North Carolina Irrevocable Trust which is a Qualifying Subchapter-S Trust

Description

How to fill out Irrevocable Trust Which Is A Qualifying Subchapter-S Trust?

If you need to comprehensive, obtain, or create legal document templates, utilize US Legal Forms, the finest assortment of legal forms, available online.

Take advantage of the site’s user-friendly and convenient search to locate the documents you require. Various templates for business and personal purposes are organized by categories and keywords.

Use US Legal Forms to access the North Carolina Irrevocable Trust, which qualifies as a Subchapter-S Trust, in just a few clicks.

Every legal document template you purchase belongs to you permanently. You have access to all forms you downloaded within your account. Check the My documents section to select a form to print or download again.

Compete and obtain, and print the North Carolina Irrevocable Trust classified as a Qualifying Subchapter-S Trust with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are a current US Legal Forms user, Log In to your account and click the Acquire button to access the North Carolina Irrevocable Trust, classified as a Qualifying Subchapter-S Trust.

- You can also find forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct state/region.

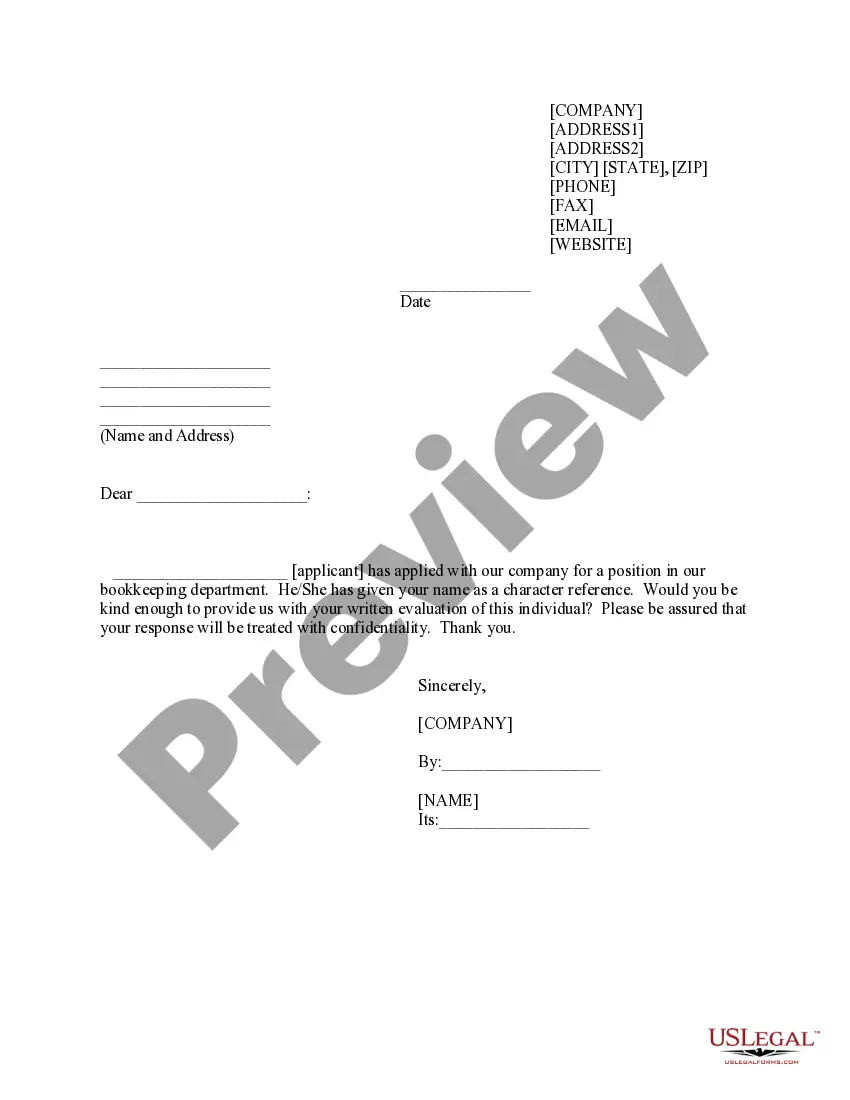

- Step 2. Use the Review option to examine the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Research section at the top of the screen to find other types in the legal form template.

- Step 4. Once you have located the form you need, select the Get now button. Choose your pricing plan and provide your details to create an account.

- Step 5. Complete the transaction. You can use your Misa or MasterCard or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the North Carolina Irrevocable Trust classified as a Qualifying Subchapter-S Trust.

Form popularity

FAQ

An irrevocable grantor trust can own S corporation stock if it meets IRS regulations. The trust must contain language stating that all the ordinary income the trust earns along with the original trust assets are owned by the trust grantor.

A Qualified Subchapter S Trust, commonly referred to as a QSST Election, or a Q-Sub election, is a Qualified Subchapter S Subsidiary Election made on behalf of a trust that retains ownership as the shareholder of an S corporation, a corporation in the United States which votes to be taxed.

Testamentary trusts. These trusts, which are established by your will, are eligible S corporation shareholders for up to two years after the transfer and then must either distribute the stock to an eligible shareholder or qualify as a QSST or ESBT.

Testamentary trusts. These trusts, which are established by your will, are eligible S corporation shareholders for up to two years after the transfer and then must either distribute the stock to an eligible shareholder or qualify as a QSST or ESBT.

An irrevocable trust that is setup as a grantor trust, qualified subchapter S trust or as an electing small business trust may own shares of an S corporation.

Three commonly used types of ongoing trusts qualify as S corporation shareholders: grantor trusts, qualified subchapter S trusts (QSSTs) and electing small business trusts (ESBTs).

Designing a QSSTThe trust must have only one income beneficiary during the life of the current income beneficiary, and that beneficiary must be a U.S. citizen or resident;All of the income of the trust must be (or must be required to be) distributed currently to the one income beneficiary;More items...?

The main difference between an ESBT and a QSST is that an ESBT may have multiple income beneficiaries, and the trust does not have to distribute all income. Unlike with the QSST, the trustee, rather than the beneficiary, must make the election.

Irrevocable trusts are often set up as grantor trusts, which simply means that they are not recognized for income tax purposes (all of the income tax attributes of the trust, such as income, loss, gains, etc. is passed on to the grantor of the trust).

If a trust is not one of the trusts specifically authorized by the Internal Revenue Code, however, and becomes a shareholder, the Corporation ceases to be a qualified S corporation and will be taxed as an ordinary C corporation.