North Carolina Domestic Partnership Dependent Certification Form

Description

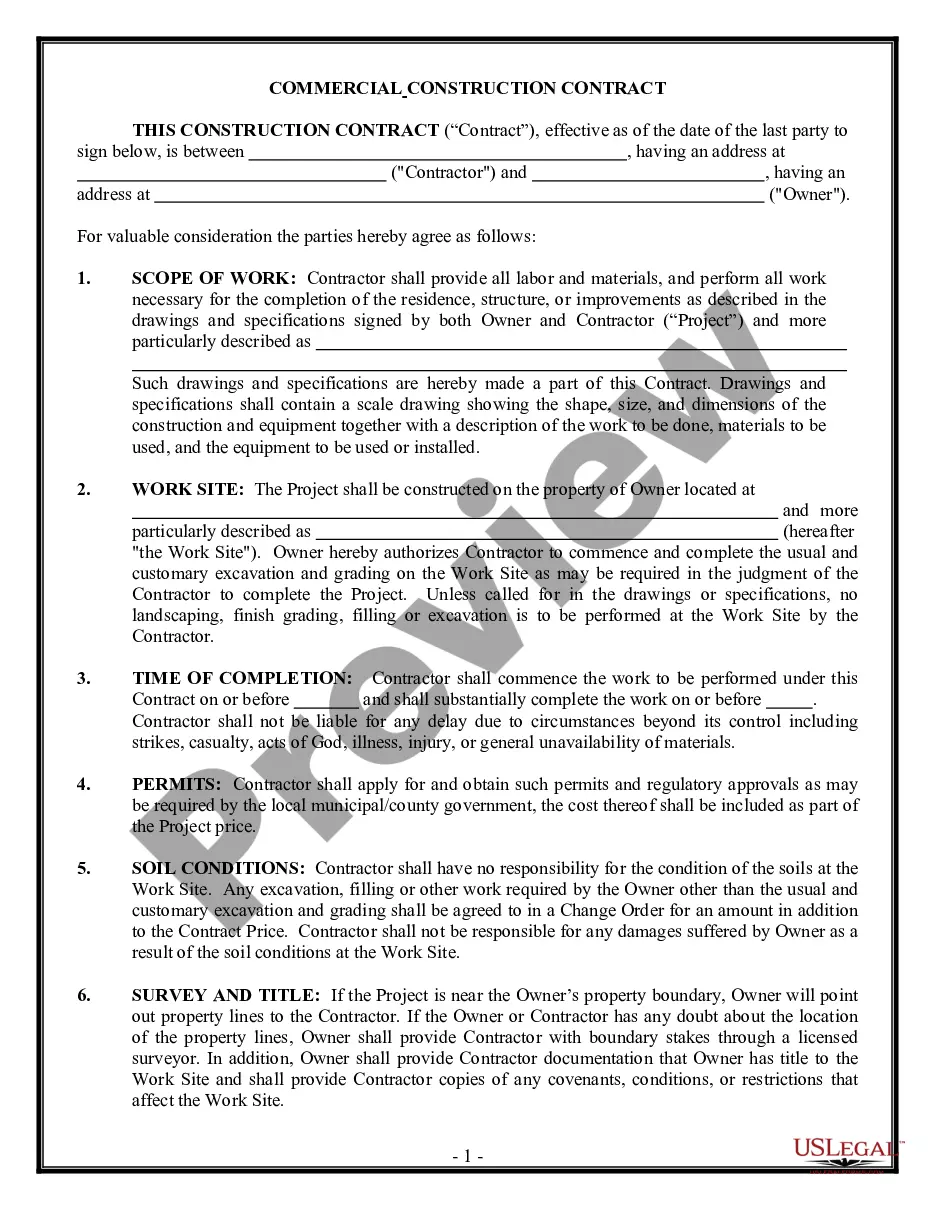

How to fill out Domestic Partnership Dependent Certification Form?

You can invest time online attempting to locate the official document template that aligns with the federal and state requirements you need.

US Legal Forms provides thousands of legal documents that are reviewed by experts.

It is easy to download or print the North Carolina Domestic Partnership Dependent Certification Form from their service.

If available, use the Review button to view the document format as well. If you wish to obtain another version of your form, use the Search field to find the template that meets your needs and requirements.

- If you possess a US Legal Forms account, you can Log In and click on the Obtain button.

- After that, you can complete, modify, print, or sign the North Carolina Domestic Partnership Dependent Certification Form.

- Every legal document format you receive is yours indefinitely.

- To get another copy of any obtained form, go to the My documents tab and select the appropriate button.

- If this is your first time using the US Legal Forms website, follow the straightforward instructions below.

- First, ensure you have chosen the correct document format for the county/city of your preference.

- Review the form outline to confirm you have selected the appropriate form.

Form popularity

FAQ

Federal law treats benefits for spouses, children and certain dependents the same way. However, a domestic partner is not considered a spouse under federal law.

To be more detailed, Domestic Partner Agreements are agreements between two parties who are not married, but generally live together in an arrangement similar to marriage. They share properties and expenses. They may own real estate together.

To qualify as a dependent, your partner must receive more than half of his or her support from you. If your partner is a dependent, you might also be eligible for other favorable tax treatment. If you think that your partner might be your dependent under federal law, consult a tax professional.

In these marriages, the state will recognize when two people live together as spouses and hold themselves out as a married couple. North Carolina does not recognize common law marriage arising in the state. However, a few states, including Iowa, South Carolina, and Colorado, and Texas do recognize common law marriages.

So you've been with your partner for a long time. It's time to start considering yourselves common-law married, a sort of "marriage-like" status that triggers when you've lived together for seven years.

Can my domestic partner claim me as a dependent? Yes, your domestic partner can claim you as a dependent on their tax return under qualifying relative rules for determining dependency status. Dependents don't necessarily need to be related to be claimed on tax returns.

"Declaration of Domestic Partnership." A "Declaration of Domestic Partnership" is a statement signed under penalty of perjury. By signing it, the two people swear that they meet the requirements of the definition of domestic partnership when they sign the statement. Each must provide a mailing address.

Domestic Partnership Laws in North CarolinaThe state of North Carolina does not recognize domestic partnerships in any capacity, meaning couples who live together but are not married aren't legally guaranteed similar rights of married couples.

Although the State of North Carolina has never recognized domestic partnerships or civil unions, many states, like Connecticut, Delaware, New Hampshire, and Washington, have converted all civil unions entered in their jurisdiction to marriages, effectively granting those couples all the benefits of marriage.

You must have paid more than half of your partner's living expenses during the calendar year for which you want to claim that person as a dependent. When calculating the total amount of support, you must include money received from: You and other people.