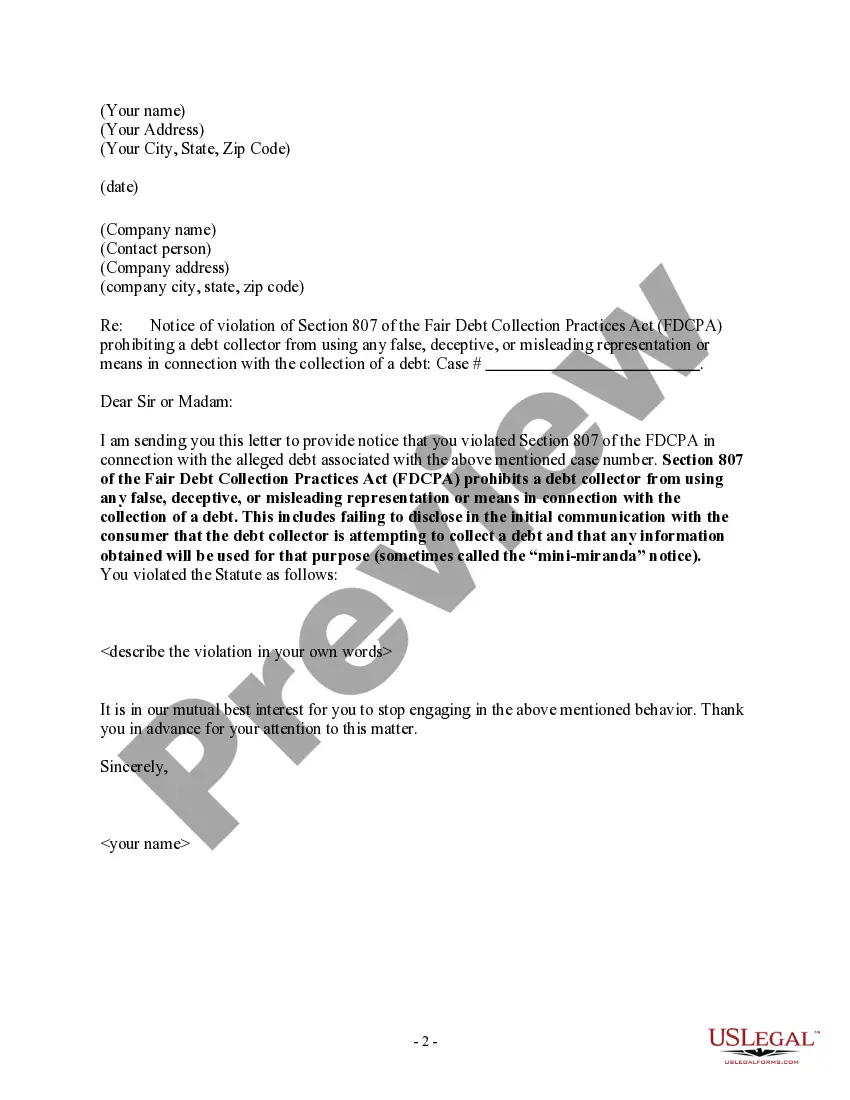

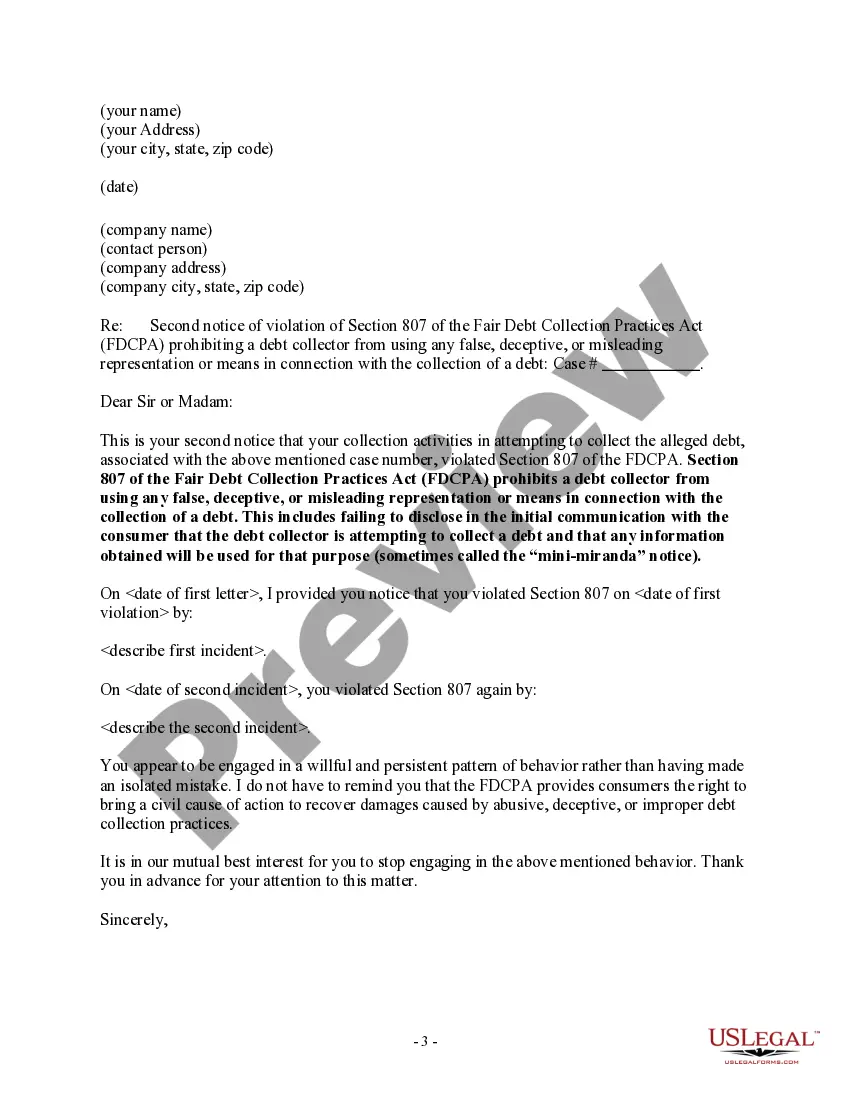

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes failing to disclose in the initial communication with the consumer that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose (Mini Miranda)

North Carolina Notice to Debt Collector - Failure to Provide Mini-Miranda

Description

How to fill out Notice To Debt Collector - Failure To Provide Mini-Miranda?

Have you ever found yourself in a situation where you require documents for various company or personal reasons almost every workday.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of document templates, such as the North Carolina Notice to Debt Collector - Failure to Provide Mini-Miranda, which are designed to comply with federal and state regulations.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the North Carolina Notice to Debt Collector - Failure to Provide Mini-Miranda template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the template you need and ensure it is for your correct jurisdiction.

- Use the Preview button to review the document.

- Read the description to make sure you have selected the right template.

- If the document isn’t what you’re looking for, use the Search field to find the template that fits your needs and requirements.

- Once you find the right template, click Get now.

- Choose the pricing plan you want, fill in the required information to set up your account, and pay for your order using PayPal or credit card.

- Select a convenient document format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can re-download the North Carolina Notice to Debt Collector - Failure to Provide Mini-Miranda anytime, if needed. Just select the desired template to download or print the document.

Form popularity

FAQ

North Carolina offers certain protections for debtors, reflecting its debtor-friendly approach. The state enforces the North Carolina Notice to Debt Collector - Failure to Provide Mini-Miranda, requiring debt collectors to follow clear guidelines. While it's essential to understand your rights, many individuals find that the legal framework can be beneficial in resolving debt issues effectively.

