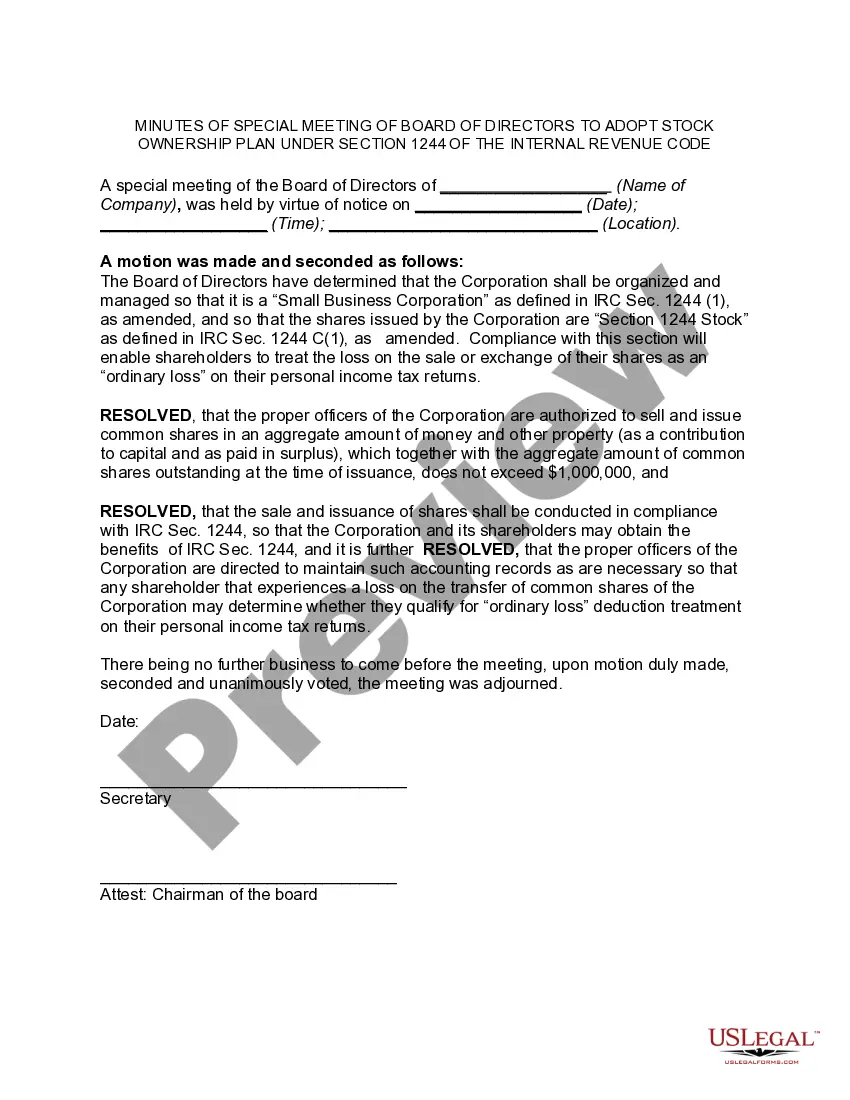

North Carolina Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code

Description

How to fill out Minutes Of Special Meeting Of The Board Of Directors Of (Name Of Corporation) To Adopt Stock Ownership Plan Under Section 1244 Of The Internal Revenue Code?

Selecting the optimal official document design can be challenging. Clearly, there are numerous templates available online, but how do you locate the official document you require? Utilize the US Legal Forms website.

The service offers an extensive array of templates, such as the North Carolina Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code, which can be utilized for business and personal purposes.

All templates are reviewed by experts and comply with federal and state regulations.

Once you are sure the form is correct, click the Get now button to acquire the form. Select the pricing plan you wish and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Choose the file format and download the official document design to your device. Complete, modify, print, and sign the received North Carolina Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code. US Legal Forms is the largest repository of official templates where you can find a range of document templates. Use the service to download professionally crafted documents that adhere to state requirements.

- If you are already registered, Log In to your account and click the Download button to secure the North Carolina Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code.

- Use your account to examine the official templates you have previously acquired.

- Visit the My documents tab of your account and retrieve another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure that you have chosen the correct form for your city/county. You can view the form using the Preview button and review the form details to make sure it is suitable for you.

- If the form does not meet your requirements, utilize the Search box to find the right document.

