North Carolina Post-Employment Information Sheet

Description

How to fill out Post-Employment Information Sheet?

You might spend hours online attempting to locate the legal document template that meets your federal and state requirements.

US Legal Forms offers a vast array of legal forms that are vetted by experts.

You can download or print the North Carolina Post-Employment Information Sheet from their service.

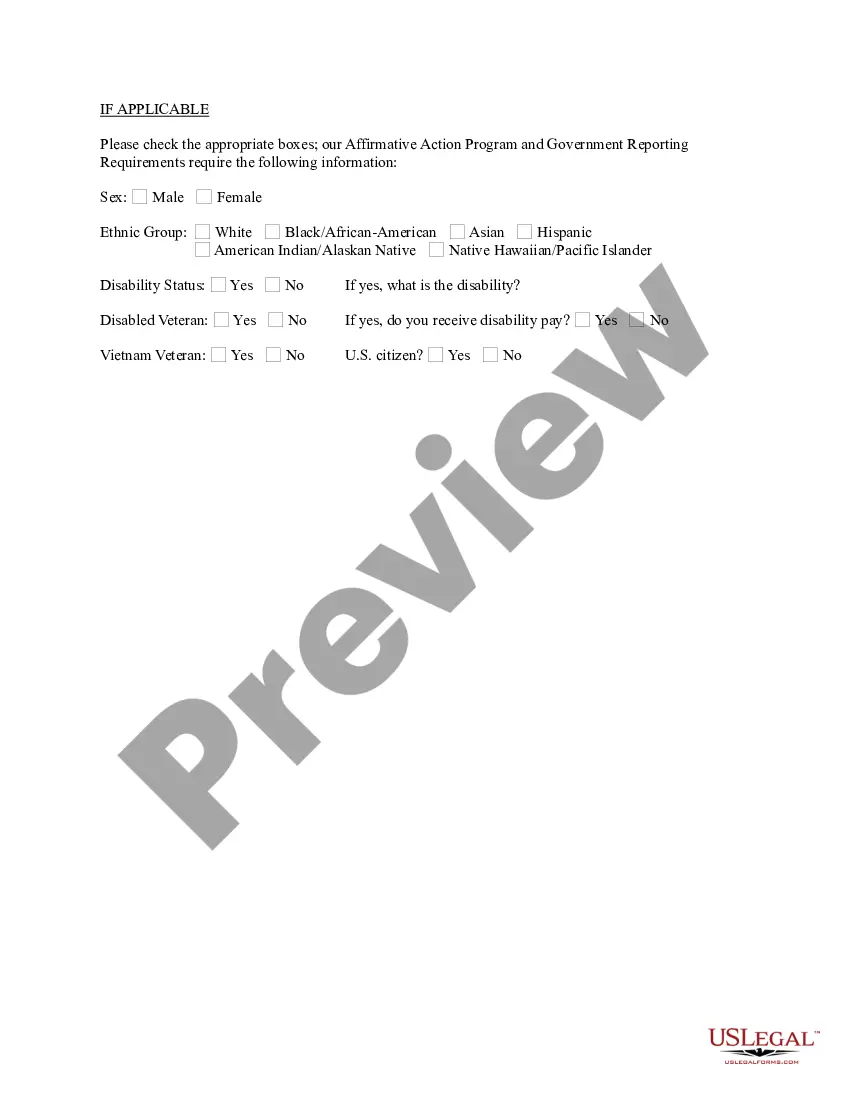

If available, utilize the Preview option to review the document template as well.

- If you possess a US Legal Forms account, you can Log In and select the Obtain option.

- After that, you may complete, edit, print, or sign the North Carolina Post-Employment Information Sheet.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of the acquired form, visit the My documents tab and click the appropriate option.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your chosen region/city.

- Check the form details to confirm you have selected the right form.

Form popularity

FAQ

Filling out an employment verification form template is straightforward. Start by gathering relevant information, such as your employment dates, job title, and salary. Next, clearly input this information into the designated fields of the North Carolina Post-Employment Information Sheet. Finally, review your entries for accuracy and completeness before submission to ensure your verification request is processed smoothly.

All overpayments must be repaid to the Division of Employment Security. To avoid collections, you must repay your overpayment balance in full. If you cannot repay the balance in full, you may enter into a payment agreement with DES.

Your work search record must include:Date of the employer contact or reemployment activity.Name of the company contacted or reemployment activity attended.The position you are seeking.Name of contact person (if applicable).Contact method (in person, by phone, by email, online, by fax, etc.).More items...

North Carolina is what's referred to as a PEO-reporting state for unemployment insurance.

While the Department of Labor does require employers to display labor law posters with information about occupational safety and health laws, state wage and hour laws, and workers' compensation and unemployment insurance information in workplaces, these posters are free. You should not pay for them.

Your work search record must include:Date of the employer contact or reemployment activity.Name of the company contacted or reemployment activity attended.The position you are seeking.Name of contact person (if applicable).Contact method (in person, by phone, by email, online, by fax, etc.).More items...

Forms for New EmployeesW-4 (2021) (Federal Withholding Allowance Certificate)Withholding Form for North Carolina State Tax (NC-4)Confidentiality Agreement Form.Substance Abuse Policy Form.Employee Information Form.Online Directory Profile Creation/Update Form.

According to the North Carolina Department of Commerce, everyone who claims unemployment is notified that unemployment benefits are taxable income and must be reported on federal and state tax returns.

Diethylstilbestrol (DES) is a synthetic form of the female hormone estrogen. It was prescribed to pregnant women between 1940 and 1971 to prevent miscarriage, premature labor, and related complications of pregnancy (1).

For 2021, unchanged from 2020, unemployment tax rates for experienced employers are to range from 0.06% to 5.76%. The tax rate for new employers is to be 1% in 2021, unchanged from 2020.