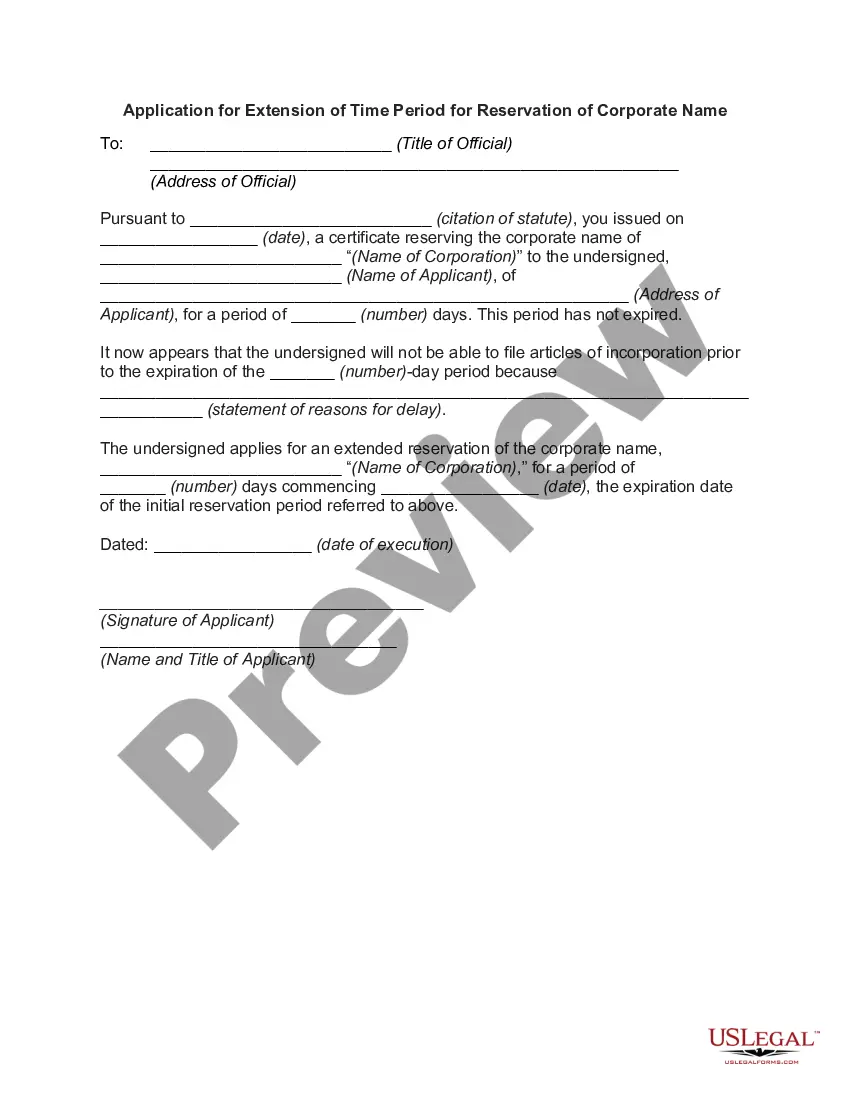

North Carolina Application for Extension of Time Period for Reservation of Corporate Name

