North Carolina Complaint for Impropriety Involving Loan Application

Description

How to fill out Complaint For Impropriety Involving Loan Application?

If you want to full, acquire, or print legal record templates, use US Legal Forms, the greatest variety of legal kinds, which can be found on-line. Take advantage of the site`s simple and handy research to discover the documents you need. Different templates for business and person functions are sorted by classes and suggests, or keywords and phrases. Use US Legal Forms to discover the North Carolina Complaint for Impropriety Involving Loan Application in a few mouse clicks.

When you are currently a US Legal Forms client, log in in your bank account and click on the Download switch to have the North Carolina Complaint for Impropriety Involving Loan Application. You can also access kinds you previously downloaded inside the My Forms tab of your bank account.

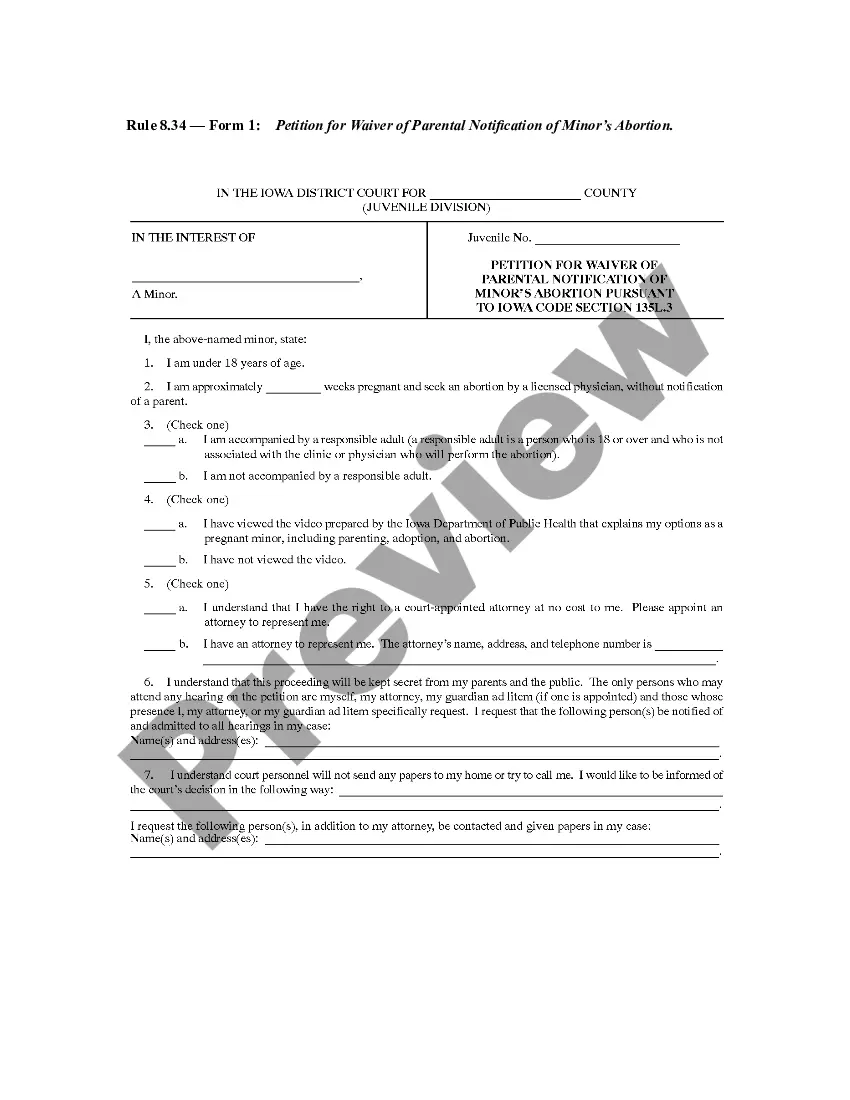

If you work with US Legal Forms the very first time, refer to the instructions under:

- Step 1. Ensure you have chosen the shape for that proper town/region.

- Step 2. Use the Preview choice to examine the form`s information. Don`t forget to read through the description.

- Step 3. When you are not satisfied with the develop, utilize the Research industry near the top of the screen to discover other versions in the legal develop design.

- Step 4. After you have located the shape you need, click on the Purchase now switch. Pick the rates program you choose and add your accreditations to sign up to have an bank account.

- Step 5. Procedure the deal. You may use your charge card or PayPal bank account to accomplish the deal.

- Step 6. Select the format in the legal develop and acquire it on your own system.

- Step 7. Total, change and print or indicator the North Carolina Complaint for Impropriety Involving Loan Application.

Each and every legal record design you acquire is the one you have eternally. You may have acces to each and every develop you downloaded in your acccount. Select the My Forms section and decide on a develop to print or acquire yet again.

Compete and acquire, and print the North Carolina Complaint for Impropriety Involving Loan Application with US Legal Forms. There are many professional and status-certain kinds you may use for your personal business or person requires.

Form popularity

FAQ

The Attorney General: Represents all state government departments, agencies and commissions in legal matters. Provides legal opinions to the General Assembly, the Governor, or any other public official when requested.

You can mail documentation to the attention of the individual processing your complaint to NCCOB, 4309 Mail Service Center, Raleigh, NC 27699-4309. However, mailing the information will delay the processing of your complaint. Fax number: 919-733-6918.

The North Carolina Unfair and Deceptive Trade Practices Act, for instance, regulates how entities tell consumers about the products they provide. And the Consumer Economic Protection Act helps parties resolve foreclosure issues for owner-occupied residential real estate.

Feel free to call our consumer assistance line at (919) 716-6000 should you need help completing the form.

The FTC's Bureau of Consumer Protection stops unfair, deceptive and fraudulent business practices by collecting reports from consumers and conducting investigations, suing companies and people that break the law, developing rules to maintain a fair marketplace, and educating consumers and businesses about their rights ...

File a complaint with government or consumer programs File a complaint with your local consumer protection office. Notify the Better Business Bureau (BBB) in your area about your problem. The BBB tries to resolve complaints against companies. If you think you may have experienced a scam, report it to the FTC.