This due diligence workform is used to review property information and title commitments and policies in business transactions.

North Carolina Fee Interest Workform

Description

How to fill out Fee Interest Workform?

Selecting the ideal legal document template can be quite a challenge. Of course, there are numerous templates available online, but how do you locate the legal form you require.

Utilize the US Legal Forms website. The service offers a vast array of templates, such as the North Carolina Fee Interest Form, which can be utilized for both business and personal purposes. All the forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to access the North Carolina Fee Interest Form. Use your account to browse the legal forms you have previously purchased. Visit the My documents section of your account to obtain another copy of the document you need.

Complete, revise, print, and sign the obtained North Carolina Fee Interest Form. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Utilize the service to download professionally crafted paperwork that adheres to state requirements.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

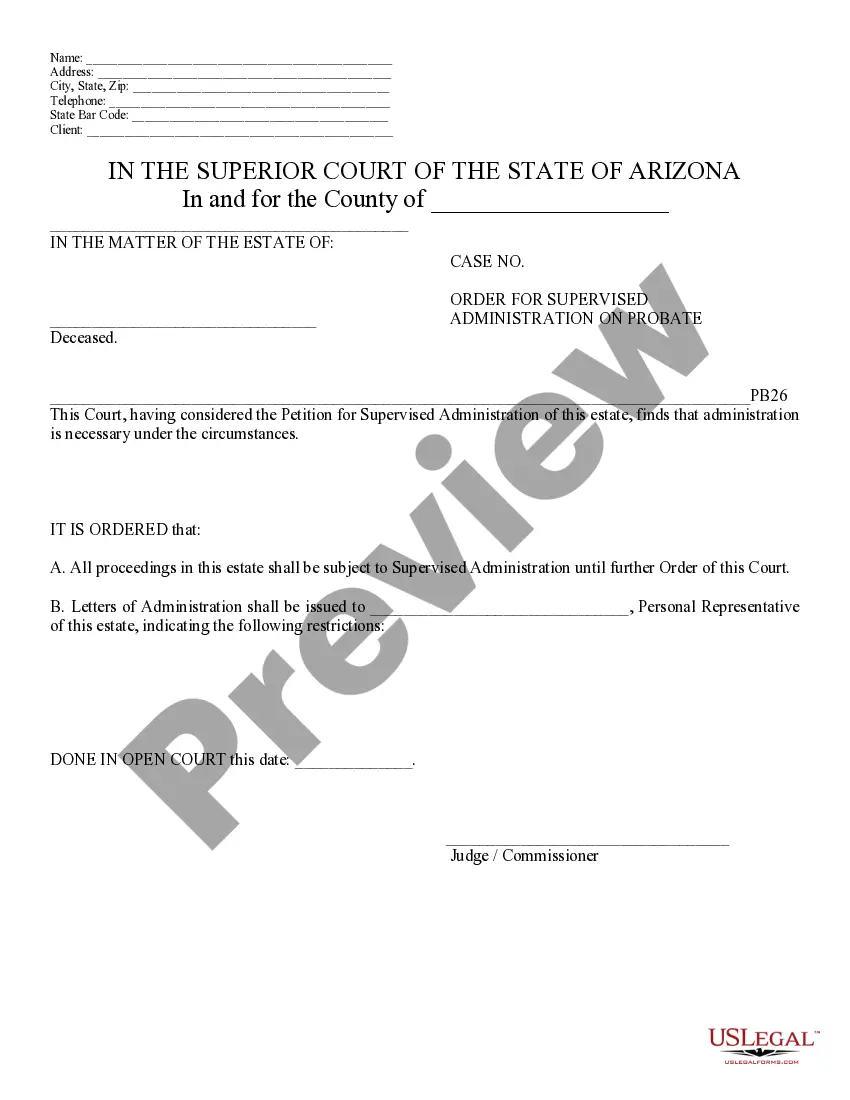

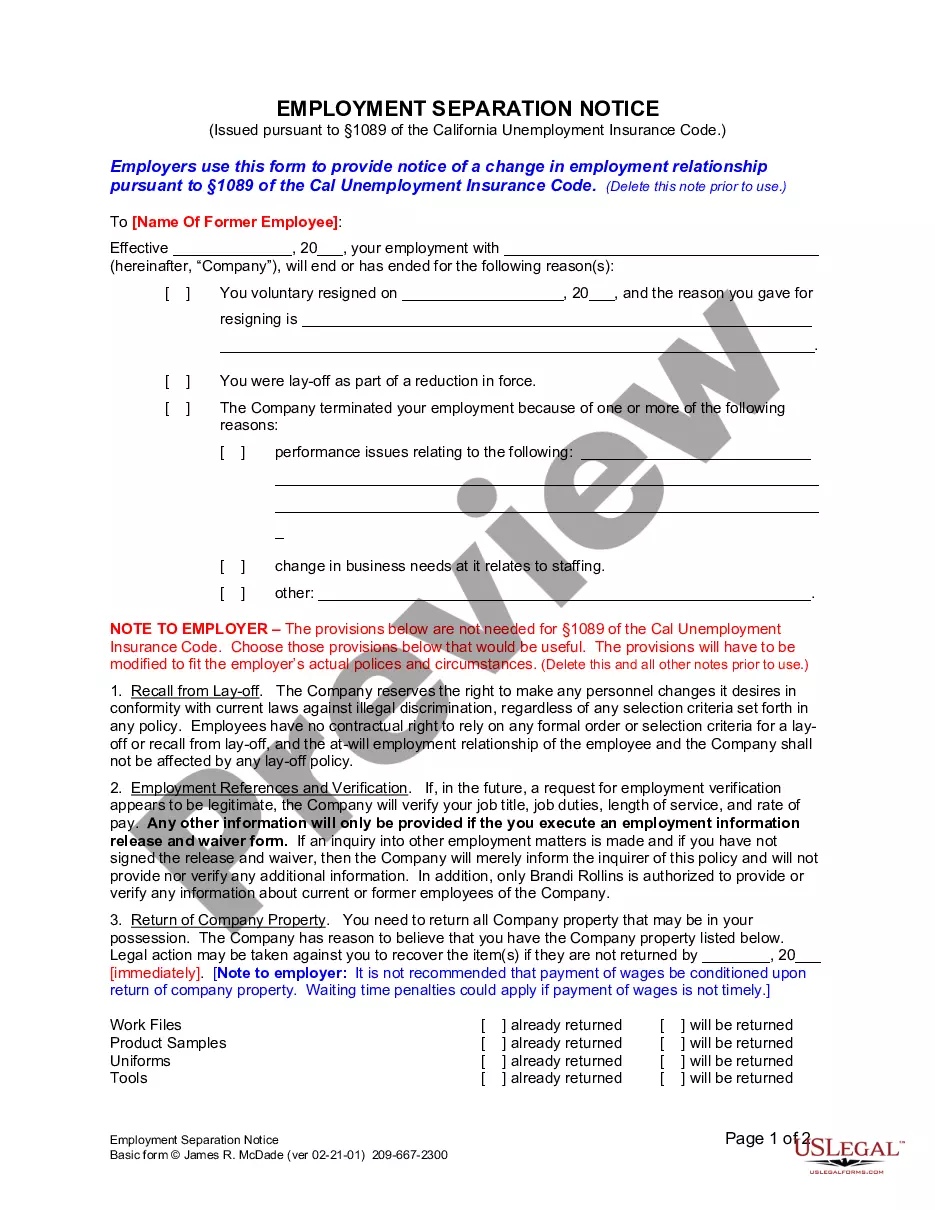

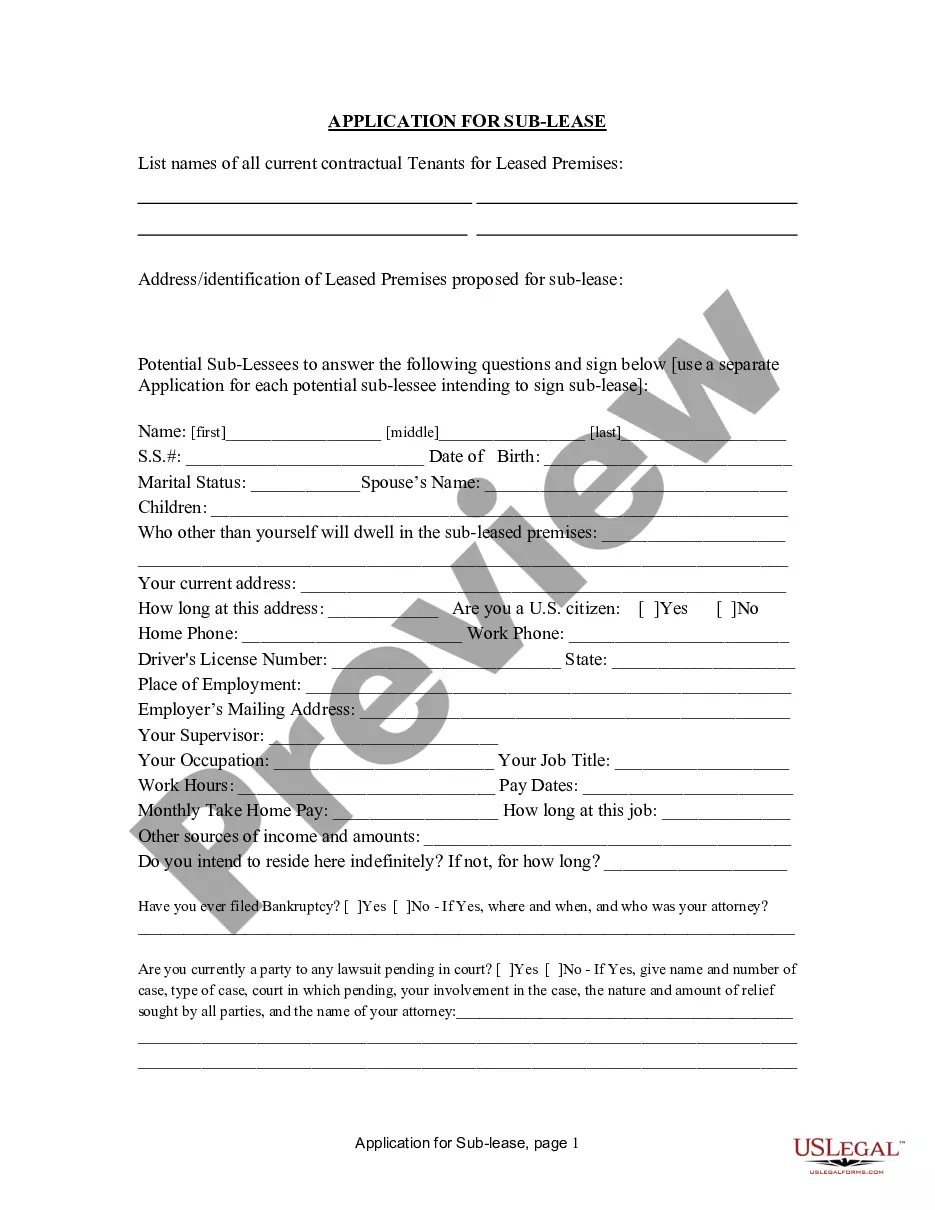

- First, ensure that you have selected the correct form for your city/region. You can preview the form using the Preview button and review the form description to confirm it is suitable for you.

- If the form does not meet your needs, use the Search field to find the right form.

- Once you are confident that the form is appropriate, click the Buy Now button to acquire the form.

- Choose the pricing plan you prefer and fill in the required information. Create your account and pay for the transaction using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

Form popularity

FAQ

