North Carolina Waiver of the Right to be Spouse's Beneficiary

Description

How to fill out Waiver Of The Right To Be Spouse's Beneficiary?

Are you currently in the location where you require documents for both professional or personal objectives daily.

There are numerous legitimate document templates accessible online, but finding ones you can trust is quite challenging.

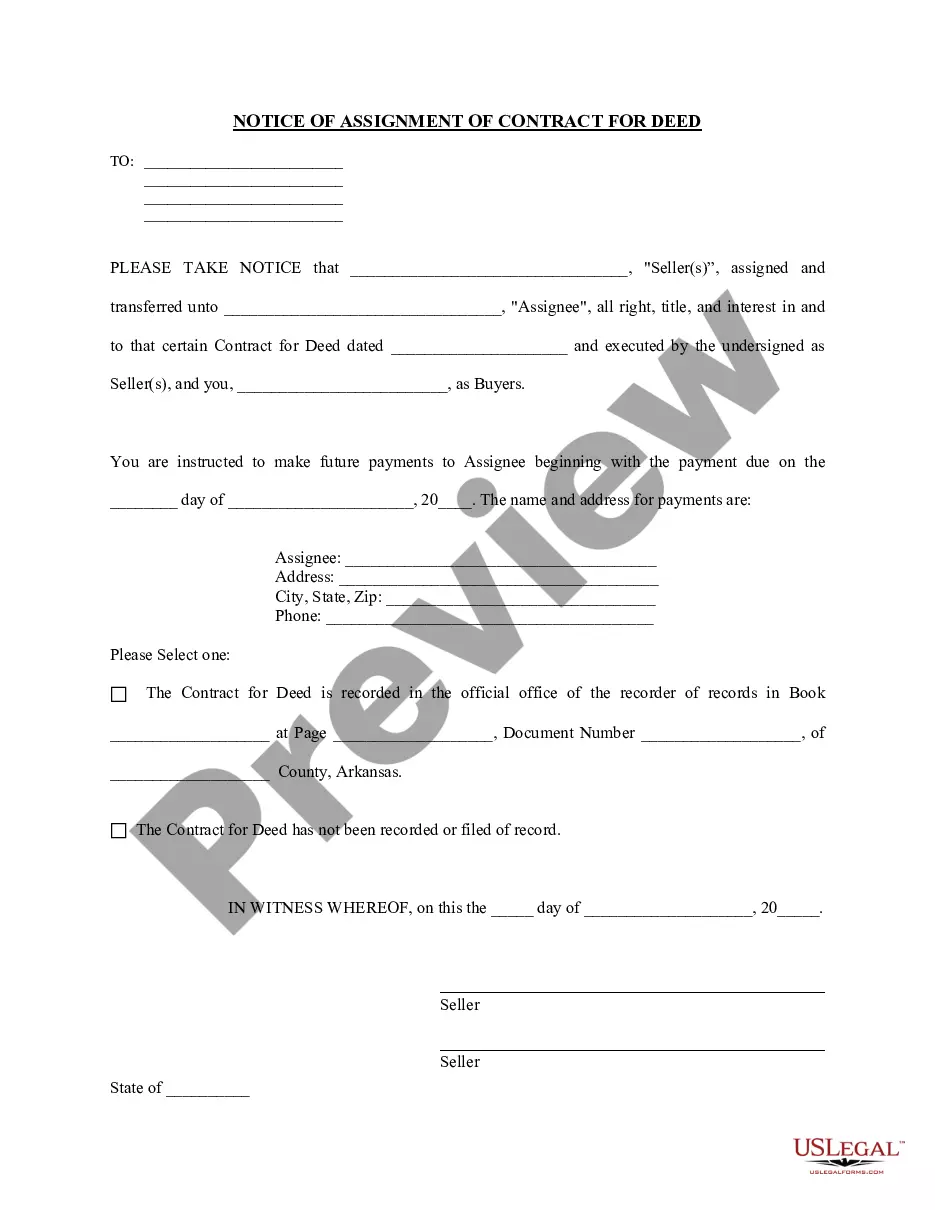

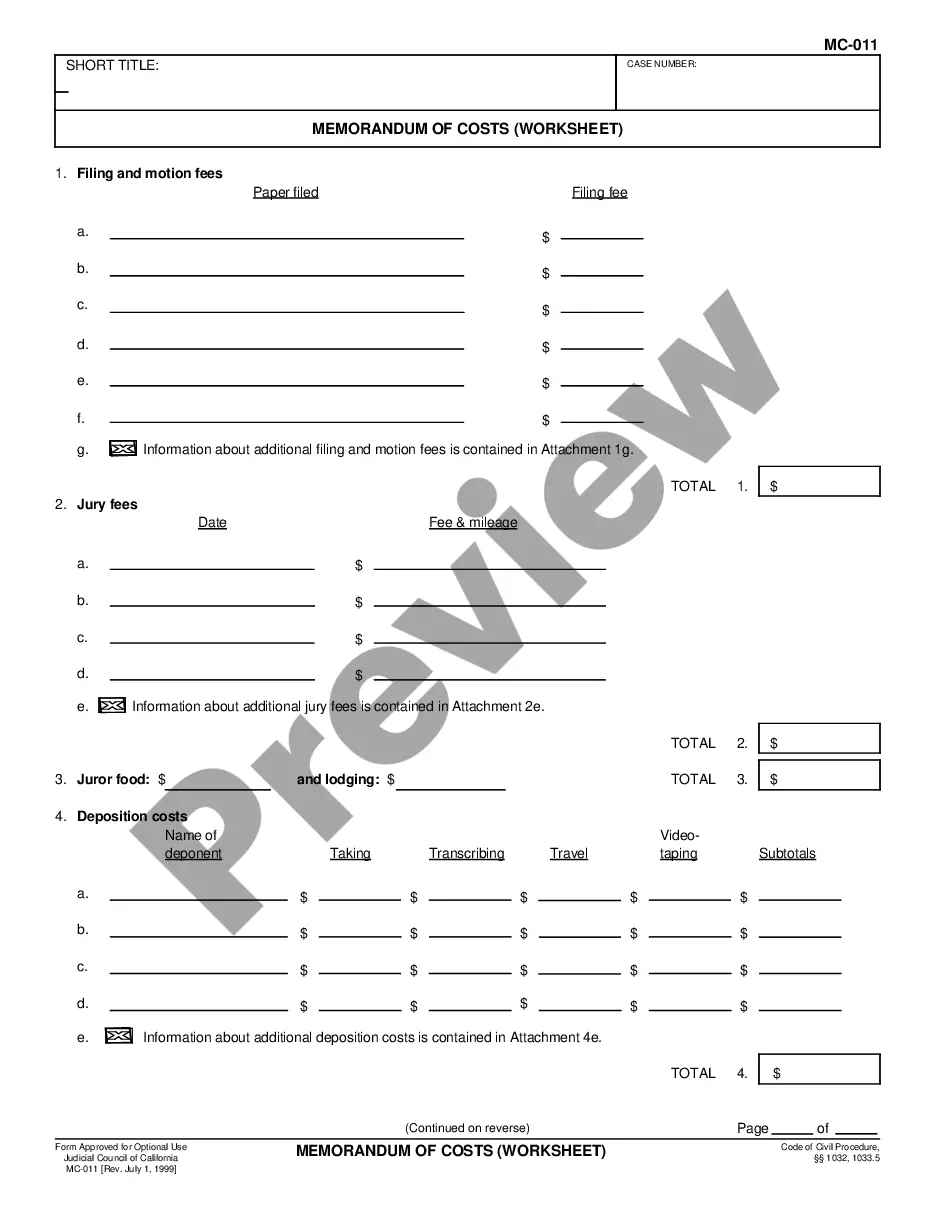

US Legal Forms provides thousands of form templates, such as the North Carolina Waiver of the Right to be Spouse's Beneficiary, which can be customized to meet federal and state requirements.

Once you locate the appropriate form, click Buy now.

Choose the pricing plan you want, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card. Select a suitable document format and download your copy. Find all the document templates you have acquired in the My documents menu. You can obtain another copy of the North Carolina Waiver of the Right to be Spouse's Beneficiary at any time, if needed. Simply follow the necessary form to download or print the template. Use US Legal Forms, the most extensive collection of legitimate forms, to save time and prevent mistakes. The service offers well-crafted legal document templates that can be utilized for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the North Carolina Waiver of the Right to be Spouse's Beneficiary template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is suitable for your city/region.

- Use the Review option to check the form.

- Read the details to make sure you have selected the correct form.

- If the form is not what you are looking for, utilize the Search area to find the form that satisfies your requirements.

Form popularity

FAQ

If the person who dies is not survived by a child, a grandchild, or a parent, the spouse takes the entire estate, both real and personal property.