Form popularity

FAQ

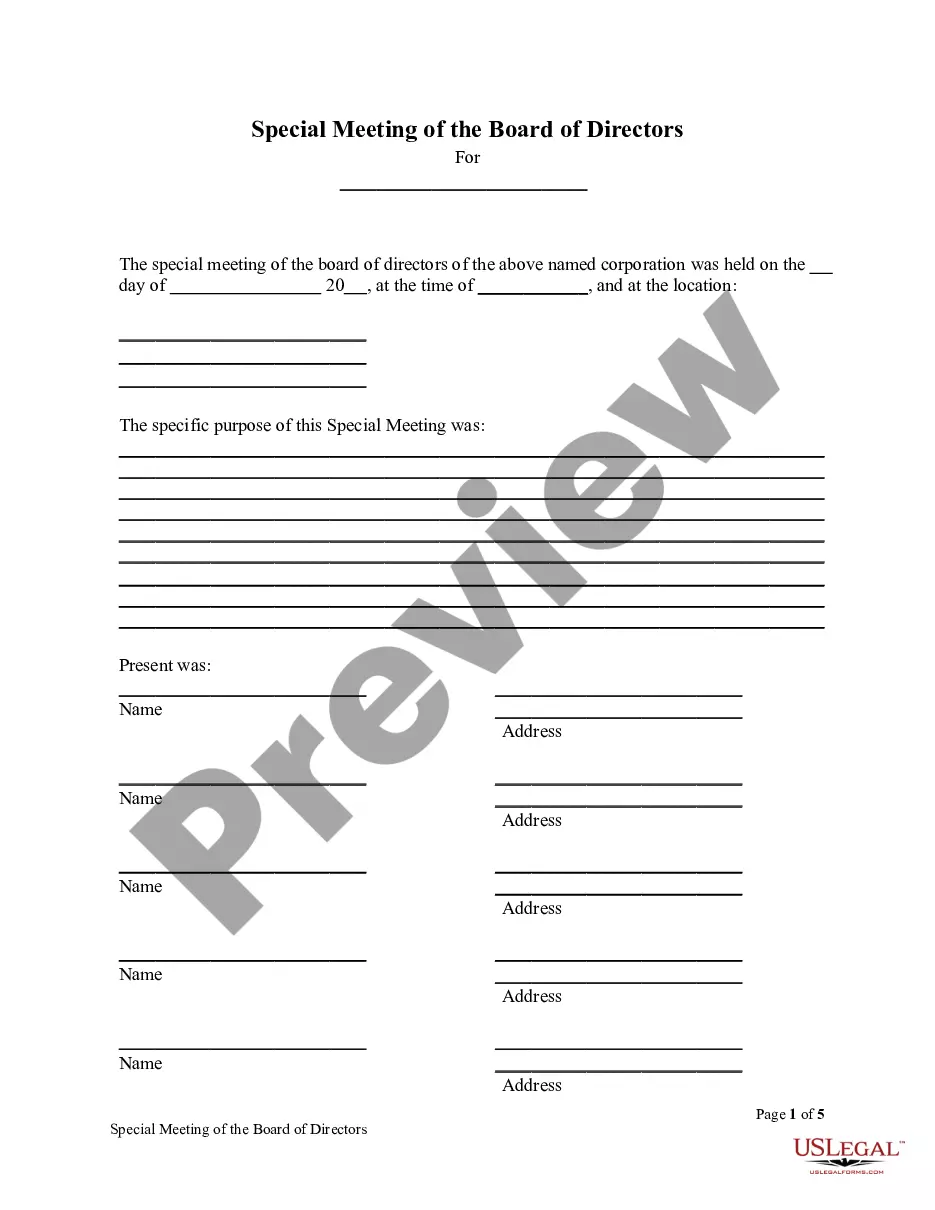

Include the name of the organization, the meeting time and place and whether the meeting was regular or special. The minutes should also include the names of those present, particularly the chairman and keeper of the minutes.

Special meeting is a meeting called by shareholders to discuss specific matters stated in the notice of the meeting. It is a meeting of shareholders outside the usual annual general meeting.

Special meeting is a meeting called by shareholders to discuss specific matters stated in the notice of the meeting. It is a meeting of shareholders outside the usual annual general meeting.

How to Write Meeting Minutesthe name of the company, date, and location of the meeting.the type of meeting (annual board of directors meeting, special meeting, and so on.)the names and titles of the person chairing the meeting and the one taking minutes.the names of attendees and the names of those who did not attend.More items...

How to write corporate minutes: step by stepTaking Meeting Notes.Type Meeting Notes - Type up a full version of the meeting minutes.Circulate a Draft - Follow your corporation's policy about who must review the draft notes.Distribute Minutes to Board - Usually in advance of the next meeting.More items...

The minutes should include the title of the group that is meeting; the date, time, and venue; the names of those in attendance (including staff) and the person recording the minutes; and the agenda.

Most special meetings involve director elections, which typically work pursuant to a less-restrictive plurality standard, rather than a majority standard.

Special meetings of the shareholders may be called for any purpose or purposes, at any time, by the Chief Executive Officer; by the Chief Financial Officer; by the Board or any two or more members thereof; or by one or more shareholders holding not less than 10% of the voting power of all shares of the corporation

Special stockholder meetings can be called by the board of directors or any person that is authorized in the certificate of incorporation or in the bylaws of the company.

: a meeting held for a special and limited purpose specifically : a corporate meeting held occasionally in addition to the annual meeting to conduct only business described in a notice to the shareholders.