North Carolina Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor

Description

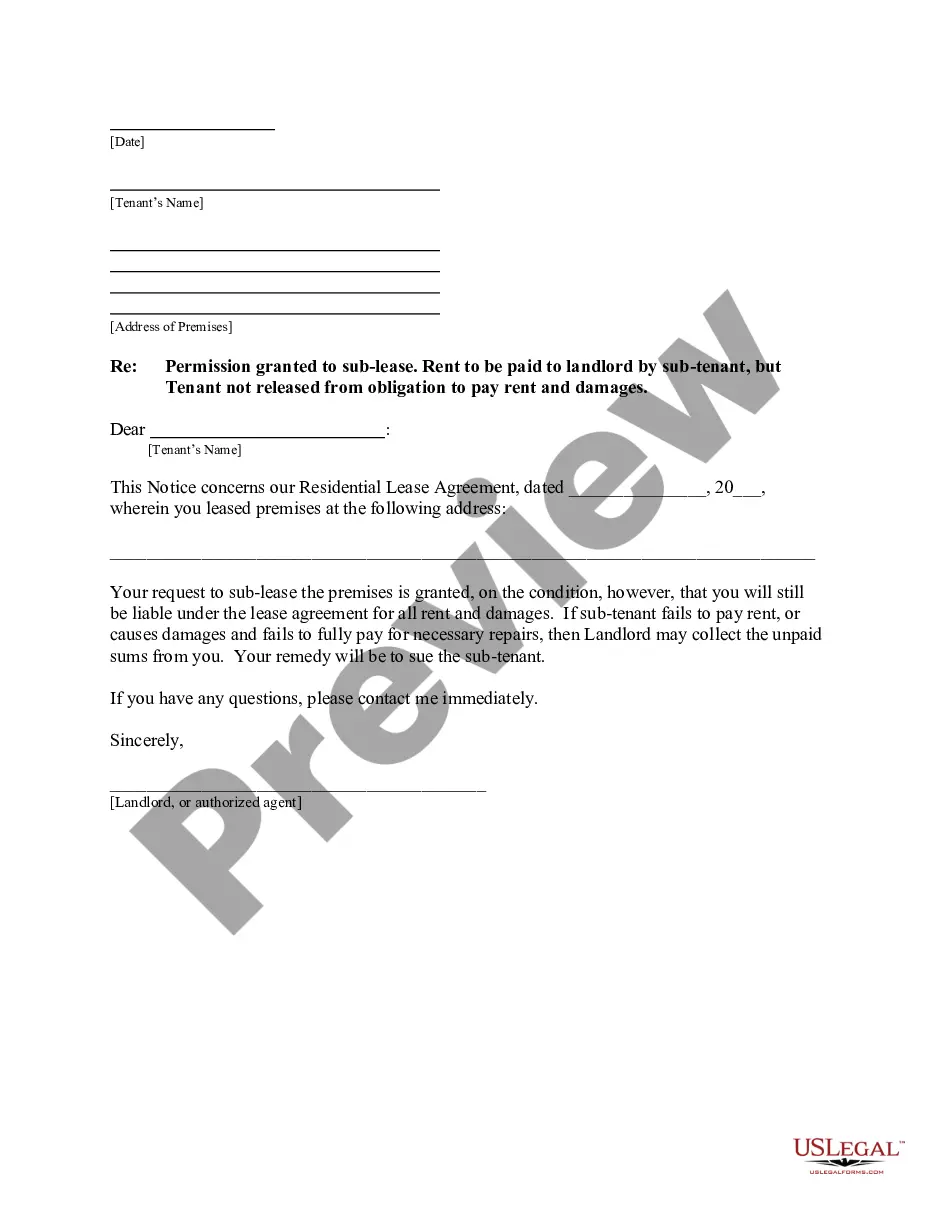

How to fill out Partnership Buy-Sell Agreement Fixing Value And Requiring Sale By Estate Of Deceased Partner To Survivor?

You could spend countless hours online searching for the valid document template that meets the federal and state requirements you need.

US Legal Forms offers a vast array of valid templates that have been reviewed by professionals.

You can easily download or print the North Carolina Partnership Buy-Sell Agreement Establishing Value and Mandating Sale by Estate of Deceased Partner to Survivor through the services.

- If you already have a US Legal Forms account, you can Log In and hit the Download button.

- After that, you can complete, edit, print, or sign the North Carolina Partnership Buy-Sell Agreement Establishing Value and Mandating Sale by Estate of Deceased Partner to Survivor.

- Each official document template you obtain is yours to keep indefinitely.

- To get another copy of the purchased form, go to the My documents section and click the relevant button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the appropriate document template for your state/city of choice.

- Review the form outline to confirm you have picked the right form.

- If available, use the Review button to browse through the document template as well.

- If you wish to find another version of your form, use the Search field to locate the template that meets your needs and requirements.

Form popularity

FAQ

The treatment of interest on capital when a partner dies can vary based on the partnership agreement in place. Typically, the agreement specifies how profits and losses are distributed after a partner's death. A North Carolina Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor can clarify these terms, ensuring fair treatment for the remaining partners and the deceased partner's estate.

A buyout agreement can stand on its own or can be several provisions in your written partnership agreement that control the following business decisions: whether a departing partner must be bought out. what price will be paid for the departing partner's interest in the partnership.

The creation of buy-sell agreements involves a certain amount of future-thinking. The parties must think about what could, might, or will happen and write an agreement that will work for all sides in the event an agreement is triggered at some unknown time in the future.

A buy and sell agreement is a legally binding contract that stipulates how a partner's share of a business may be reassigned if that partner dies or otherwise leaves the business. Most often, the buy and sell agreement stipulates that the available share be sold to the remaining partners or to the partnership.

Buyout agreement (also known as a buy-sell agreement) refers to a contract that gives rights to at least one party of the contract to buy the share, assets, or rights of another party given a specific event. These agreements can arise in a variety of contexts as stand-alone contracts or parts of larger agreements.

The circumstances under which the business entity can be dissolved, the process of dissolution, and how distributions of the company's assets are to be made among the owners are critical terms to be reviewed in a Buy-Sell Agreement.

Cross-purchase agreements allow remaining owners to buy the interests of a deceased or selling owner. Redemption agreements require the business entity to buy the interests of the selling owner.

The buy and sell agreement requires that the business share be sold to the company or the remaining members of the business according to a predetermined formula. In the case of the death of a partner, the estate must agree to sell.

Why do you need a buy-sell agreement?You'll establish a fair value price for shares.You'll develop an exit plan for business partners.You'll keep business interests with the surviving owners.You'll create a business continuity plan.

Some of the common triggers include death, disability, retirement or other termination of employment, the desire to sell an interest to a non-owner, dissolution of marriage or domestic partnership, bankruptcy or insolvency, disputes among owners, and the decision by some owners to expel another owner.