The elective share statute (N.C.G.S. §30-3.1), which was originally enacted in 2000 to replace the right of a surviving spouse to dissent from a decedent's will, is designed to protect a surviving spouse from being completely disinherited by a deceased spouse.

More specifically, each person becomes the owner of half of their community property, but also half of their collective debt, according to California inheritance laws. The only property that doesn't become community property automatically are gifts and inheritances that one spouse receives.

Spouses in North Carolina Inheritance LawIf you have no living parents or descendants, your spouse will inherit all of your intestate property. If you die with parents but no descendants, your spouse will inherit half of intestate real estate and the first $100,000 of personal property.

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

Simply put, if you have a legally binding will when you pass away then the dictates of that document will determine what happens to your assets- so if you have listed your spouse as sole beneficiary, they will receive everything, or exactly how much you have given to them in the will.

If you're married, your spouse is normally your primary beneficiary and your child or children are contingent. The contingent beneficiaries will receive the proceeds on your death if your primary beneficiary dies before you do or at the same time as you do.

If you live in South Carolina and die without a valid will and have only a surviving spouse (but no children), your spouse gets everything. If you have children and you die intestate in South Carolina, your spouse inherits half of your estate while your children get the other half evenly.

Below is a summary of how a surviving spouse inherits under the Intestate Succession Act. If the decedent spouse is not survived by any lineal descendants or a parent, the surviving spouse gets title to 100% of the real property, and 100% of the personal property.