North Carolina Charity Subscription Agreement

Description

How to fill out Charity Subscription Agreement?

Are you currently in a situation where you frequently require documentation for either business or personal reasons on a daily basis.

There is a wide selection of legal document templates available online, but finding trustworthy ones is not straightforward.

US Legal Forms offers a vast array of template options, including the North Carolina Charity Subscription Agreement, which are designed to comply with federal and state regulations.

Once you find the appropriate form, click on Buy now.

Select the pricing plan you desire, provide the required information to create your account, and pay for your order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the North Carolina Charity Subscription Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these guidelines.

- Select the form you require and ensure it is designated for the correct city/state.

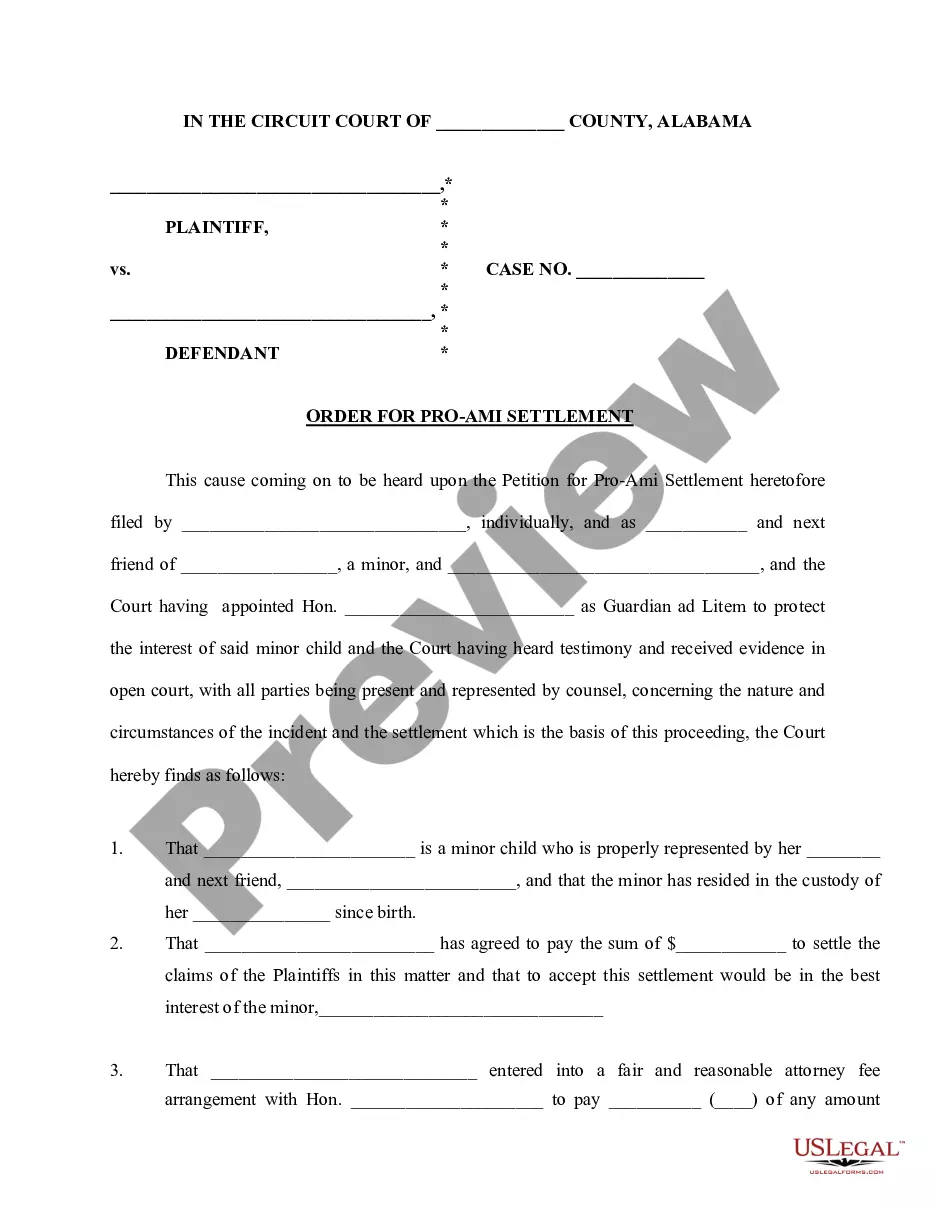

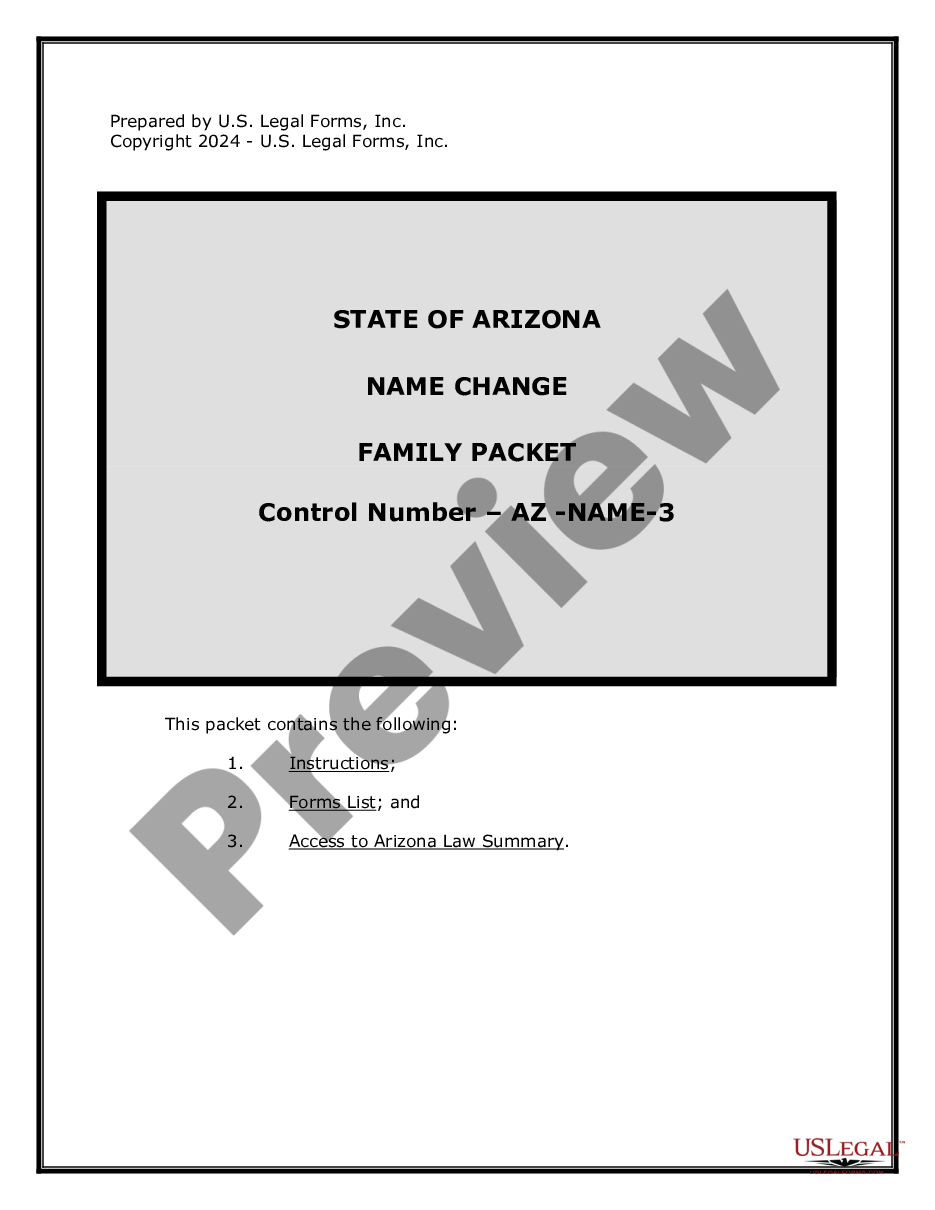

- Utilize the Preview button to examine the form.

- Review the description to confirm that you have selected the proper form.

- If the form is not what you are seeking, leverage the Search field to find a form that fulfills your needs and specifications.

Form popularity

FAQ

In North Carolina, nonprofits typically file Form 1023, which is the Application for Recognition of Exemption. This form is crucial for obtaining your federal tax-exempt status, which can greatly benefit your operations. If you’re managing a North Carolina Charity Subscription Agreement, having tax-exempt status can enhance donor trust and increase contributions. Engage with professionals to ensure your filing is accurate and complete.