North Carolina Partnership Agreement for Law Firm

Description

How to fill out Partnership Agreement For Law Firm?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a variety of legal document templates that you can purchase or print.

Through the website, you can access thousands of forms for business and personal needs, organized by categories, states, or keywords. You can obtain the latest forms such as the North Carolina Partnership Agreement for Law Firms within minutes.

If you have a monthly subscription, sign in to retrieve the North Carolina Partnership Agreement for Law Firms from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents tab of your account.

Proceed with the purchase. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make edits. Complete, adjust, print, and sign the downloaded North Carolina Partnership Agreement for Law Firms.

Every template you add to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need.

- Ensure you have selected the correct form for your region/area.

- Click the Preview button to examine the form's content.

- Review the form description to verify you have chosen the correct one.

- If the form does not meet your needs, utilize the Search field at the top of the display to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Download now button.

- Then, choose the pricing plan you prefer and provide your information to register for the account.

Form popularity

FAQ

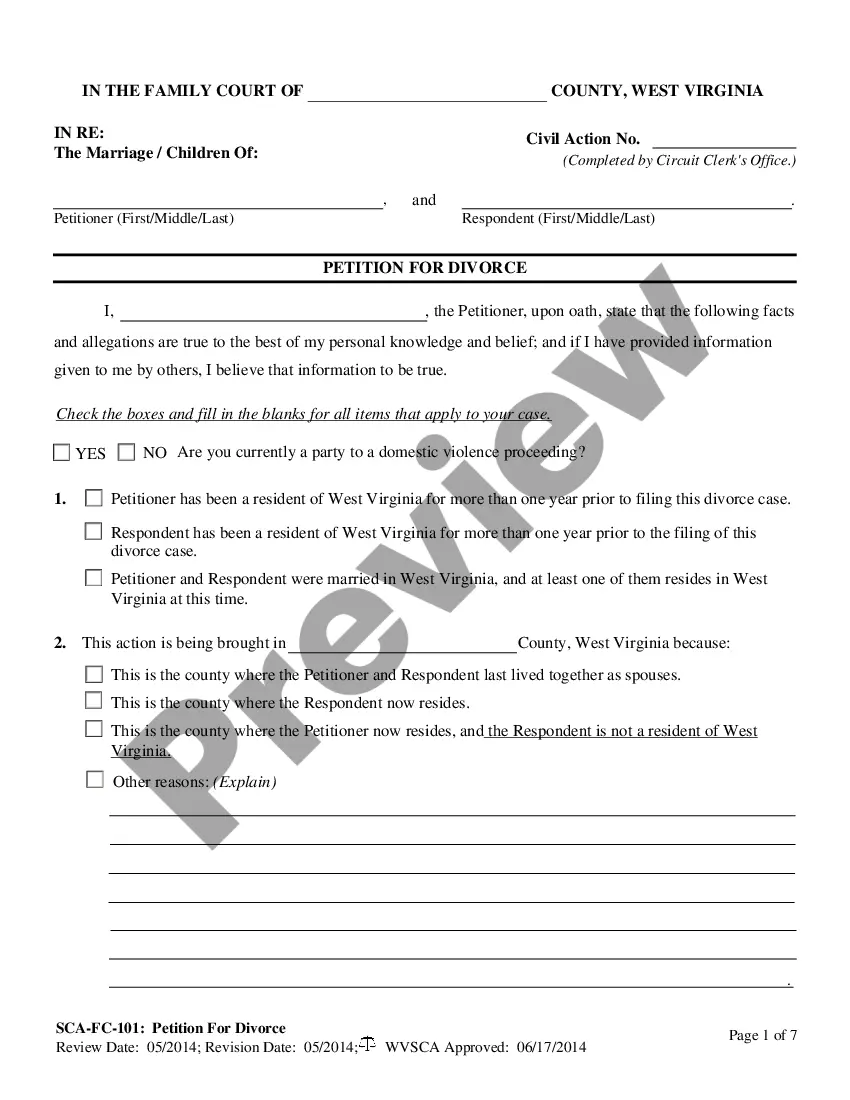

Setting up a partnership agreement in North Carolina is a crucial step in creating a successful partnership. Start by discussing key elements with your partner, such as profit distribution, decision-making processes, and dispute resolution. Draft your partnership agreement clearly and concisely, ensuring it covers all important topics. Utilizing a North Carolina Partnership Agreement for Law Firm will provide you with a comprehensive framework that meets legal requirements and protects your interests.