Yes, North Carolina offers e-file options for taxpayers. The North Carolina Fee Interest Workform can often be completed and submitted online, which simplifies the process. E-filing provides a faster processing time, helps reduce errors, and allows you to receive your confirmation quickly. Check uslegalforms for easy e-filing options and to ensure you are using the correct forms.

Yes, interest income is taxable in North Carolina. Any interest that you earn, whether from savings accounts, bonds, or other sources, must be reported using the North Carolina Fee Interest Workform. It's essential to keep accurate records to ensure you report all taxable income correctly, thus avoiding any penalties. If you have questions about how to report your interest income, consider using resources from uslegalforms for detailed guidance.

Form D422 is the North Carolina Fee Interest Workform, specifically designed for reporting interest income. This form helps taxpayers to accurately report their interest earnings to the state. Completing this form ensures you comply with tax regulations and can minimize any potential issues with the North Carolina Department of Revenue. Access and guidance for completing Form D422 can be found on platforms like uslegalforms.

To file NC withholding tax, you need to complete the appropriate forms. Typically, you’ll use the North Carolina Fee Interest Workform for reporting purposes. First, gather your income records, and ensure you have your employer identification number. After completing the form, you can submit it online or via mail, depending on what works best for you.

To request that the IRS waive interest, you can submit a written request or appeal, detailing your case and providing any necessary documentation to support your claim. While it’s not common for the IRS to grant waivers, situations involving reasonable cause may be considered. Utilizing the North Carolina Fee Interest Workform can help you understand your obligations and prepare your request efficiently.

