North Carolina Partnership Agreement for LLP

Description

How to fill out Partnership Agreement For LLP?

Are you currently in a position where you require documents for both professional or particular purposes nearly every working day.

There are many legal document templates accessible online, but finding ones you can trust is not simple.

US Legal Forms provides thousands of form templates, including the North Carolina Partnership Agreement for LLP, that are crafted to meet federal and state requirements.

Once you have the right form, click Purchase now.

Choose the pricing plan you want, fill in the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the North Carolina Partnership Agreement for LLP template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/state.

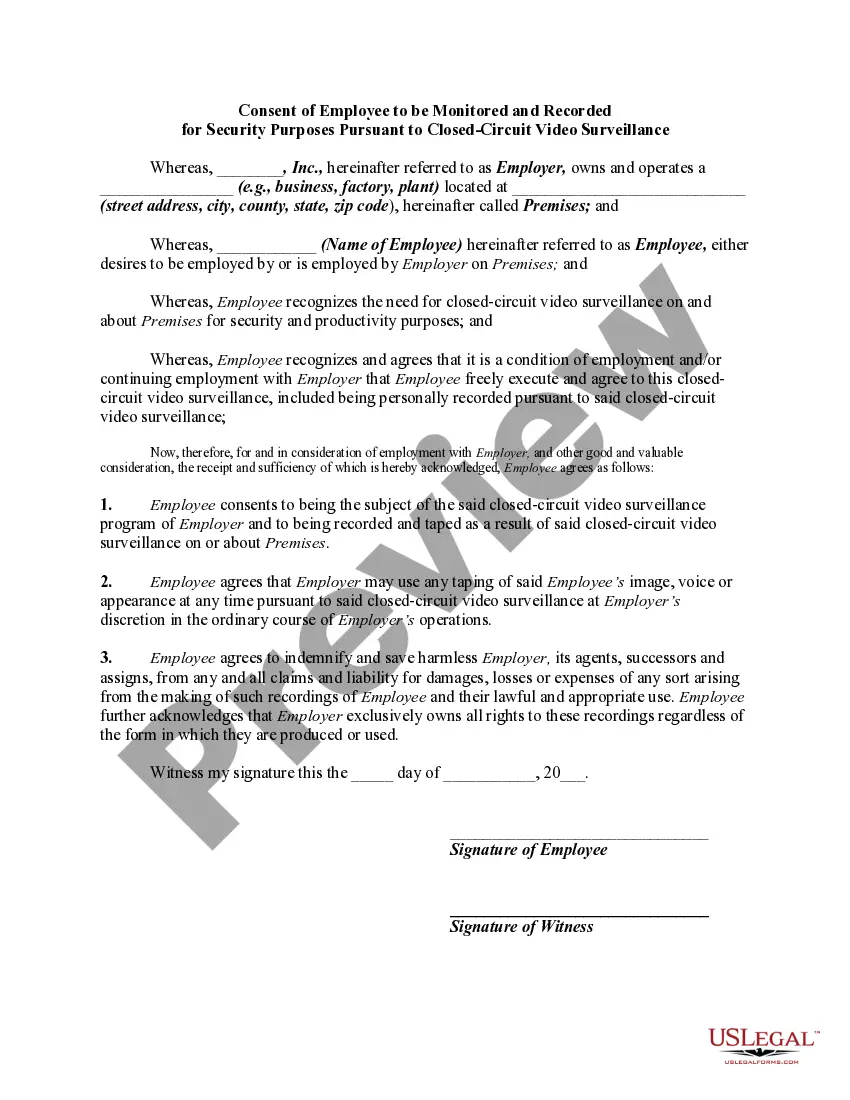

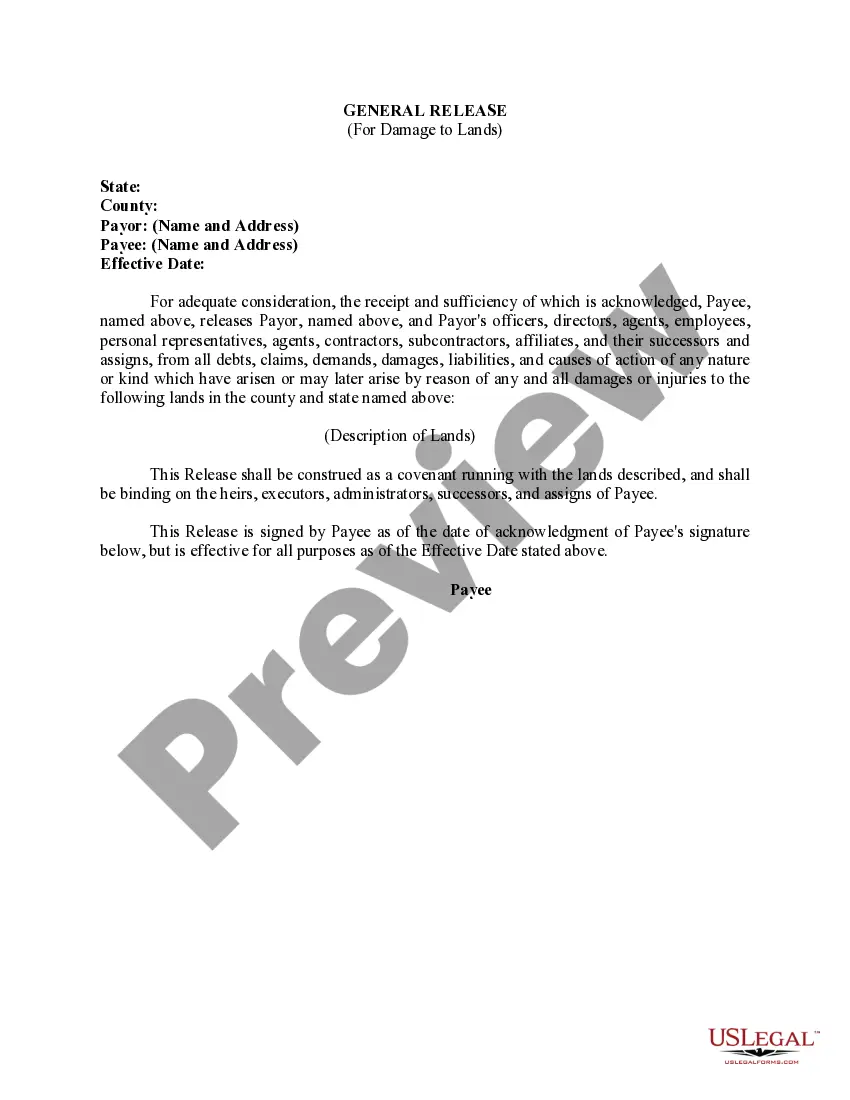

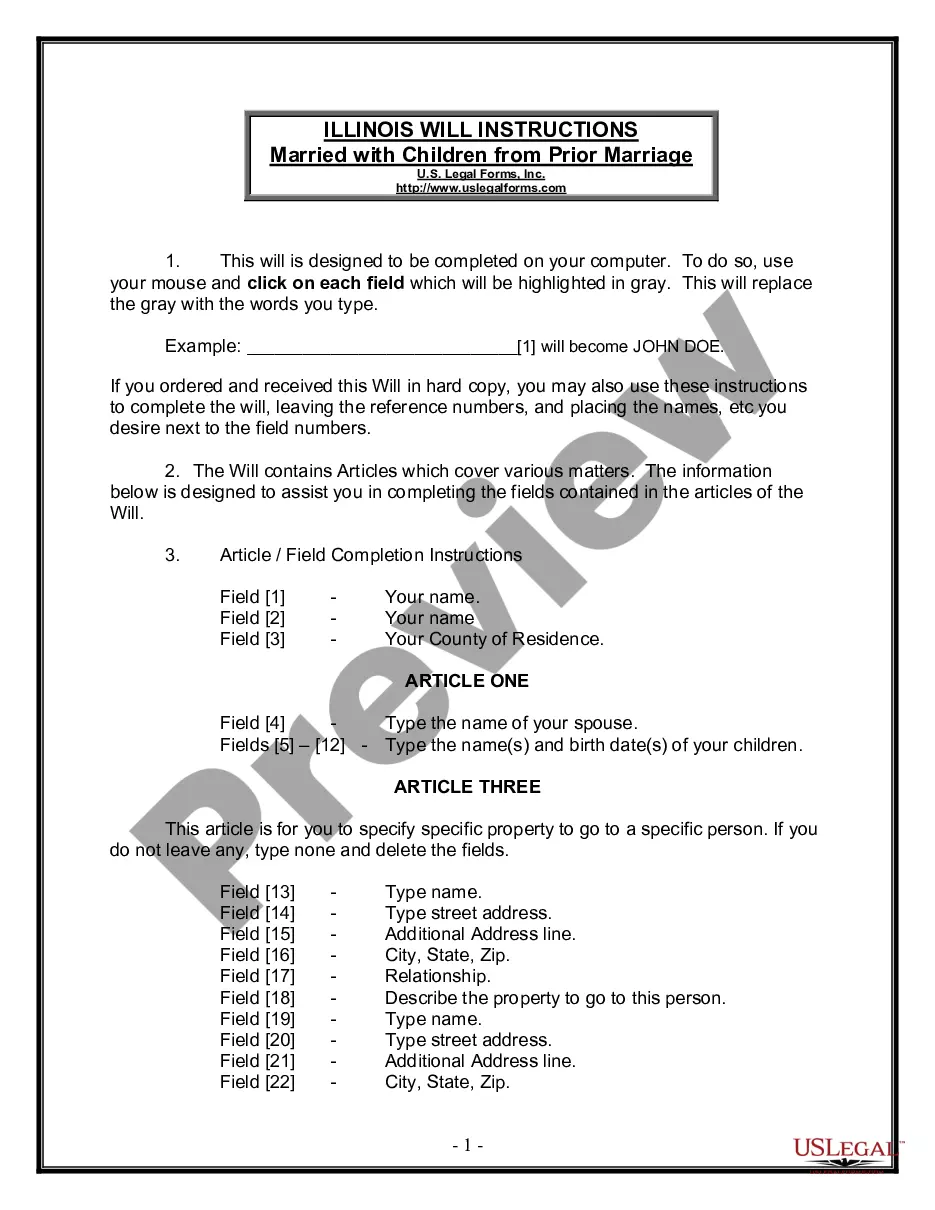

- Utilize the Review button to examine the form.

- Check the outline to ensure that you have chosen the correct form.

- If the form isn’t what you’re looking for, use the Lookup field to find the form that suits your needs.

Form popularity

FAQ