Mini-Miranda rights are a set of statements that a debt collector must use when contacting an individual to collect a debt. Mini-Miranda rights have to be recited, by law, if the debt collection effort is being made over the phone or in-person and outlined in written form if a letter is sent to the debtor.

Does a Debt Collector Have to Show Proof of a Debt? Yes, debt collectors do have to show proof of a debt if you ask them. Make sure you understand your rights under credit collection laws.

At the beginning of a collection call, a debt collector must recite wording that has come to be called the mini-Miranda disclosure. It informs the consumer that the call is from a debt collector, that they are calling to collect a debt, and that any information revealed in the call will be used to collect that debt.

The Basic Law: The first notice from the debt collector to the debtor must include a warning known as the "Mini-Miranda Warning," which must state that the communication is from a debt collector and that any information obtained may be used to collect the debt.

Mini-Miranda rights are a set of statements that a debt collector must use when contacting an individual to collect a debt. Mini-Miranda rights have to be recited, by law, if the debt collection effort is being made over the phone or in-person and outlined in written form if a letter is sent to the debtor.

Debt collectors are required to give the full mini Miranda in their initial communication with you, no matter what form. 1fefffeff The first time a third-party debt collector speaks with you on the phone or sends you a letter, the mini Miranda statement must be included.

When a debt collector contacts you, they have to identify themselves as a collector and tell you they're trying to collect on a debt. This is sometimes called a "Mini Miranda requirement. This requirement was created to prevent unfair questioning and practices in the debt collection process.

Mini-Miranda rights are a set of statements that a debt collector must use when contacting an individual to collect a debt. Mini-Miranda rights have to be recited, by law, if the debt collection effort is being made over the phone or in-person and outlined in written form if a letter is sent to the debtor.