The New Jersey Chapter 11 Plan is a form of reorganization that allows a business to restructure its debt and continue operations. It is a form of bankruptcy that is available to businesses that cannot repay their debt in the short term. This type of reorganization allows the debtor to reduce debt payments, extend the repayment period, and create a plan to pay creditors over time. The plan must be approved by the court and creditors before it can be implemented. There are two types of New Jersey Chapter 11 Plan. The first is a “Pre-packaged” plan, which means that a majority of creditors must agree to the terms in order for the plan to be approved. The second type is a “Confirmed” plan, which requires the court to approve the plan before it can be implemented.

New Jersey Chapter 11 Plan

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out New Jersey Chapter 11 Plan?

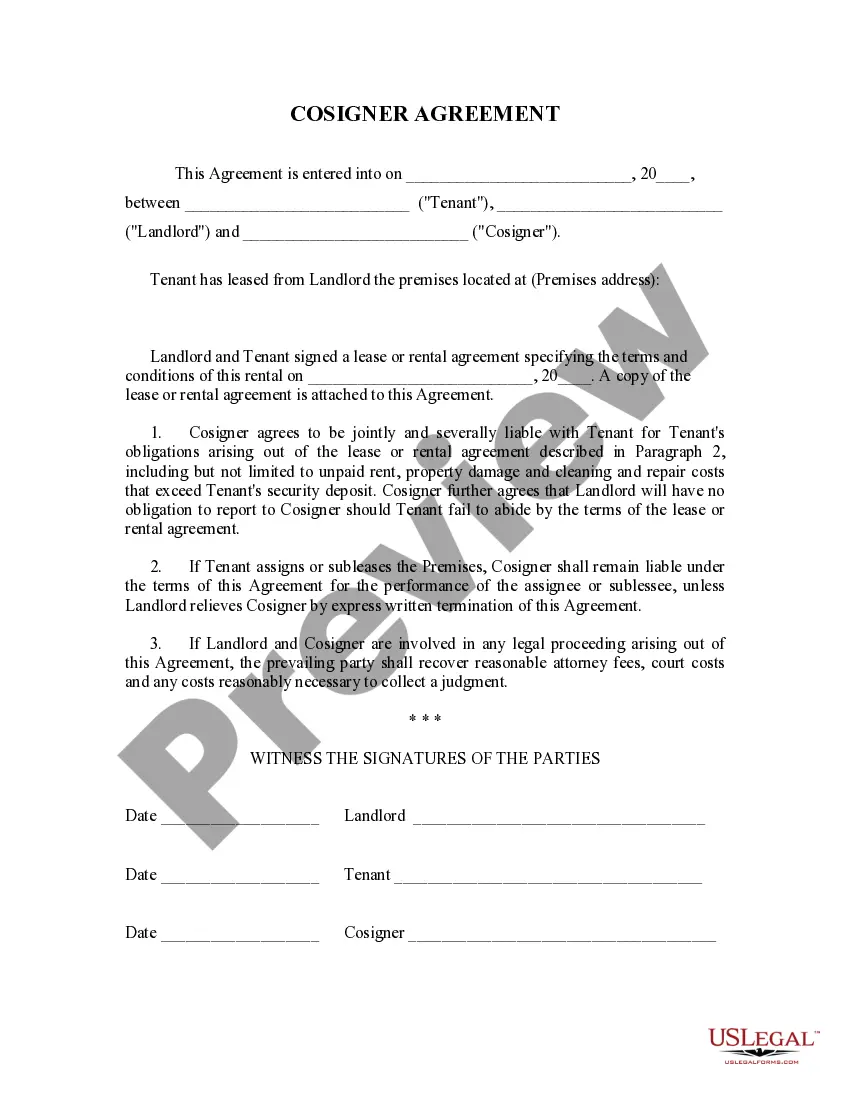

Preparing legal paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you find, as all of them comply with federal and state regulations and are verified by our experts. So if you need to prepare New Jersey Chapter 11 Plan, our service is the perfect place to download it.

Obtaining your New Jersey Chapter 11 Plan from our service is as simple as ABC. Previously registered users with a valid subscription need only sign in and click the Download button once they find the proper template. Afterwards, if they need to, users can get the same blank from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few minutes. Here’s a quick guideline for you:

- Document compliance check. You should carefully examine the content of the form you want and ensure whether it suits your needs and complies with your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library through the Search tab on the top of the page until you find an appropriate blank, and click Buy Now when you see the one you want.

- Account creation and form purchase. Create an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your New Jersey Chapter 11 Plan and click Download to save it on your device. Print it to fill out your paperwork manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to obtain any official document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

While the average length of a Chapter 11 Bankruptcy case can last 17 months, larger and more complex cases can take up to five years. And following the conclusion of the bankruptcy case, it can still take months for Debtors to begin distributing payouts to the highest priority class of Creditors.

How Do They Settle Proof of Claim Objections in Bankruptcy? An objection to a proof of claim must be in writing and filed with the bankruptcy court. A copy of the objection and the notice of court hearing date must be mailed to the creditor, the trustee, and the debtor at least 30 days before the hearing.

An objection to confirmation is a response filed in a chapter 13 bankruptcy to an original or amended plan that is filed in the case. When you file a chapter 13 bankruptcy you fill out a petition, schedules and a number of related documents. These are really disclosure documents.

Reasons For the Debtor Filing an Objection The claim lists an incorrect amount due. The claim lists false interest or penalty charges. The claim lists an incorrect category, falsely stating it is a priority or secured. The claim has been filed for unethical reasons.

Common reasons for objecting to a Chapter 11 plan The plan is submitted in bad faith ? Debtors are required to be transparent and honest about the state of their finances. Any sort of questionable accounting could indicate an attempt to deceive the creditors and the court.

In ance with Federal Rule of Bankruptcy Procedure 2002(b), all parties-in-interest must receive at least 28 days' notice of: (1) the deadline for filing objections to confirmation of the plan; and (2) the hearing to consider confirmation of the plan.

After a Chapter 11 plan is confirmed by the court, the plan must be implemented and carried out, either by the debtor or by the successor to the debtor under the plan. If the plan calls for the debtor to be reorganized or for a new corporation to be formed, this function must be carried out first.

A case filed under chapter 11 of the United States Bankruptcy Code is frequently referred to as a "reorganization" bankruptcy. Usually, the debtor remains ?in possession,? has the powers and duties of a trustee, may continue to operate its business, and may, with court approval, borrow new money.