North Carolina Renunciation of Legacy in Favor of Other Family Members

Description

How to fill out Renunciation Of Legacy In Favor Of Other Family Members?

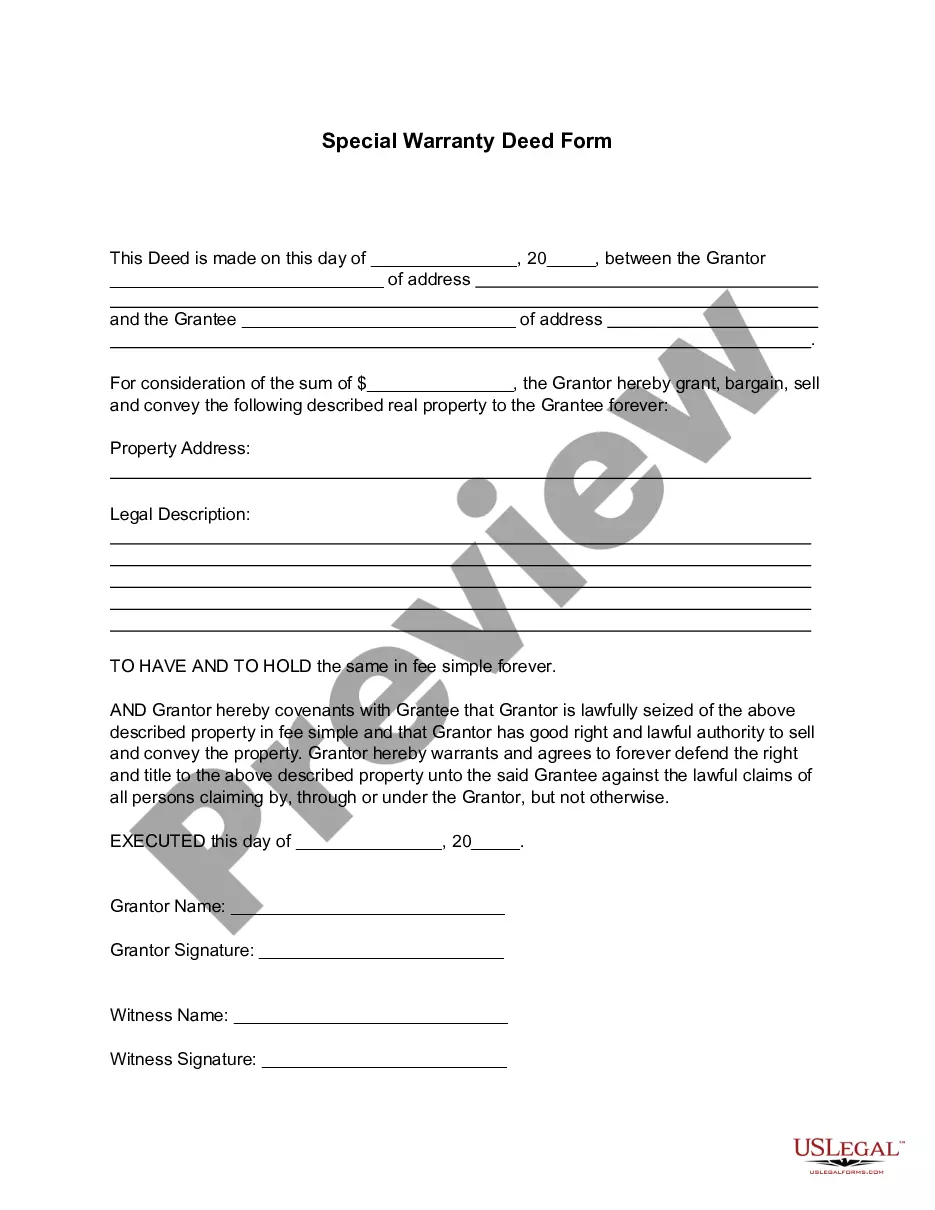

Finding the right legitimate file format can be quite a battle. Obviously, there are tons of templates available on the Internet, but how can you get the legitimate form you need? Make use of the US Legal Forms site. The service gives a huge number of templates, for example the North Carolina Renunciation of Legacy in Favor of Other Family Members, which you can use for company and personal needs. All of the kinds are checked out by pros and satisfy state and federal specifications.

If you are already authorized, log in to the accounts and click the Download switch to obtain the North Carolina Renunciation of Legacy in Favor of Other Family Members. Make use of accounts to look through the legitimate kinds you possess bought formerly. Proceed to the My Forms tab of your own accounts and acquire an additional copy from the file you need.

If you are a fresh consumer of US Legal Forms, allow me to share straightforward guidelines for you to follow:

- Initial, make sure you have selected the appropriate form to your city/region. It is possible to look over the form using the Preview switch and browse the form description to ensure it will be the best for you.

- When the form does not satisfy your needs, make use of the Seach industry to obtain the proper form.

- Once you are certain the form would work, go through the Buy now switch to obtain the form.

- Opt for the rates plan you desire and enter in the required details. Build your accounts and buy the order with your PayPal accounts or credit card.

- Pick the submit format and obtain the legitimate file format to the product.

- Total, revise and print and sign the attained North Carolina Renunciation of Legacy in Favor of Other Family Members.

