North Carolina Jury Instruction - 10.10.2 Debt vs. Equity

Description

How to fill out Jury Instruction - 10.10.2 Debt Vs. Equity?

If you need to total, down load, or printing legal file themes, use US Legal Forms, the most important selection of legal forms, which can be found online. Take advantage of the site`s easy and hassle-free lookup to obtain the files you will need. Numerous themes for enterprise and personal purposes are sorted by groups and suggests, or keywords and phrases. Use US Legal Forms to obtain the North Carolina Jury Instruction - 10.10.2 Debt vs. Equity in just a couple of click throughs.

If you are currently a US Legal Forms client, log in to the account and then click the Download option to have the North Carolina Jury Instruction - 10.10.2 Debt vs. Equity. You may also accessibility forms you previously acquired in the My Forms tab of your account.

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Make sure you have selected the form for the appropriate city/country.

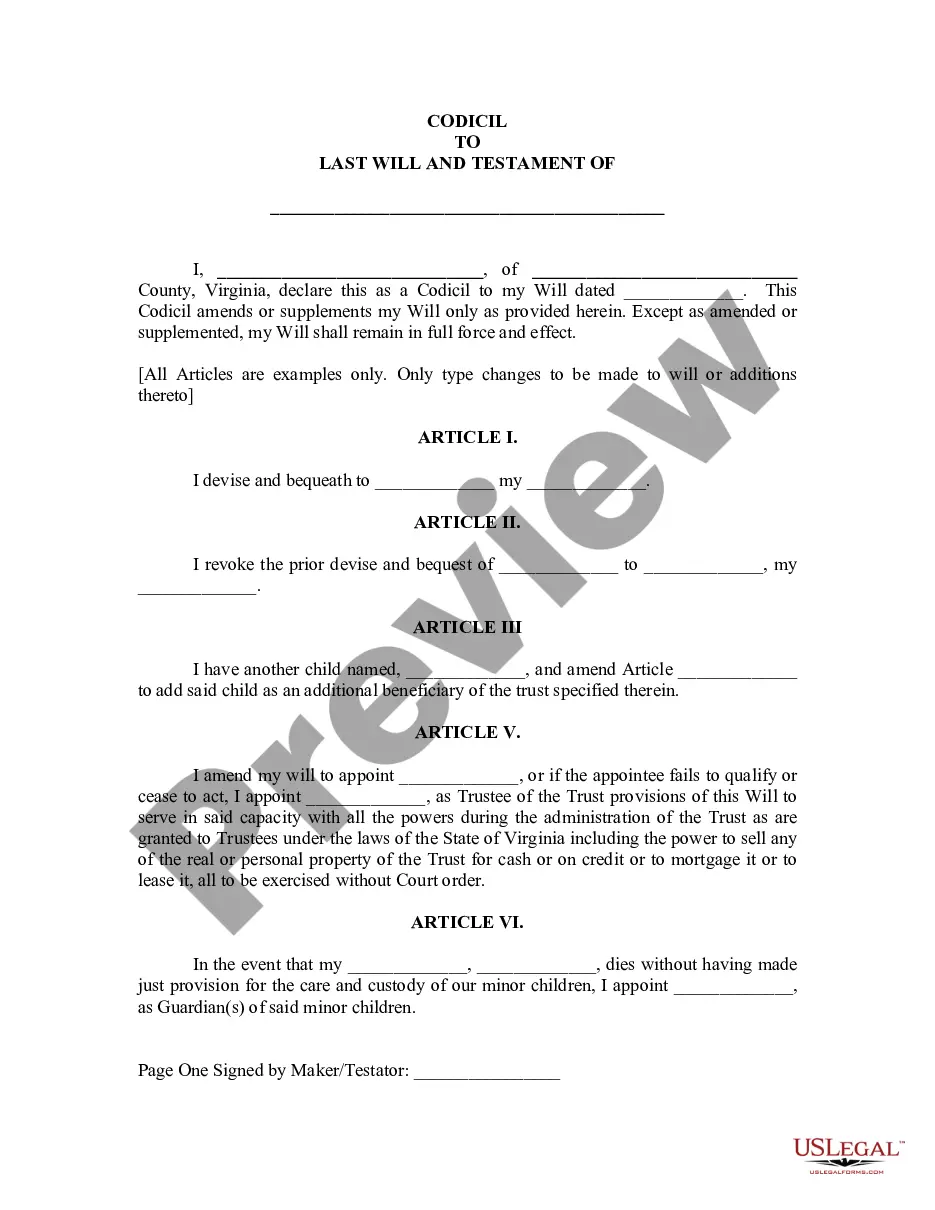

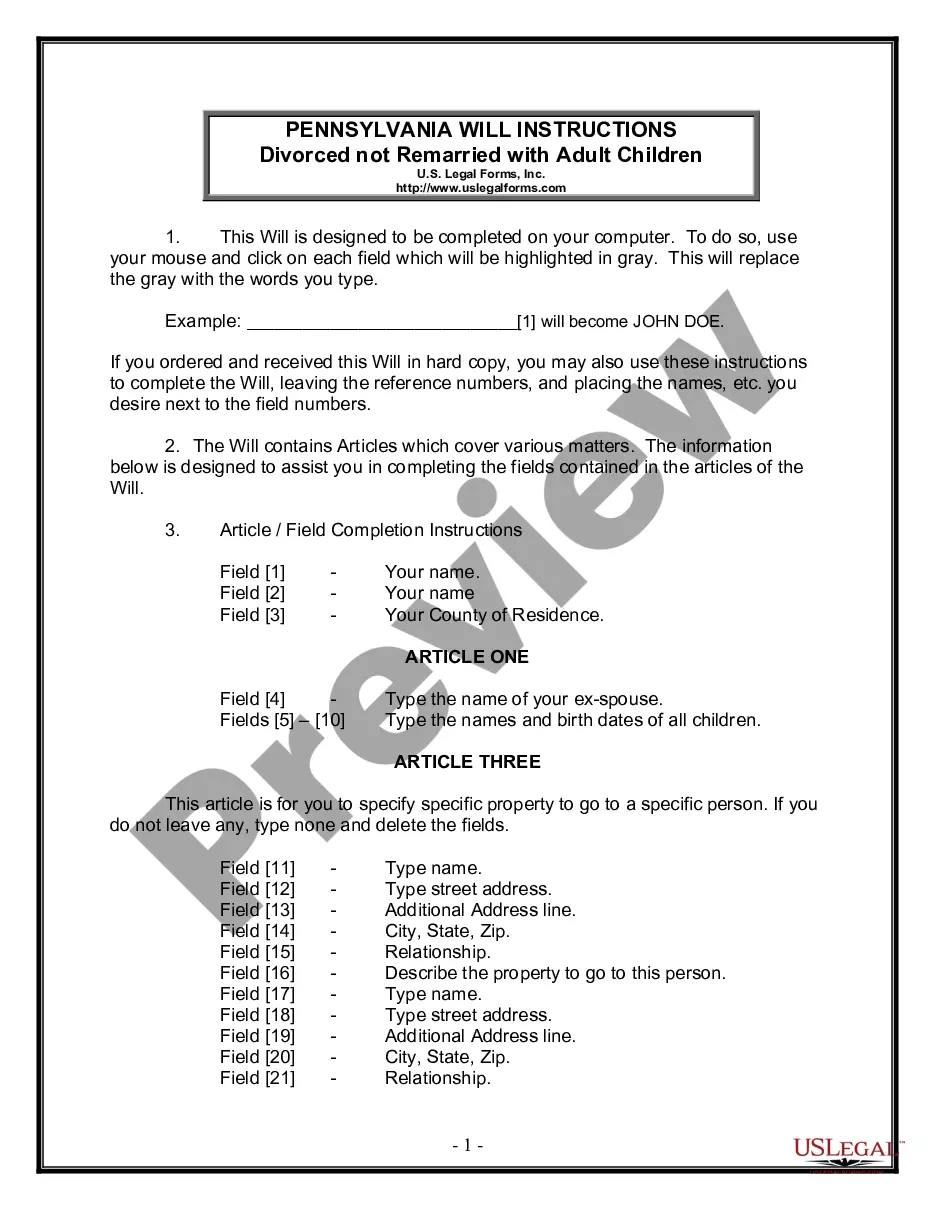

- Step 2. Utilize the Review solution to examine the form`s content material. Don`t forget to learn the explanation.

- Step 3. If you are not happy together with the develop, make use of the Lookup area on top of the monitor to locate other variations from the legal develop template.

- Step 4. When you have located the form you will need, go through the Buy now option. Pick the pricing strategy you favor and add your credentials to register for the account.

- Step 5. Approach the financial transaction. You may use your bank card or PayPal account to accomplish the financial transaction.

- Step 6. Select the file format from the legal develop and down load it on your own gadget.

- Step 7. Full, edit and printing or indicator the North Carolina Jury Instruction - 10.10.2 Debt vs. Equity.

Every single legal file template you acquire is your own property forever. You might have acces to every single develop you acquired with your acccount. Select the My Forms segment and select a develop to printing or down load yet again.

Remain competitive and down load, and printing the North Carolina Jury Instruction - 10.10.2 Debt vs. Equity with US Legal Forms. There are millions of specialist and status-specific forms you can use for your personal enterprise or personal needs.