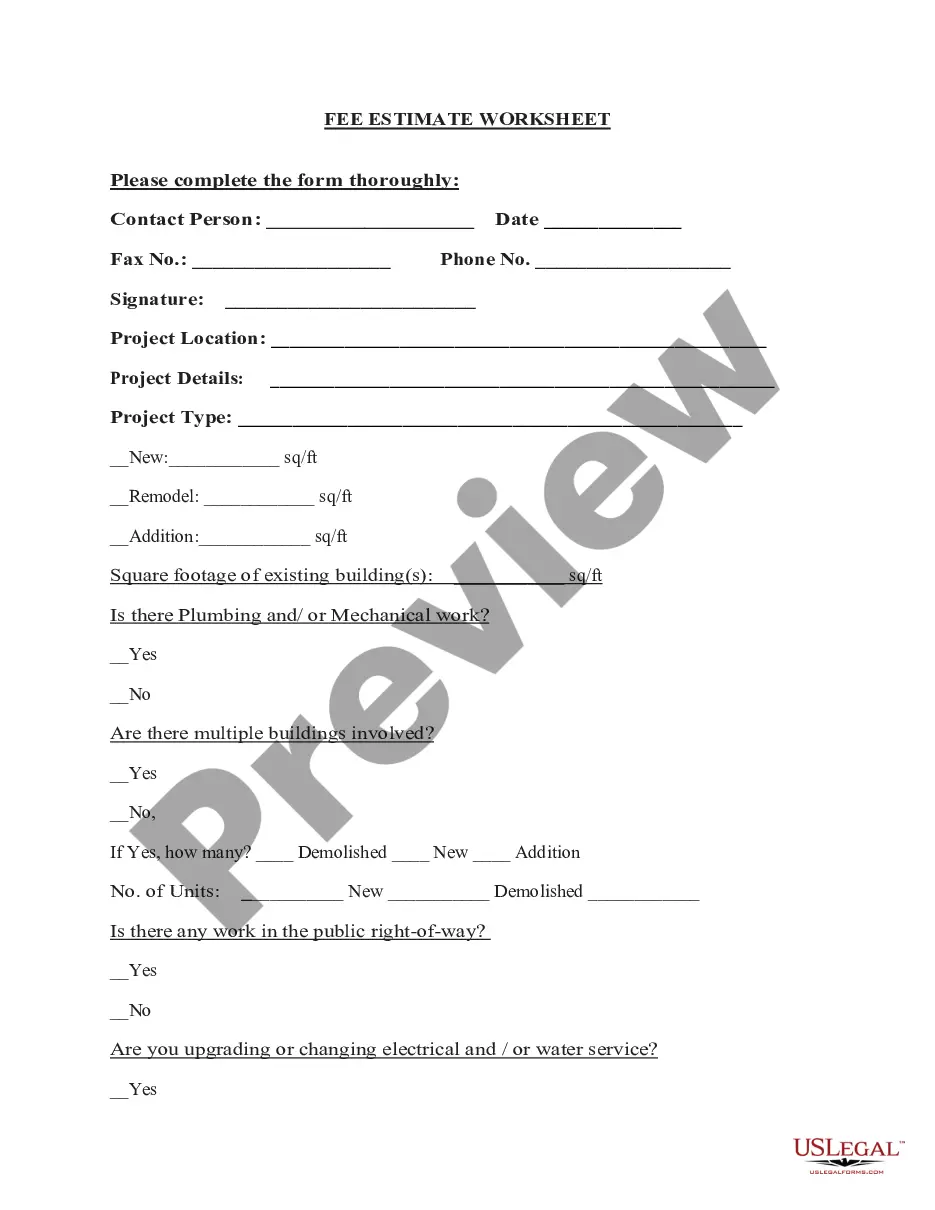

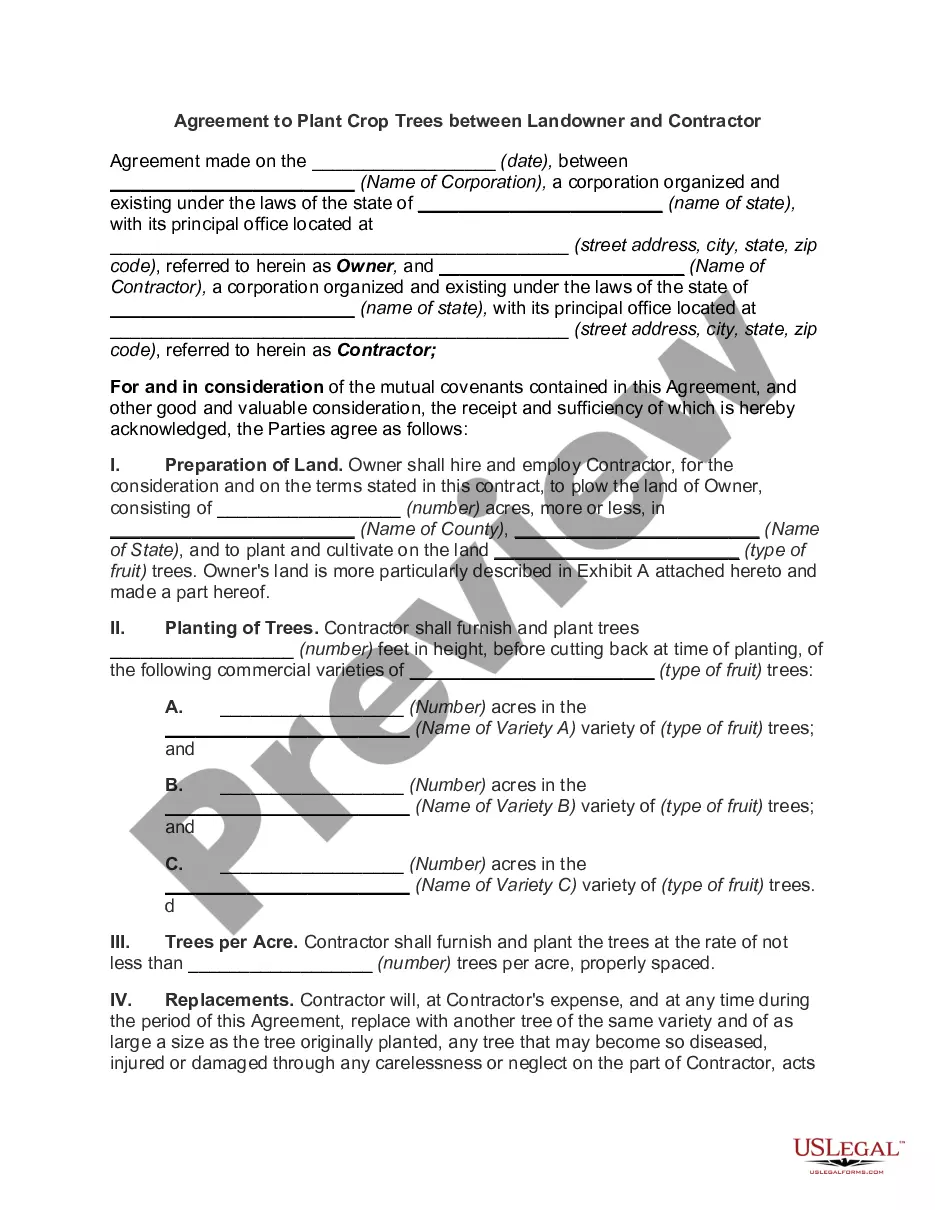

How to fill out Electronic Services Form?

Are you currently within a position in which you require paperwork for sometimes business or specific uses just about every day? There are plenty of authorized papers web templates available on the Internet, but discovering ones you can trust isn`t easy. US Legal Forms gives thousands of type web templates, much like the North Carolina Electronic Services Form, which can be composed to fulfill federal and state needs.

Should you be previously acquainted with US Legal Forms internet site and also have your account, simply log in. Following that, you may acquire the North Carolina Electronic Services Form design.

Unless you provide an bank account and would like to begin using US Legal Forms, adopt these measures:

- Find the type you need and make sure it is to the correct metropolis/state.

- Utilize the Preview option to review the form.

- See the description to actually have selected the correct type.

- When the type isn`t what you are looking for, take advantage of the Look for area to obtain the type that meets your requirements and needs.

- Whenever you find the correct type, click Get now.

- Choose the rates strategy you desire, complete the necessary information to generate your account, and purchase an order using your PayPal or charge card.

- Select a handy document structure and acquire your version.

Discover all of the papers web templates you possess purchased in the My Forms food list. You can obtain a additional version of North Carolina Electronic Services Form whenever, if needed. Just select the required type to acquire or print the papers design.

Use US Legal Forms, probably the most extensive assortment of authorized kinds, to conserve time and prevent mistakes. The assistance gives professionally produced authorized papers web templates which can be used for a variety of uses. Generate your account on US Legal Forms and commence generating your daily life a little easier.

Form popularity

FAQ

If you don't qualify for NC Free File, you can still eFile for a Fee using a competitively priced online eFile provider. Available for current, amended, and prior year returns and payments.