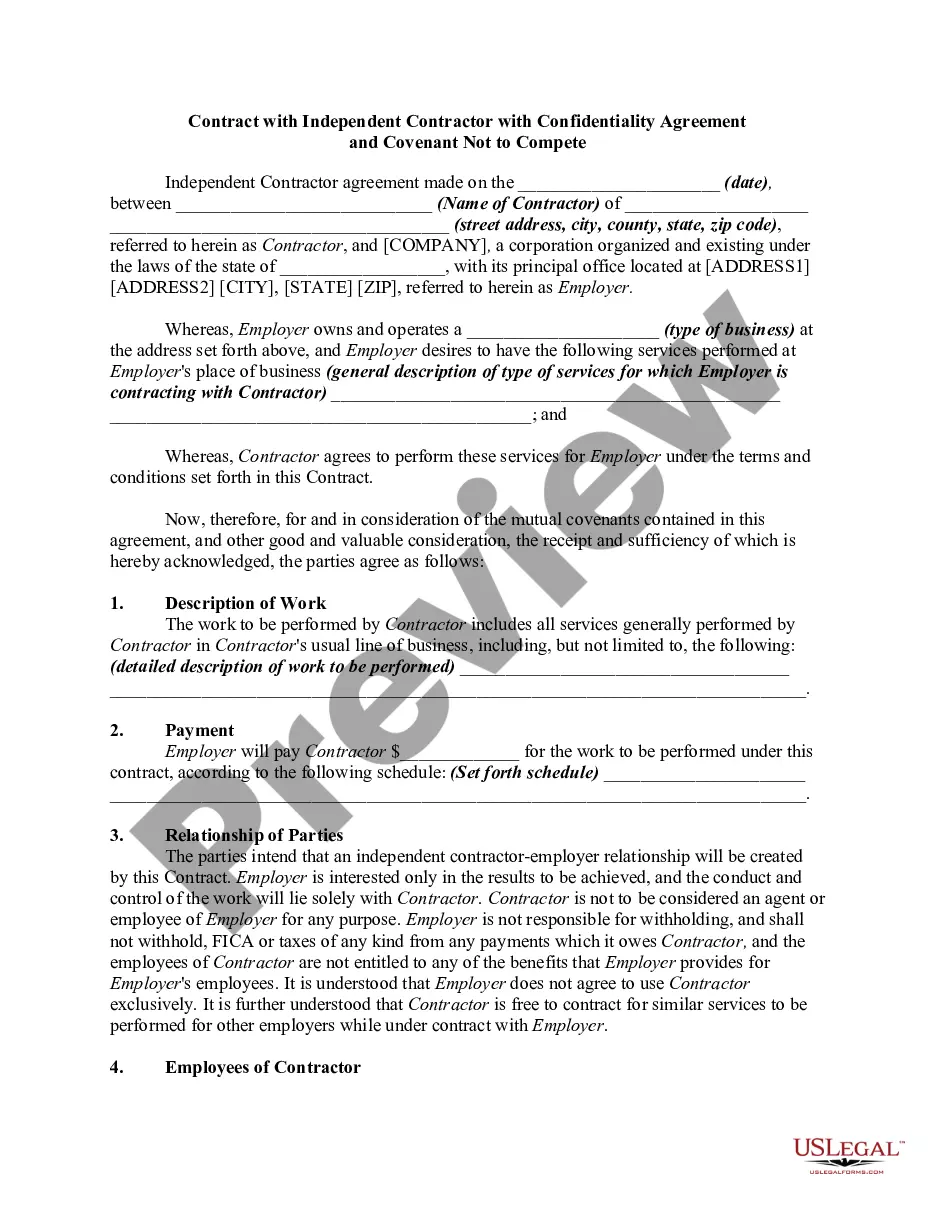

Description

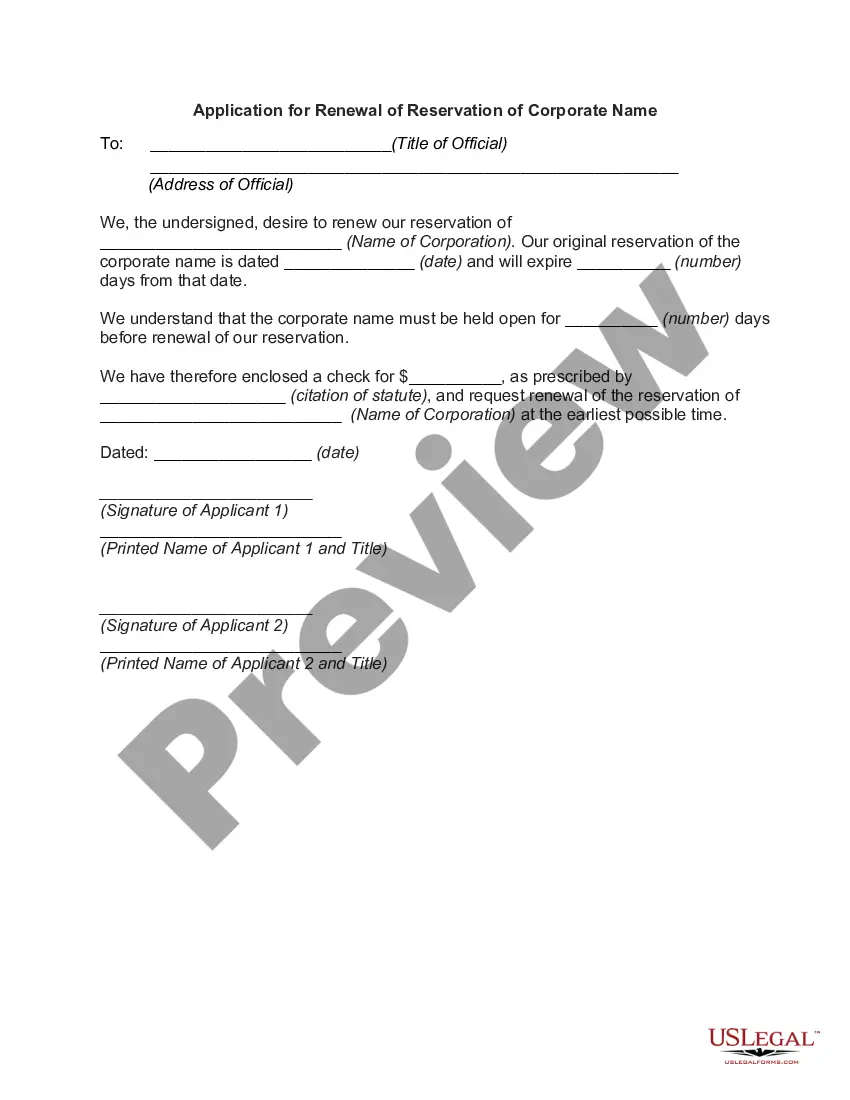

How to fill out Application For Extension Of Time Period For Reservation Of Corporate Name?

It is possible to commit time on the web looking for the lawful papers template which fits the federal and state demands you will need. US Legal Forms supplies thousands of lawful varieties that happen to be evaluated by professionals. You can actually acquire or print the North Carolina Application for Extension of Time Period for Reservation of Corporate Name from my assistance.

If you have a US Legal Forms bank account, you can log in and click the Obtain button. Afterward, you can comprehensive, edit, print, or indicator the North Carolina Application for Extension of Time Period for Reservation of Corporate Name. Every lawful papers template you acquire is your own property permanently. To acquire one more copy of the acquired develop, proceed to the My Forms tab and click the corresponding button.

If you use the US Legal Forms website initially, keep to the straightforward recommendations under:

- First, be sure that you have selected the correct papers template for the area/town of your choosing. See the develop information to ensure you have picked out the correct develop. If accessible, utilize the Review button to look with the papers template at the same time.

- If you want to find one more model of the develop, utilize the Search industry to get the template that meets your requirements and demands.

- Once you have discovered the template you need, click Get now to carry on.

- Pick the prices strategy you need, type your qualifications, and register for your account on US Legal Forms.

- Full the purchase. You can utilize your Visa or Mastercard or PayPal bank account to purchase the lawful develop.

- Pick the file format of the papers and acquire it to your product.

- Make changes to your papers if required. It is possible to comprehensive, edit and indicator and print North Carolina Application for Extension of Time Period for Reservation of Corporate Name.

