North Carolina Credit Inquiry

Description

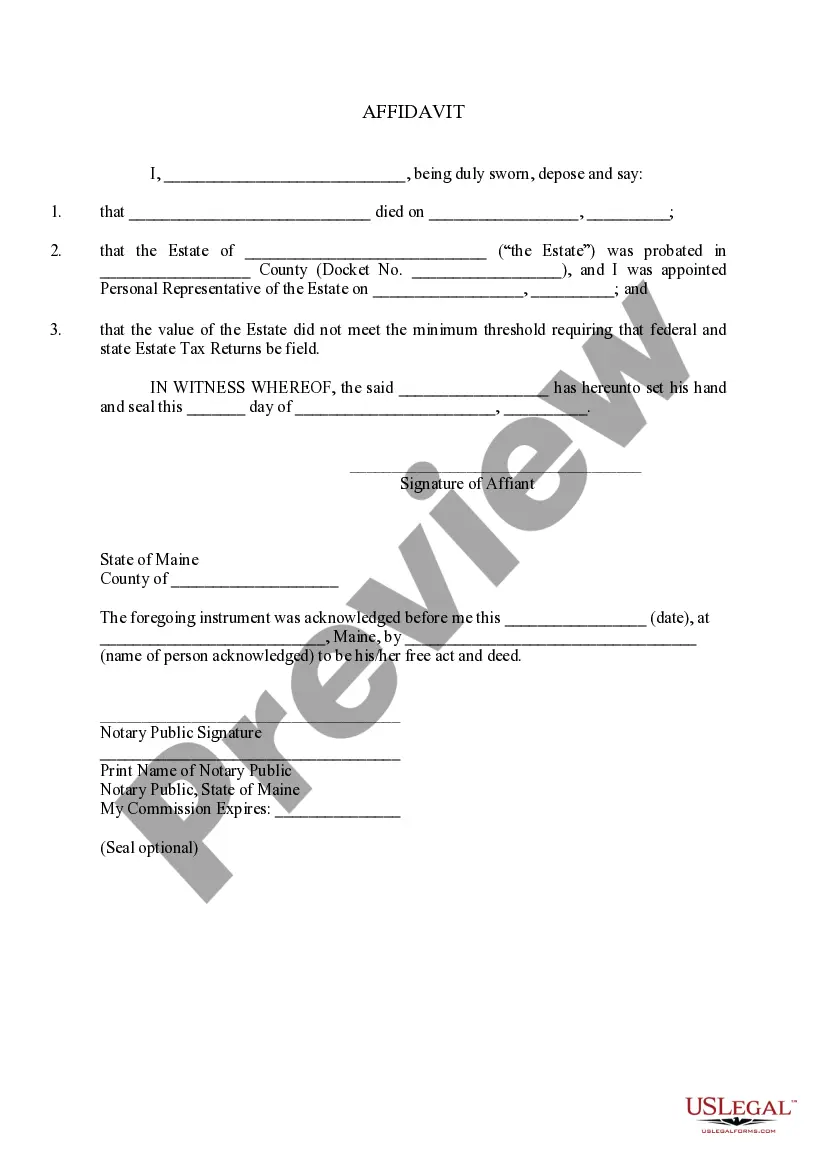

How to fill out Credit Inquiry?

Are you currently situated in a location where you need documents for routine organization or particular purposes on a daily basis? There are numerous legal document templates available on the web, but finding ones you can trust isn't straightforward.

US Legal Forms offers a wide array of form templates, such as the North Carolina Credit Inquiry, which are designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Then, you can download the North Carolina Credit Inquiry template.

- Obtain the form you need and confirm it is for the correct city/region.

- Use the Review option to examine the form.

- Check the description to ensure that you have chosen the correct form.

- If the form isn’t what you’re looking for, use the Lookup field to find the form that suits your needs and requirements.

- If you locate the right form, simply click Purchase now.

- Select the pricing plan you want, complete the necessary information to create your account, and process your payment using PayPal or a credit card.

- Choose a convenient paper format and download your copy.

Form popularity

FAQ

AnnualCreditReport has a strong history of safeguarding user information. While no website is completely immune, the site employs strict security measures to protect against data breaches. When conducting a North Carolina credit inquiry, rest assured that they continually update their protocols to keep your data safe.

All new auto or mortgage loan or utility inquiries will show on your credit report; however, only one of the inquiries within a specified window of time will impact your credit score. This exception generally does not apply to other types of loans, such as credit cards.

No, requesting your credit report will not hurt your credit score. Checking your own credit report is not an inquiry about new credit, so it has no effect on your score.

You should generally wait six months to a year before applying for a new credit card. Over time, hard inquiries don't have as much impact on your credit score. Typically, within six months to a year, those inquiries don't have as much weight.

This information is reported to Equifax by your lenders and creditors and includes the types of accounts (for example, a credit card, mortgage, student loan, or vehicle loan), the date those accounts were opened, your credit limit or loan amount, account balances, and your payment history.

Though prospective employers don't see your credit score in a credit check, they do see your open lines of credit (such as mortgages), outstanding balances, auto or student loans, foreclosures, late or missed payments, any bankruptcies and collection accounts.

According to FICO, a hard inquiry from a lender will decrease your credit score five points or less. If you have a strong credit history and no other credit issues, you may find that your scores drop even less than that.

Review All Your Credit Reports At Least Once a Year to Maintain Credit Health. There are three major credit reporting agencies in the U.S. Equifax, Experian, and TransUnion and each produces proprietary reports. These agencies simply report the data provided to them by creditors.

If you find an unauthorized or inaccurate hard inquiry, you can file a dispute letter and request that the bureau remove it from your report. The consumer credit bureaus must investigate dispute requests unless they determine your dispute is frivolous. Still, not all disputes are accepted after investigation.

Six or more inquiries are considered too many and can seriously impact your credit score. If you have multiple inquiries on your credit report, some may be unauthorized and can be disputed.