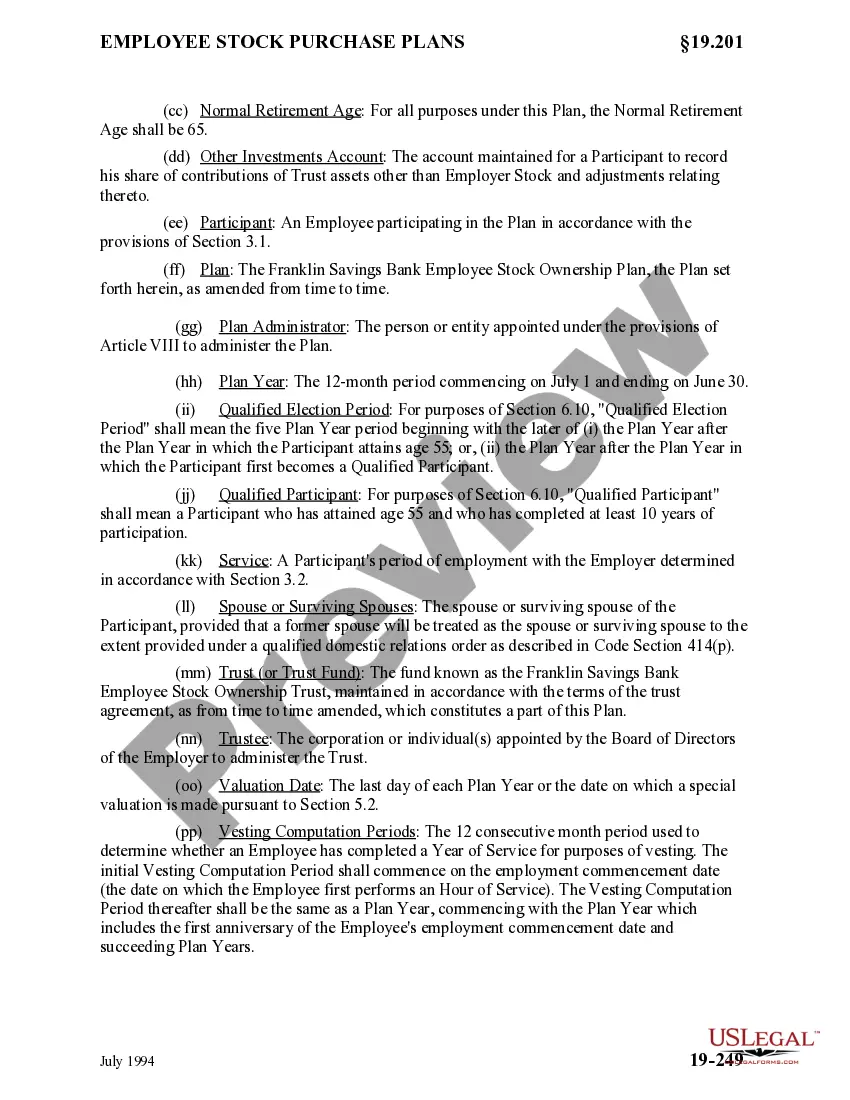

North Carolina Employee Stock Ownership Plan of Franklin Savings Bank - Detailed

Description

How to fill out Employee Stock Ownership Plan Of Franklin Savings Bank - Detailed?

You may spend time on the web looking for the legitimate papers design that meets the federal and state demands you need. US Legal Forms gives thousands of legitimate forms which can be reviewed by professionals. You can actually obtain or produce the North Carolina Employee Stock Ownership Plan of Franklin Savings Bank - Detailed from my services.

If you have a US Legal Forms profile, you may log in and click the Obtain switch. Afterward, you may total, revise, produce, or signal the North Carolina Employee Stock Ownership Plan of Franklin Savings Bank - Detailed. Every legitimate papers design you buy is yours forever. To have yet another copy for any bought form, visit the My Forms tab and click the corresponding switch.

Should you use the US Legal Forms website the very first time, adhere to the simple instructions beneath:

- Very first, make certain you have chosen the correct papers design to the county/metropolis of your choosing. Look at the form information to ensure you have picked the correct form. If offered, make use of the Review switch to search with the papers design at the same time.

- If you would like get yet another model of the form, make use of the Research area to obtain the design that meets your needs and demands.

- Once you have located the design you desire, simply click Buy now to continue.

- Select the costs plan you desire, key in your references, and sign up for a free account on US Legal Forms.

- Total the transaction. You may use your charge card or PayPal profile to pay for the legitimate form.

- Select the format of the papers and obtain it in your device.

- Make modifications in your papers if needed. You may total, revise and signal and produce North Carolina Employee Stock Ownership Plan of Franklin Savings Bank - Detailed.

Obtain and produce thousands of papers layouts utilizing the US Legal Forms Internet site, which provides the greatest selection of legitimate forms. Use skilled and condition-certain layouts to handle your company or person needs.

Form popularity

FAQ

An ESOP Valuation will follow these basic steps: Your ESOP trustee hires a qualified independent valuation expert or appraiser. The valuation expert or appraiser examines your company's data. ... The valuation expert or appraiser determines the FMV of the company's ESOP shares through various methods (see ?methods? below).

After the employee terminates, the company can make the distribution in shares, cash, or some of both. Cash is paid to the employee directly. Often, company shares are immediately repurchased by the ESOP, and the employee receives cash equivalent to fair market value as determined by the most recent annual valuation.

ESOP rules set a limit of 25% of salary as the maximum amount that can be contributed to a participant's account annually, though most companies contribute between 6-10% of salary annually. The 25% is a combined limit that includes ESOPs, 401(k)s, profit sharing, and stock bonus plans offered by the company.

An ESOP Valuation is the process by which the Fair Market Value (FMV) of a company's ESOP shares is determined by an independent appraiser and confirmed by the company's ESOP trustee. Ultimately, under the recommendation of the appraiser, the fiduciary (trustee) makes the final ESOP valuation.

In 2018, Employee Stock Ownership Plans Distributed a total of $126.7 billion. An estimated $1.37 trillion in value is held by ESOPs in the US, that's an average of $129,521 per employee owner.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

The average employee in an ESOP company has accumulated $134,000 from his or her stake in the business, ing to a 2018 Rutgers University study. This is 29 percent more than the average 401(k) balance of $103,866 reported by Vanguard the same year.

By law, your company must send you an annual account statement telling you how much is in your ESOP in cash and in stock. The stock price is determined by an independent outside appraisal firm. If you do not receive a statement, contact the company's human resources or payroll department and request a copy.