US Legal Forms may be the most significant catalogue of legitimate kinds where you will find numerous file templates. Make use of the service to obtain professionally-created paperwork that follow condition specifications.

Form popularity

FAQ

In order to disclaim an inheritance, you will need to write a Disclaimer, which states that you are disclaiming your inheritance in writing. Within your Disclaimer, you will need to explain what is being disclaimed, whether it is only part of your inheritance or all of it, as well as sign the document to make it legal.

A person may renounce any interest in or power over property, including a power of appointment, even if its creator imposed a spendthrift provision or similar restriction on transfer or a restriction or limitation on the right to renounce.

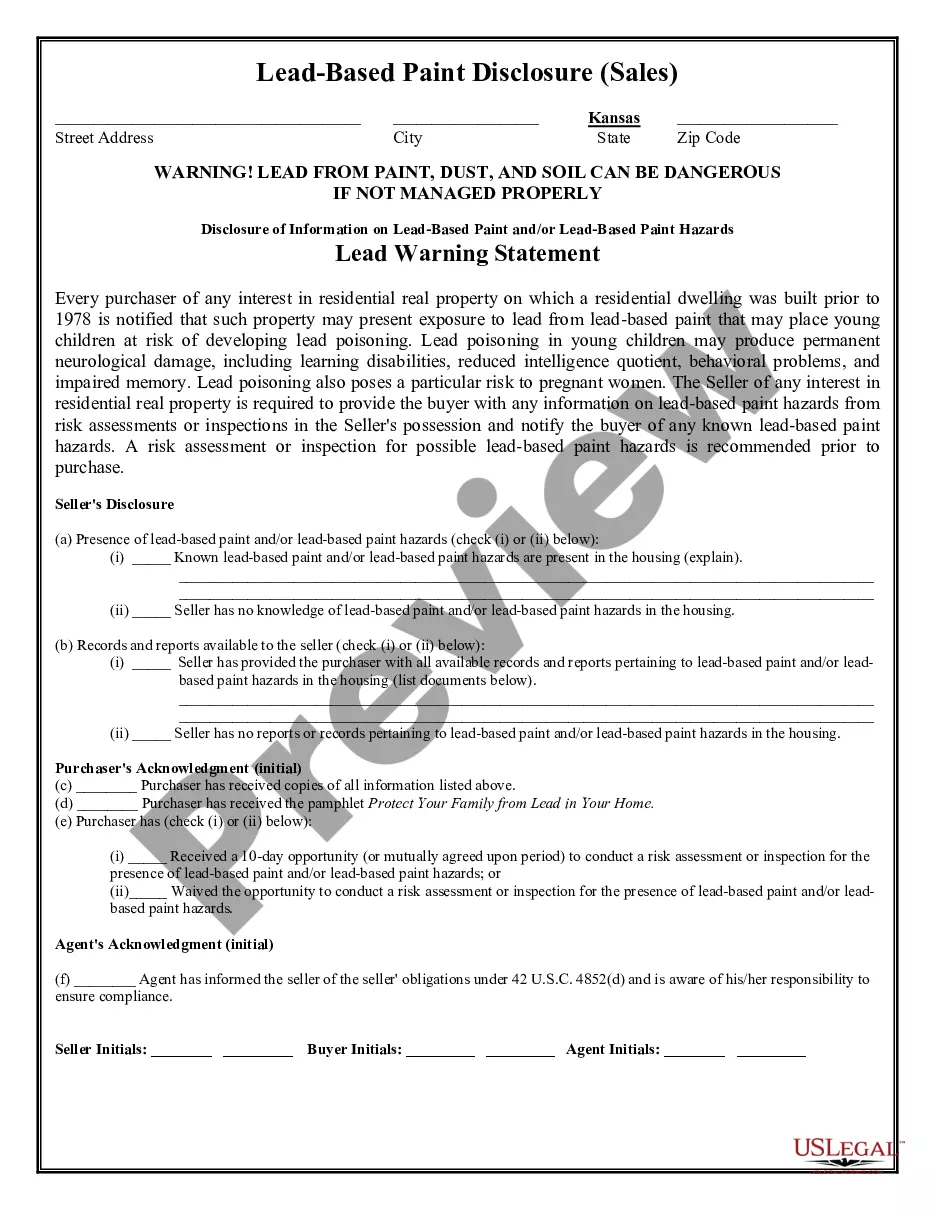

The written disclaimer must be delivered to the transferor's legal representative, such as the executor of an estate, and in North Carolina to the probate court, within nine months after the transferor's death, with the exception of a disclaimer by a minor disclaimant, which may be made within nine months after the ...

§ 28A-5-1. (a) Express Renunciation by Executor. ? Any person named or designated as executor in a duly probated will may renounce the office by filing with the clerk of superior court a writing signed by such person, and acknowledged or proved to the satisfaction of the clerk.

Renunciation of inheritance means that an heir renounces his/her right to inherit any of legacy when the heir does not want to inherit the legacy of the ancestor (a deceased person).

Renunciation of Right to Qualify (AOC-E-200): This form is used if the named personal representative in the will does not wish to serve in this capacity 9. A surety bond might be necessary based upon specific guidelines discussed in the online Bond tutorial. *This document must be signed in the presence of a notary.