North Carolina Resolution of Meeting of LLC Members to Sell Assets

Description

How to fill out Resolution Of Meeting Of LLC Members To Sell Assets?

Locating the appropriate legal document template can be quite a challenge. Certainly, there are numerous templates accessible online, but how can you find the legal form you require? Utilize the US Legal Forms website.

The platform provides a vast array of templates, including the North Carolina Resolution of Meeting of LLC Members to Sell Assets, which can be utilized for business and personal purposes. All the templates are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Acquire button to download the North Carolina Resolution of Meeting of LLC Members to Sell Assets. Use your account to browse the legal forms you have previously purchased. Proceed to the My documents section of your account to retrieve another copy of the document you require.

Select the file format and download the legal document template to your device. Finally, complete, modify, print, and sign the obtained North Carolina Resolution of Meeting of LLC Members to Sell Assets. US Legal Forms is the largest repository of legal templates, where you can access a multitude of document formats. Leverage the service to download professionally crafted documents that adhere to state requirements.

- First, ensure you have selected the correct template for your locality/county.

- You can review the form using the Review option and check the form summary to confirm that it suits your needs.

- If the template does not meet your requirements, use the Search field to find the appropriate document.

- Once you are certain the template is correct, select the Buy now option to acquire the form.

- Choose the pricing plan you prefer and enter the necessary information.

- Create your account and pay for the order via your PayPal account or credit card.

Form popularity

FAQ

How to Sell Your LLC and Transfer Complete OwnershipReview your Operating Agreement and Articles of Organization.Establish What Your Buyer Wants to Buy.Draw Up a Buy-Sell Agreement with the New Buyer.Record the Sale with the State Business Registration Agency.

Every North Carolina LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

LLC authorization to sign is generally assigned to a managing member who has the authority to sign binding documents on behalf of the LLC. When signing, the managing member must clarify if the signature is as an individual or in their capacity to sign as the representative of the LLC.

Law ? 203(d), 202. Since an LLC is a legal person, the property it owns is the property of the LLC, not of the members.

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

To amend a North Carolina LLCs articles of organization, you file form L-17, Limited Liability Company Amendment of Articles of Organization with the North Carolina Secretary of State, Corporations Division SOS. You can submit the amendment by mail, in person, or online.

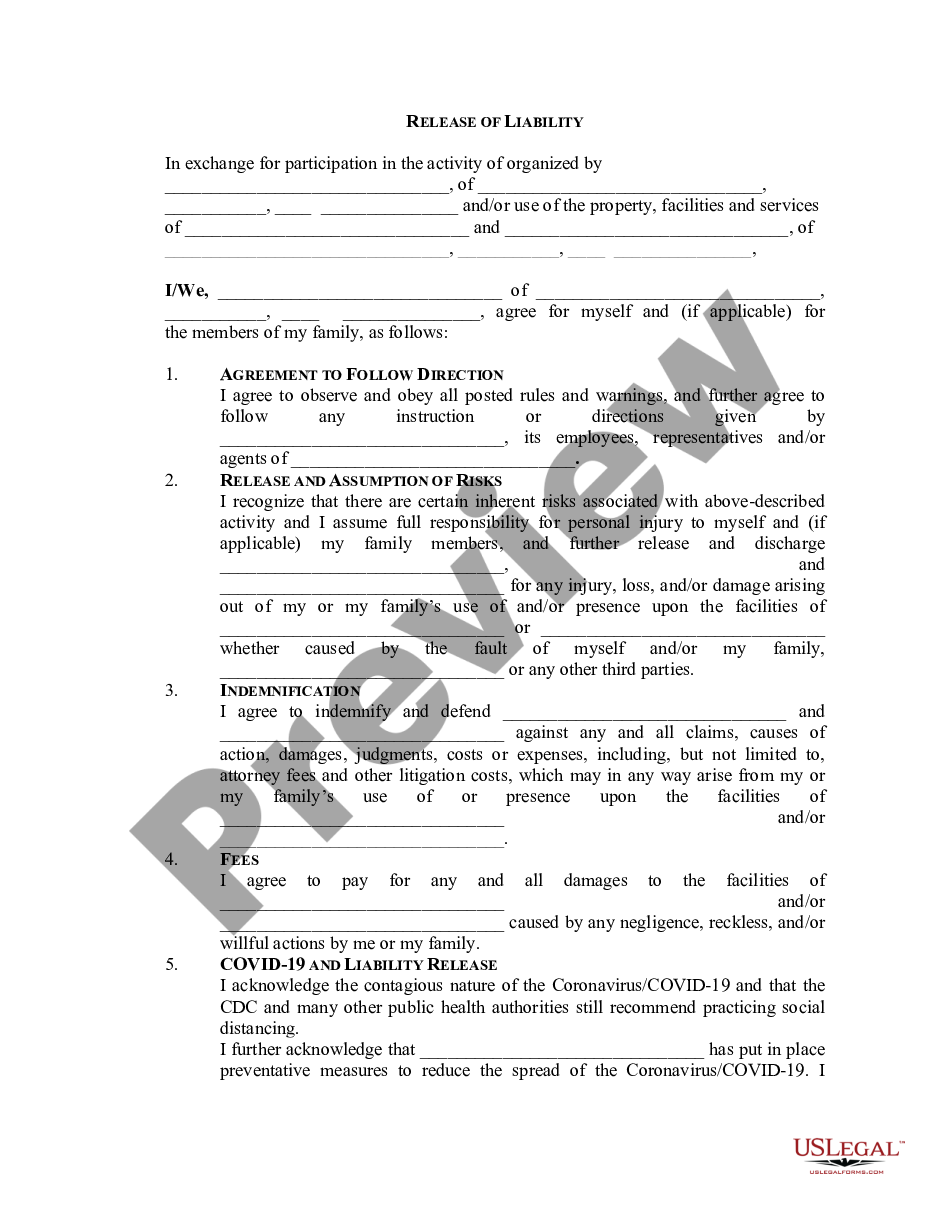

An LLC resolution is a document describing an action taken by the managers or owners of a company, with a statement regarding the issue that needs to be voted on. This does not need to be a complicated document, and need only include necessary information.

The state allows you to skip the Principal Office address during LLC formation. However, you must enter a Principal Office address when you file your first North Carolina LLC Annual Report.

An LLC member resolution is the written record of a member vote authorizing a specific business action. Formal resolutions aren't necessary for small, everyday decisions. However, they're useful for granting authority to members to transact significant business actions, such as taking out a loan on behalf of the LLC.

Why do you need an operating agreement? To protect the business' limited liability status: Operating agreements give members protection from personal liability to the LLC. Without this specific formality, your LLC can closely resemble a sole proprietorship or partnership, jeopardizing your personal liability.