Full text and statutory guidelines for the Financial Services Modernization Act (Gramm-Leach-Bliley Act)

North Carolina Financial Services Modernization Act (Gramm-Leach-Bliley Act)

Description

How to fill out Financial Services Modernization Act (Gramm-Leach-Bliley Act)?

US Legal Forms - one of many biggest libraries of authorized forms in the United States - offers a wide array of authorized document web templates you can download or print. While using website, you will get 1000s of forms for organization and person purposes, sorted by classes, suggests, or keywords.You can find the newest models of forms just like the North Carolina Financial Services Modernization Act (Gramm-Leach-Bliley Act) within minutes.

If you currently have a subscription, log in and download North Carolina Financial Services Modernization Act (Gramm-Leach-Bliley Act) through the US Legal Forms local library. The Acquire option will appear on every develop you view. You have accessibility to all previously downloaded forms in the My Forms tab of your respective profile.

If you want to use US Legal Forms the first time, listed below are basic instructions to help you began:

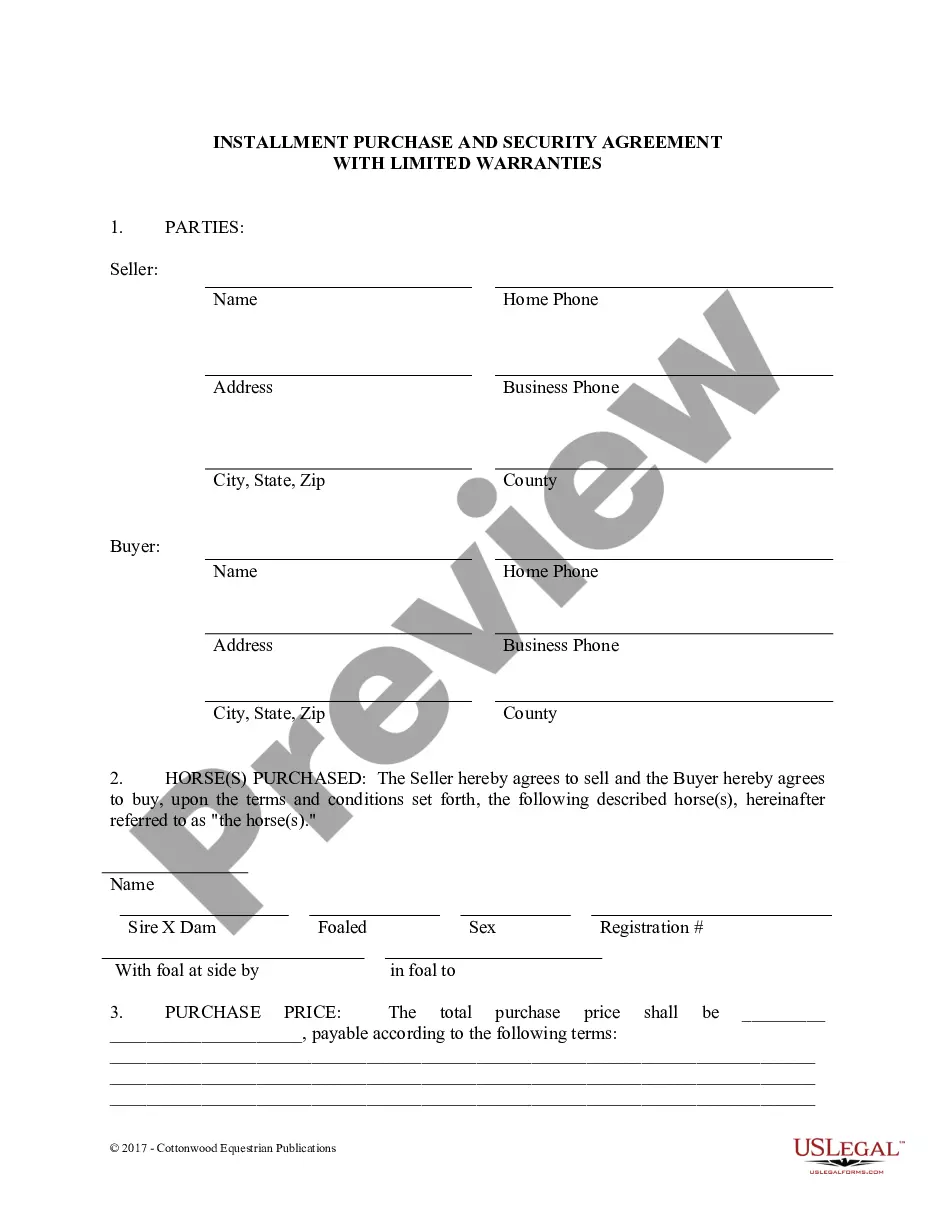

- Ensure you have chosen the best develop for your personal metropolis/county. Click on the Review option to analyze the form`s content. Look at the develop description to actually have selected the appropriate develop.

- In the event the develop does not fit your needs, take advantage of the Lookup discipline on top of the monitor to find the one who does.

- In case you are happy with the shape, validate your selection by simply clicking the Buy now option. Then, pick the pricing plan you want and offer your credentials to register on an profile.

- Process the purchase. Make use of charge card or PayPal profile to accomplish the purchase.

- Find the formatting and download the shape on your gadget.

- Make modifications. Fill out, revise and print and sign the downloaded North Carolina Financial Services Modernization Act (Gramm-Leach-Bliley Act).

Each design you included in your account does not have an expiration time and is also yours eternally. So, if you wish to download or print an additional backup, just visit the My Forms portion and click on on the develop you need.

Get access to the North Carolina Financial Services Modernization Act (Gramm-Leach-Bliley Act) with US Legal Forms, the most comprehensive local library of authorized document web templates. Use 1000s of skilled and condition-specific web templates that satisfy your company or person needs and needs.

Form popularity

FAQ

Examples of activities that GLB would apply to include administering financial aid, processing of credit card information, and collecting of any other form of customer financial information. University units must document all such collection and processing activities.

The Gramm-Leach-Bliley Act requires financial institutions ? companies that offer consumers financial products or services like loans, financial or investment advice, or insurance ? to explain their information-sharing practices to their customers and to safeguard sensitive data.

The FTC is one of the federal agencies that enforces provisions of Gramm-Leach Bliley, and the law covers not only banks, but also securities firms, and insurance companies, and companies providing many other types of financial products and services.

The Gramm Leach Bliley Act (GLBA) is a comprehensive, federal law affecting institutions. The law requires financial institutions to develop, implement and maintain administrative, technical and physical safeguards to protect the security, integrity andconfidentiality of customer information.

To be GLBA compliant, financial institutions must communicate to their customers how they share the customers' sensitive data, inform customers of their right to opt-out if they prefer that their personal data not be shared with third parties, and apply specific protections to customers' private data in ance with ...

The three sections include the following: Financial Privacy Rule. This rule, often referred to as the Privacy Rule, places requirements on how organizations may collect and disclose private financial data. ... Safeguard Rule. ... Pretexting Rule.

The act was passed in late 1999 and allows banks to offer financial services previously forbidden by the Glass-Steagall Act. Under the GLBA, each manager or service-person is only allowed to sell or manage one type of financial product/instrument.

The Financial Services Modernization Act of 1999 is a law that serves to partially deregulate the financial industry. The law allows companies working in the financial sector to integrate their operations, invest in each other's businesses, and consolidate.