How to Form a North Carolina Limited Partnership (in 6 Steps)Step One) Choose an LP Name.Step Two) Designate a Registered Agent.Step Three) File the Certificate of Domestic Limited Partnership.Step Four) Create a Limited Partnership Agreement.Step Five) Handle Taxation Requirements.More items...?

If there is no written partnership agreement, partners are not allowed to draw a salary. Instead, they share the profits and losses in the business equally. The agreement outlines the rights, responsibilities, and duties each partner has to the company and to each other.

Since Oct. 1, 1999, North Carolina law has allowed a general partnership to obtain limited liability for its general partners by registering as a limited liability partnership (LLP).

Are there rules on how partnerships are run? The only requirement is that in the absence of a written agreement, partners don't draw a salary and share profits and losses equally. Partners have a duty of loyalty to the other partners and must not enrich themselves at the expense of the partnership.

It's not a legal requirement to enter into a limited liability partnership agreement and an LLP can be set up without one. However, it's a very common and generally sound recommendation that a new LLP puts a partnership agreement in place.

A limited partnership is a type of partnership that consists of at least one general partner and at least one limited partner. A limited liability partnership does not have a general partner, since every partner in an LLP is given the ability to take part in the management of the company.

A limited partnership is different from a general partnership in that it requires a partnership agreement. Some information about the business and the partners must be filed with the appropriate state agency (usually the secretary of state). Additionally, a limited partnership has both limited and general partners.

Limited partnerships must be registered at the Registrar of Companies (Companies House). Until registered, both types of partners are equally responsible for any debts and obligations incurred. It is usual to register immediately after the partnership agreement has been signed.

In North Carolina, a limited partnership is a partnership formed pursuant to the North Carolina Revised Uniform Limited Partnership Act (RULPA), and consists of one or more general partners, and one or more limited partners.

The partnership firm under the Partnership Act is to have a partnership deed. The LLP is a hybrid of Companies Act and Partnership Act. The bill provides for the limited liability partnership agreement ('agreement' for short).