North Carolina Packing Slip

Description

How to fill out Packing Slip?

If you desire to finalize, acquire, or produce legal document templates, utilize US Legal Forms, the largest collection of legal templates, which is accessible online.

Employ the site's straightforward and efficient search feature to find the documents you require.

Various templates for business and personal purposes are categorized by groups and states, or keywords.

Every legal document template you purchase is yours permanently. You have access to every form you downloaded in your account.

Compete and acquire, and print the North Carolina Packing Slip with US Legal Forms. There are millions of professional and state-specific templates you can use for your business or personal needs.

- Utilize US Legal Forms to procure the North Carolina Packing Slip within a few clicks.

- If you are already a US Legal Forms user, sign in to your account and then click the Obtain button to get the North Carolina Packing Slip.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

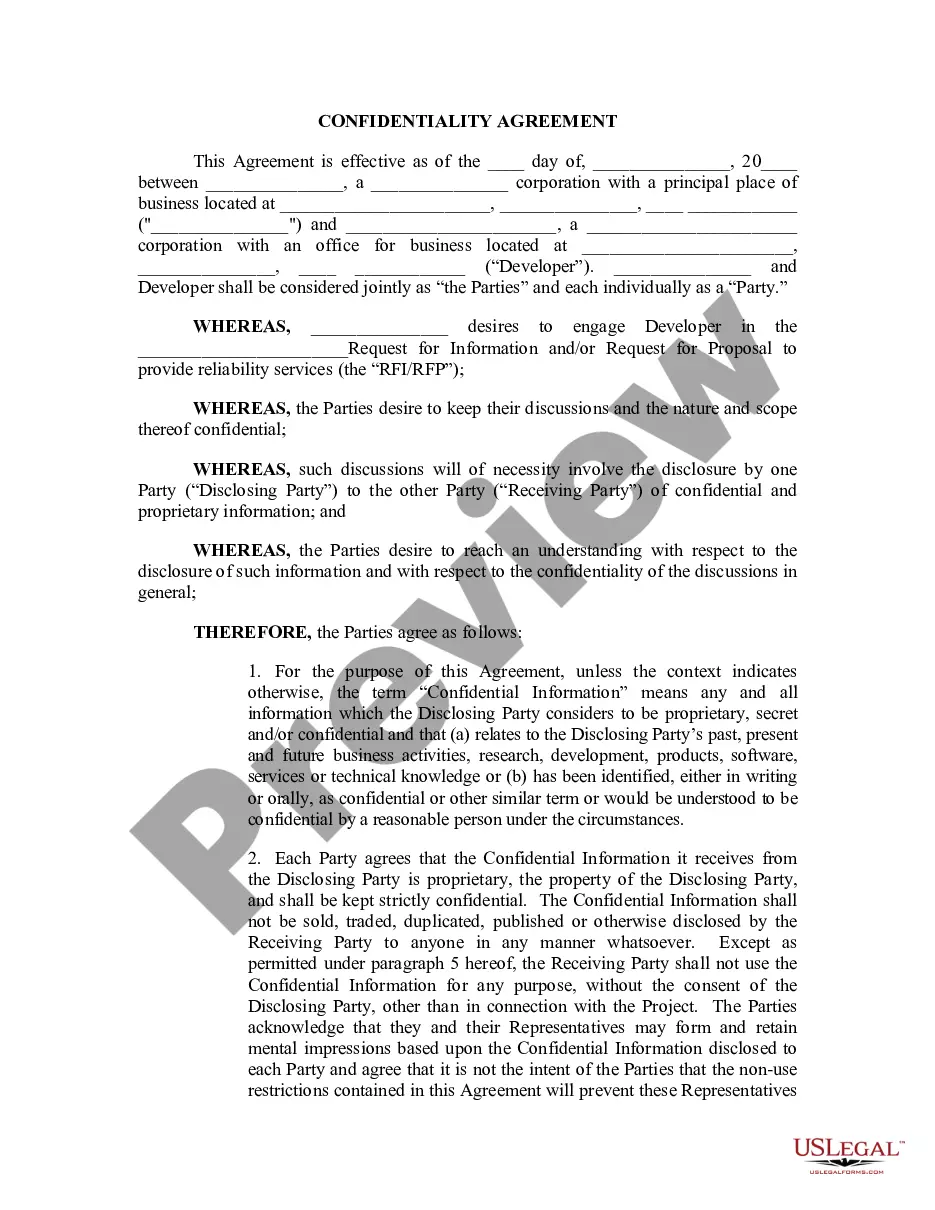

- Step 2. Use the Review option to examine the form's content. Don't forget to read the summary.

- Step 3. If you are dissatisfied with the form, use the Lookup field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, select the Purchase now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Process the purchase. You can utilize your Visa or Mastercard or PayPal account to complete the transaction.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, edit and print or sign the North Carolina Packing Slip.

Form popularity

FAQ

Reading a packing slip is straightforward if you focus on key elements. Start by noting the items listed, their quantities, and any special instructions or notes. Cross-reference this information with the items you've received to confirm everything is accounted for. A well-structured North Carolina packing slip will make this process smooth and efficient.

A packing slip should include the item names, quantities, descriptions, and any relevant order numbers. It may also contain the sender's contact information and a return policy for the items shipped. Including these details improves the purchasing experience for your customers. Always ensure that your North Carolina packing slip is accurate and complete to prevent any confusion.

Yes, a packing slip typically goes inside the package to provide clarity on what is included. Placing the packing slip inside helps the recipient verify the items received against their order. For best practices, consider including a copy of the packing slip on the outside of the package for easier identification. This approach is especially beneficial when handling a North Carolina packing slip.

Filling out a packing slip involves detailing the contents of your package. List each item included in the shipment, along with their quantities and descriptions. Always make sure to print the packing slip clearly and include any order numbers or references. Using a template from US Legal can help streamline creating a North Carolina packing slip.

To fill out a mailing slip, start by entering the sender's name, address, and contact information at the top. Next, include the recipient's details in the designated fields. Make sure to clearly indicate the shipping method and any tracking information to ensure smooth delivery. For a reliable North Carolina packing slip, check for any additional requirements your shipper may have.

Claiming the NC standard deduction is often beneficial for many taxpayers in the state. It reduces your taxable income, allowing for a lower tax bill. To ensure you're taking full advantage of this benefit, gather necessary documents, such as your North Carolina packing slip, to validate your residency. Consult a tax professional if you’re unsure about your eligibility.

The 183 day rule works by determining tax residency based on the number of days you spend in North Carolina. If you reside in the state for 183 days or more, you are deemed a resident for that tax year. It's crucial to keep track of your days and use resources like a North Carolina packing slip to provide evidence. This ensures you meet all tax obligations adequately.

To file form NC 3, you will need to complete the form accurately and submit it to the North Carolina Department of Revenue. The form summarizes your state withholding, so ensure your North Carolina packing slip and W-2 forms are handy. These documents assist in verifying your income and taxes withheld. Follow the instructions provided by the department for submission details.

Yes, you can file your North Carolina state taxes online. The NC Department of Revenue provides various online options, which make the process efficient and convenient. Utilizing a tool like the North Carolina packing slip is essential for accurate reporting. It’s wise to gather all documentation before initiating your online submission.

The 183 day rule applies to individuals who spend significant time in North Carolina, specifically 183 days during the tax year. If you meet this requirement, you may be taxed as a resident. Tracking your days with documentation like a North Carolina packing slip helps clarify your tax obligations. It's important to stay informed on how this rule affects your state tax filings.