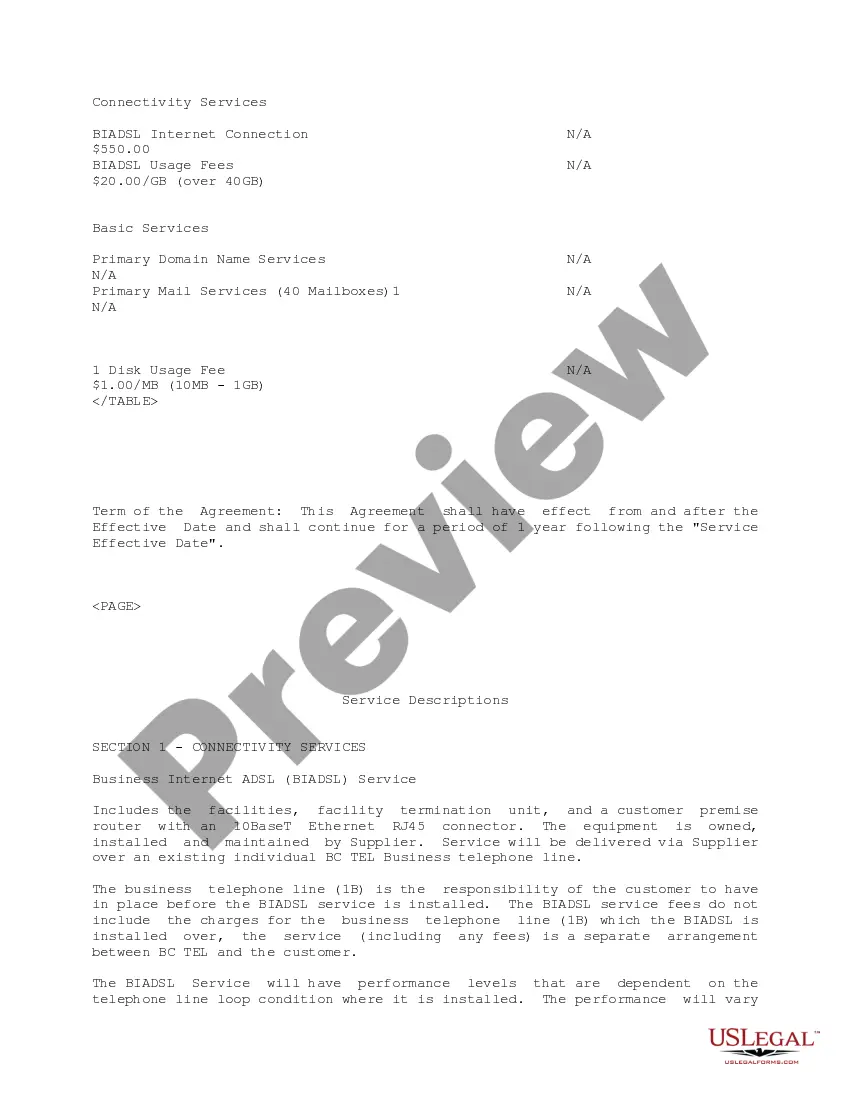

North Carolina Internet Business Services Agreement

Description

How to fill out Internet Business Services Agreement?

Have you been within a place the place you require files for possibly enterprise or person functions virtually every time? There are plenty of legitimate papers templates available online, but finding types you can rely on isn`t easy. US Legal Forms delivers a large number of type templates, just like the North Carolina Internet Business Services Agreement, which can be created to meet state and federal specifications.

When you are previously acquainted with US Legal Forms internet site and possess a merchant account, just log in. Next, you may download the North Carolina Internet Business Services Agreement design.

Unless you offer an profile and want to begin to use US Legal Forms, follow these steps:

- Get the type you need and ensure it is for the appropriate area/area.

- Take advantage of the Preview switch to examine the shape.

- See the outline to ensure that you have selected the proper type.

- In the event the type isn`t what you`re trying to find, take advantage of the Search discipline to obtain the type that meets your requirements and specifications.

- If you discover the appropriate type, click on Get now.

- Select the pricing plan you need, submit the required information and facts to make your bank account, and purchase an order making use of your PayPal or bank card.

- Pick a handy data file format and download your version.

Find every one of the papers templates you possess bought in the My Forms food list. You may get a extra version of North Carolina Internet Business Services Agreement at any time, if needed. Just go through the needed type to download or printing the papers design.

Use US Legal Forms, the most comprehensive collection of legitimate kinds, in order to save time and prevent faults. The assistance delivers professionally created legitimate papers templates that can be used for a selection of functions. Create a merchant account on US Legal Forms and begin producing your life easier.

Form popularity

FAQ

Online businesses operating in North Carolina require the same licenses and permits that are required of businesses that operate out of a retail location.

Form NC-BR Business Registration Application for Income Tax Withholding, Sales and Use Tax, and Other Taxes and Service Charge. Form NC-BR Business Registration Application for Income Tax Withholding, Sales and Use Tax, and Other Taxes and Service Charge.

North Carolina doesn't require you to have a general state business license for your LLC. However, you may need more specialized state licenses or permits if you engage in certain types of businesses.

North Carolina Sales Tax License If your business activities are subject to sales and use tax, your LLC must register with the Department of Revenue. Note: This requirement will apply whether you sell products online or in a physical location in North Carolina (aka ?remote seller?).

Generally, a remote seller is required to collect and remit tax on all taxable remote sales sourced to North Carolina, including sales made online. The Internet Tax Freedom Act prohibits states from imposing a sales tax on Internet access services, but does not prohibit states from taxing sales made via the Internet.

There is no fee to register your business or use the resale license, but companies must keep a copy of your certificate on hand, so make sure to fill out your information completely.

Form NC-3 and the required W-2 and 1099 statements, (collectively ?Form NC-3?) must be filed electronically. To file Form NC-3 electronically, visit the Department's website at .ncdor.gov. A return not filed electronically is subject to a penalty for failure to file an informational return in the proper format.

There are two ways to register for a sales tax permit in North Carolina, either by paper application or via the online website. We recommend submitting the application via the online website as it will generally be processed faster and you will receive a confirmation upon submission.