North Carolina Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement

Description

How to fill out Approval Of Transfer Of Outstanding Stock With Copy Of Liquidating Trust Agreement?

US Legal Forms - one of many greatest libraries of authorized types in the United States - delivers a wide range of authorized record themes you are able to acquire or print out. Using the website, you may get a huge number of types for business and specific reasons, sorted by types, says, or keywords and phrases.You will discover the most recent versions of types just like the North Carolina Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement within minutes.

If you currently have a monthly subscription, log in and acquire North Carolina Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement from the US Legal Forms local library. The Acquire option will appear on each and every type you see. You have accessibility to all formerly delivered electronically types in the My Forms tab of your own bank account.

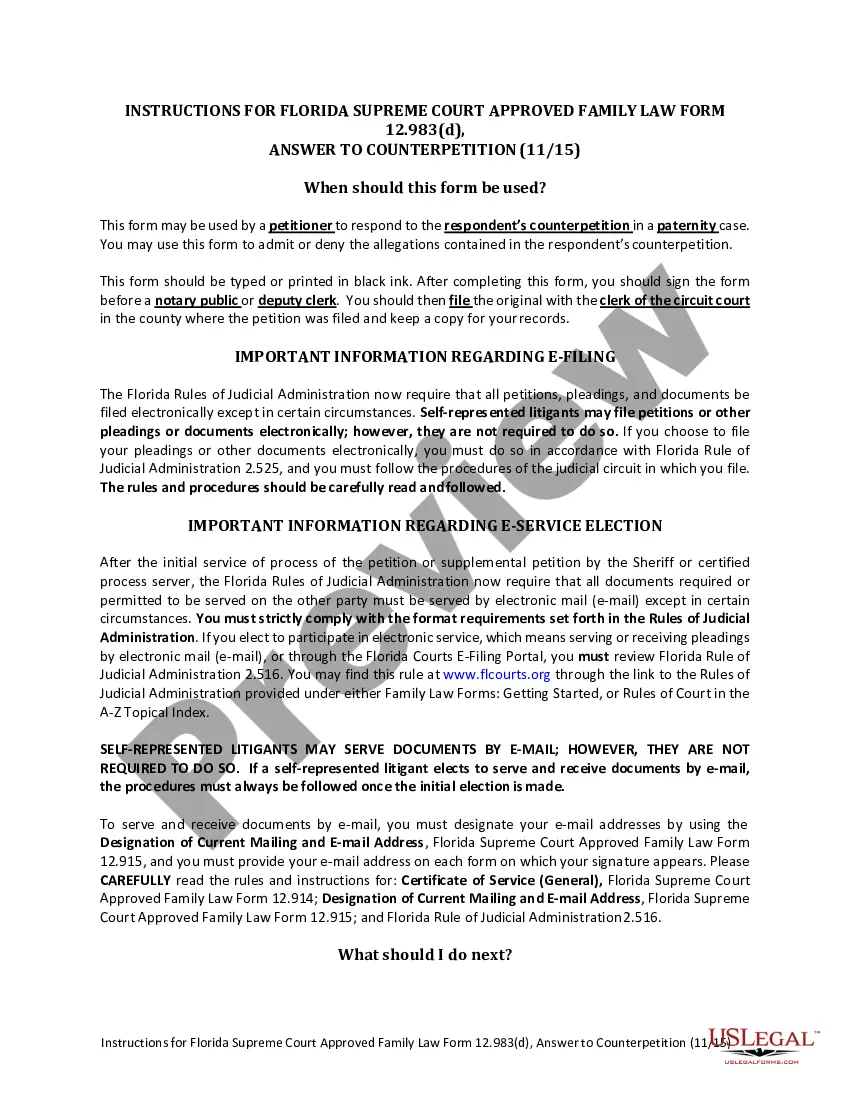

In order to use US Legal Forms for the first time, allow me to share basic recommendations to help you get began:

- Ensure you have chosen the right type for the metropolis/state. Click the Review option to check the form`s articles. Look at the type explanation to actually have chosen the proper type.

- In the event the type doesn`t fit your needs, take advantage of the Search discipline at the top of the display to get the one who does.

- When you are content with the shape, validate your option by clicking on the Purchase now option. Then, select the rates plan you want and supply your accreditations to sign up for an bank account.

- Approach the financial transaction. Utilize your credit card or PayPal bank account to finish the financial transaction.

- Choose the format and acquire the shape on your system.

- Make adjustments. Fill up, change and print out and signal the delivered electronically North Carolina Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement.

Each format you included with your account lacks an expiry particular date which is the one you have for a long time. So, in order to acquire or print out another duplicate, just proceed to the My Forms section and then click around the type you require.

Obtain access to the North Carolina Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement with US Legal Forms, one of the most extensive local library of authorized record themes. Use a huge number of expert and state-distinct themes that meet up with your company or specific needs and needs.

Form popularity

FAQ

Liquidating trustee: person or entity charged with carrying out the Plan of Liquidation while representing the estate of the debtors.

A liquidating trust formed for the primary purpose of liquidating and distributing the assets transferred to it is taxed as a trust, and not as an association, despite the possibility of profit ( Reg. §301.7701-4(d)).

A corporation declares bankruptcy. However, if a liquidating trust is established for a corporation that is in bankruptcy, an EIN for that trust is required. See Trea- sury Reg. § 301.7701-4(d).

A liquidating trust is a new legal entity that becomes successor to the liquidating fund. The remaining assets and liabilities are transferred into the newly formed trust and the former owners of the liquidating fund become unit holders or beneficiaries of the trust.

Hear this out loud PauseLiquidating trusts are funded with assets held for the benefit of creditors who may have a claim against the debtor. These trusts can exist from several months to several years, depending on how long it takes to liquidate the assets and work through various claims and settlements.