To form a partnership in North Carolina, you should take the following steps:Choose a business name.File an assumed name.Draft and sign a partnership agreement.Obtain licenses, permits, and zoning clearance.Obtain an Employer Identification Number.

Steps to Create a North Carolina General PartnershipDetermine if you should start a general partnership.Choose a business name.File a DBA name (if needed)Draft and sign partnership agreement.Obtain licenses, permits, and clearances.Get an Employer Identification Number (EIN)More items...

You don't have to file any paperwork to establish a partnership -- you can create a partnership simply by agreeing to go into business with another person.Choose a business name.Register a fictitious business name.Draft and sign a partnership agreement.Comply with tax and regulatory requirements.Obtain Insurance.

8 things your small business partnership agreement should includeWhat each business partner will contribute.How finances will be managed.Distribution of profits and losses.A process for dispute resolution.A non-compete clause.A non-disclosure confidentiality clause.A non-solicitation clause.More items...?

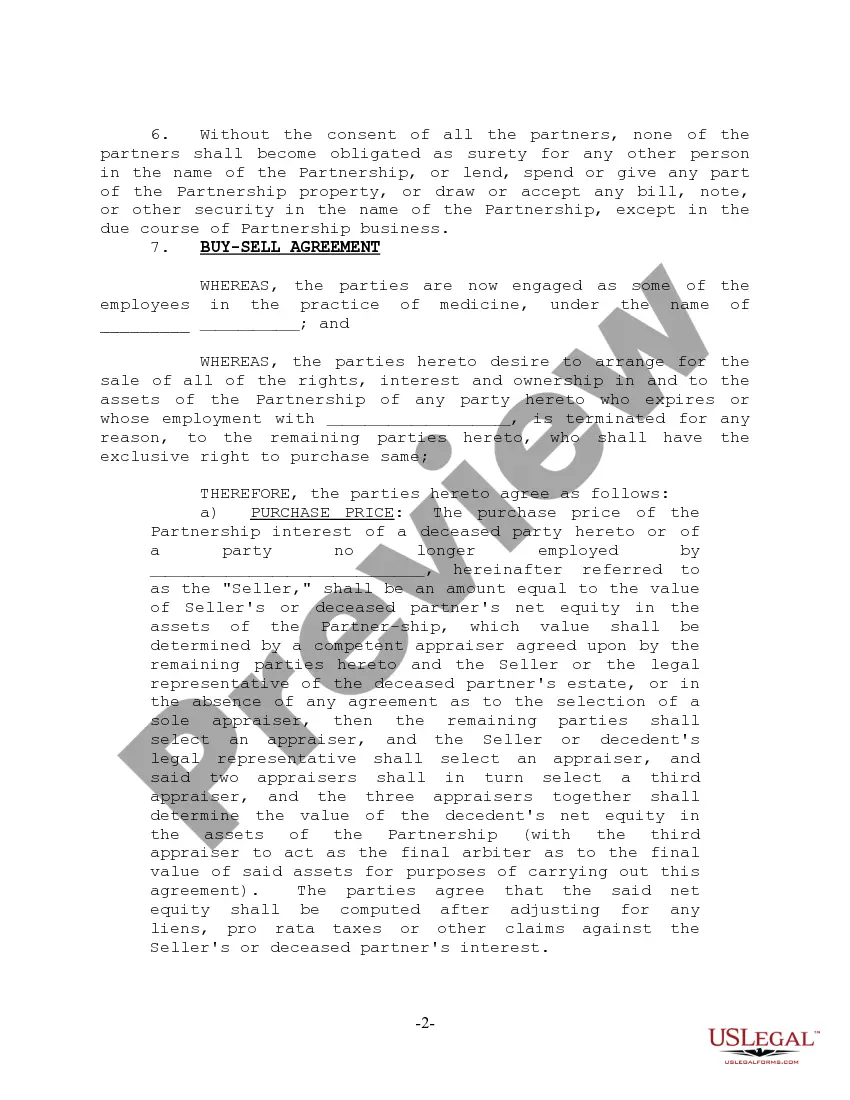

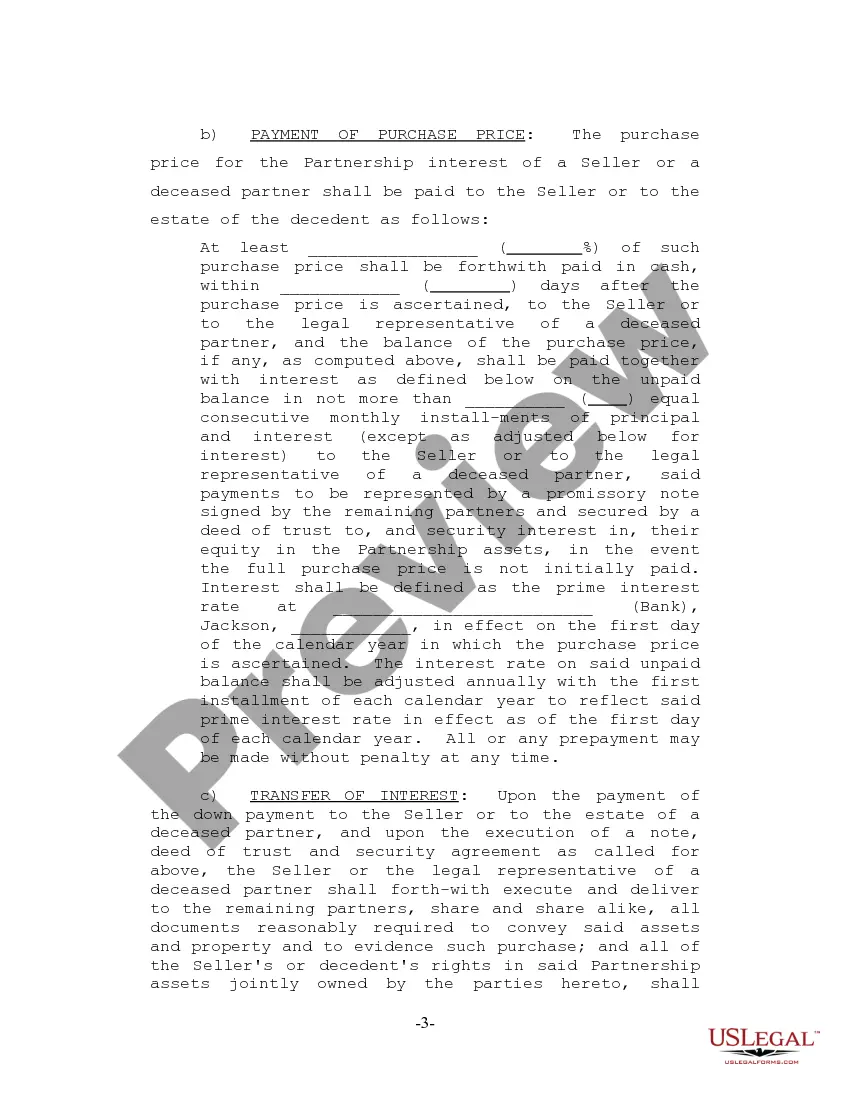

The partnership agreement spells out who owns what portion of the firm, how profits and losses will be split, and the assignment of roles and duties. The partnership agreement will also typically spell how out disputes are to be adjudicated and what happens if one of the partners dies prematurely.

Partnerships must file Form SS-4 with the Internal Revenue Service. Form SS-4 is used to get an employer identification number, also known as a federal tax ID number, from the IRS. The IRS allows a partnership to file Form SS-4 online using the IRS website, by telephone, by fax or by mail.

Here are the basic steps to forming a partnership: Choose a business name. Register a fictitious business name. Draft and sign a partnership agreement.

A general partnership is a legal entity, formed by two or more persons, where all owners share equally in rights, responsibilities, and potential liability. In most instances, all partners in a general partnership are involved in the daily operations of the business.

Features of partnership form of organisation are discussed as below:Two or More Persons:Contract or Agreement:Lawful Business:Sharing of Profits and Losses:Liability:Ownership and Control:Mutual Trust and Confidence:Restriction on Transfer of Interest:More items...