Some software products offer the ability to eFile Form NC-40 (Individual Estimated Income Tax), Form D-410 (Application for Extension for Filing Individual Income Tax Return), and/or Form D-400V (Individual Income Payment Voucher), as well as Form D-400 (Individual Income Tax Return).

The privilege tax cannot be paid online or over the phone. Please use a check or money order.

A copy of your federal tax return unless your federal return reflects a North Carolina address. Other required North Carolina forms or supporting schedules. When, Where, and How to File Your North Carolina Return - NCDOR ncdor.gov ? taxes-forms ? when-where-and-... ncdor.gov ? taxes-forms ? when-where-and-...

Each payment of estimated tax must be accompanied by Form NC-40, North Carolina Individual Estimated Income Tax. You can also pay your estimated tax online. (For more information on estimated income tax, see the Department's website.) North Carolina Individual Income Tax Instructions nc.gov ? files ? 2020-D-401-Instructions nc.gov ? files ? 2020-D-401-Instructions

If you don't qualify for NC Free File, you can still eFile for a Fee using a competitively priced online eFile provider. Available for current, amended, and prior year returns and payments. eFile for Individuals - NCDOR NCDOR (.gov) ? file-pay ? efile-individuals NCDOR (.gov) ? file-pay ? efile-individuals

Form NC-3 and the required W-2 and 1099 statements, (collectively ?Form NC-3?) must be filed electronically. To file Form NC-3 electronically, visit the Department's website at .ncdor.gov. A return not filed electronically is subject to a penalty for failure to file an informational return in the proper format.

Yes, you can file an original Form 1040 series tax return electronically using any filing status. Filing your return electronically is faster, safer, and more accurate than mailing your tax return because it's transmitted electronically to the IRS computer systems. Electronic Filing (e-file) | Internal Revenue Service irs.gov ? faqs ? electronic-filing-e-file irs.gov ? faqs ? electronic-filing-e-file