Obtain and print thousands of papers templates utilizing the US Legal Forms site, that offers the largest variety of lawful varieties. Use skilled and state-distinct templates to take on your business or specific requirements.

Form popularity

FAQ

In order to receive an automatic State extension, the taxpayer must certify on the North Carolina tax return that the person was granted an automatic federal extension.

Yes. North Carolina requires businesses to file a Federal Form 7004 rather than requesting a separate state tax extension. State Tax extension Form can be filed only if the federal tax extension Form 7004 was not granted.

You can pay corporate estimated income tax payments online. Go to "eServices" and select "CD-429". Note: Taxed S Corporations are required to make estimated tax payments in the same manner as C-Corporations, but will use Form CD-429 PTE.

North Carolina has a flat 4.75 percent individual income tax rate. North Carolina also has a 2.50 percent corporate income tax rate. North Carolina has a 4.75 percent state sales tax rate, a max local sales tax rate of 2.75 percent, and an average combined state and local sales tax rate of 6.99 percent.

To request a filing extension, use the California Department of Tax and Fee Administration's (CDTFA) online services. You must have a CDTFA Online Services Username or User ID and Password. You must submit a request for extension no later than one month after the due date of your return or prepayment form and payment.

Without a valid extension, an individual income tax return filed after the original due date is delinquent and subject to interest and all applicable penalties provided by law.

The minimum franchise tax is $200. For S-Corporations: The tax rate for an S-Corporation is $200 for the first one million dollars ($1,000,000) of the corporation's tax base and $1.50 per $1,000 of its tax base that exceeds one million dollars ($1,000,000).

Form CD-419 is used to extend the time for filing a North Carolina corporate tax return (Form CD-405, CD-401S or CD-418). When timely filed, this application for extension extends time to file the tax return by six months.