Avoiding interest on taxes is best achieved through timely filing and payment of your tax obligations. Staying informed about deadlines and using resources, like the North Carolina Fee Interest Workform, can ensure you stay on track. Regularly reviewing your financial situation can also help you make necessary adjustments to your withholding or estimated payments.

To potentially avoid paying interest on taxes, consider filing your returns on time and adhering to payment deadlines. Using the North Carolina Fee Interest Workform can facilitate your requests for waivers or modifications in state tax assessments. Moreover, establishing a payment plan with your tax authority may also help manage any tax liabilities without incurring excessive interest.

While it is challenging to get out of paying interest to the IRS completely, you can explore options like establishing an installment agreement or appealing certain penalties. Using the North Carolina Fee Interest Workform can help you address similar state issues effectively. Ensuring timely payments and filing your taxes can significantly reduce the amount of interest you may owe.

Yes, North Carolina does have a state W4 form, which is necessary for employees to determine the amount of state income tax withholding from their paychecks. You can find the North Carolina W4 form on the state’s Department of Revenue website. Completing this form accurately can help you avoid misunderstandings or excess tax liabilities, potentially omitting issues related to interest penalties.

To request a penalty waiver for the North Carolina Department of Revenue (NCDOR), you should complete the appropriate forms provided on their official website. When you fill out the North Carolina Fee Interest Workform, make sure to clearly state your reason for requesting the waiver and include any relevant documentation. It’s essential to submit your request promptly to have the best chance of approval, ensuring you maintain compliance with state regulations.