North Carolina Sample Letter for Collection of Refund

Description

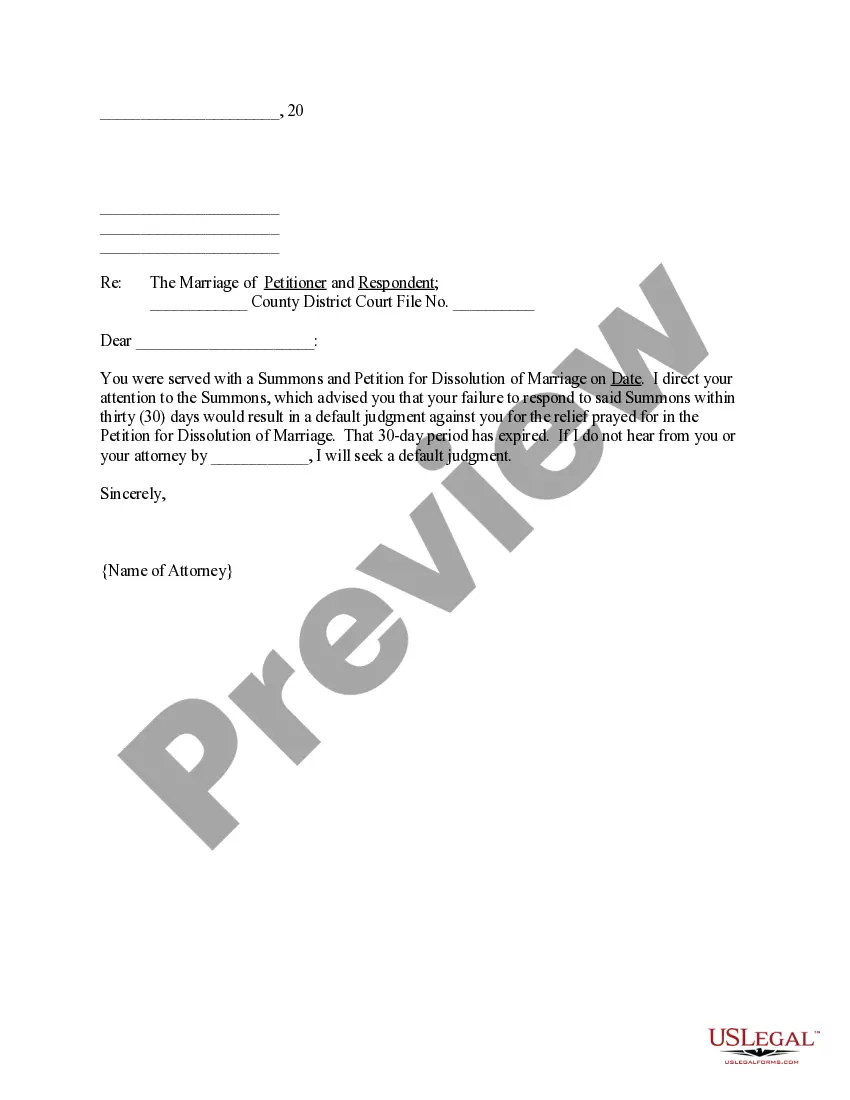

How to fill out Sample Letter For Collection Of Refund?

Have you been inside a placement the place you need to have files for sometimes enterprise or personal uses nearly every time? There are plenty of lawful document web templates available online, but discovering types you can rely isn`t straightforward. US Legal Forms offers a huge number of develop web templates, like the North Carolina Sample Letter for Collection of Refund, which can be created to meet federal and state requirements.

Should you be already informed about US Legal Forms website and also have a free account, simply log in. Following that, you are able to download the North Carolina Sample Letter for Collection of Refund format.

If you do not have an bank account and want to begin to use US Legal Forms, adopt these measures:

- Obtain the develop you require and make sure it is to the correct metropolis/area.

- Take advantage of the Review option to examine the form.

- Browse the description to actually have selected the appropriate develop.

- In the event the develop isn`t what you are trying to find, take advantage of the Look for industry to discover the develop that meets your needs and requirements.

- If you find the correct develop, click on Buy now.

- Pick the rates plan you would like, submit the desired information to produce your bank account, and purchase the order with your PayPal or credit card.

- Decide on a practical data file format and download your copy.

Get every one of the document web templates you might have purchased in the My Forms food list. You may get a extra copy of North Carolina Sample Letter for Collection of Refund at any time, if required. Just select the necessary develop to download or print out the document format.

Use US Legal Forms, probably the most comprehensive collection of lawful types, to conserve time and avoid blunders. The assistance offers appropriately manufactured lawful document web templates that you can use for a range of uses. Make a free account on US Legal Forms and initiate producing your daily life a little easier.

Form popularity

FAQ

Delays can be due to issues like return errors, unpaid taxes, or old debts. Typically, simple returns take under 3 weeks, while complex ones might take 60-90 days. To make the process smoother, ensure accurate filing, settle any debts, and use IRS tools.

"Failure to include basic information, such as the Social Security numbers of dependents, can significantly hold up a refund," ing to Lee E. Holland, CPA, CFP, and former IRS agent. For paper returns, failure to include copies of W-2 or 1099 forms increases processing time, as do missing forms or schedules.

This notice is sent if a taxpayer's tax debt (tax due, penalties, and interest) is final and collectible, but has not been paid in full.

Any tax, penalty, and interest not paid within 60 days after it becomes collectible under G.S. 105-241.22 is subject to a 20% collection assistance fee. The fee will not apply if the taxpayer enters into an installment payment agreement with the Department before the fee is imposed.

If you have received a Notice of Individual Income Tax Assessment, you have been assessed for income taxes due. You may have also previously received a "Notice to File a Return" and failed to respond to that notice within 30 days.

As refund fraud resulting from identify theft has become more widespread, we're taking extra steps to review all individual income tax returns we receive to be sure refunds go to the rightful owners. Additional safeguards can mean that it takes us longer to process your refund.

Most refund checks were issued within approximately four weeks; however, some may have taken longer. If you have not received your Individual Income Tax refund, you may check the status of it at Where's My Refund. Disclaimer: Allow additional time to receive your refund if you requested a paper check.

This may happen if your return was incomplete or incorrect. The IRS may send you instructions through the mail if it needs additional information in order to process your return. You may also experience delays if you claimed the Earned Income Tax Credit or the Additional Child Tax Credit.