North Carolina Hair Salon Booth or Chair Rental Agreement

Description

How to fill out Hair Salon Booth Or Chair Rental Agreement?

You can allocate time online searching for the approved document template that satisfies the federal and state requirements you need.

US Legal Forms provides thousands of legal forms that are reviewed by experts.

You may download or print the North Carolina Hair Salon Booth or Chair Rental Agreement from the service.

If available, utilize the Preview button to review the document template as well.

- If you possess a US Legal Forms account, you can sign in and click on the Obtain button.

- After that, you can complete, edit, print, or sign the North Carolina Hair Salon Booth or Chair Rental Agreement.

- Every legal document template you purchase belongs to you permanently.

- To obtain another copy of any purchased form, navigate to the My documents tab and click on the relevant button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the location/city of your choice.

- Read the form description to confirm you have chosen the appropriate form.

Form popularity

FAQ

Chair rental in a salon allows stylists to rent a designated space or chair within the salon to operate independently. One of the main benefits is the flexibility it provides, as stylists can set their schedules, manage their clients, and keep the profits they earn. A North Carolina Hair Salon Booth or Chair Rental Agreement will help define the expectations, providing clarity on terms for both the salon owner and the stylist, fostering a successful working relationship.

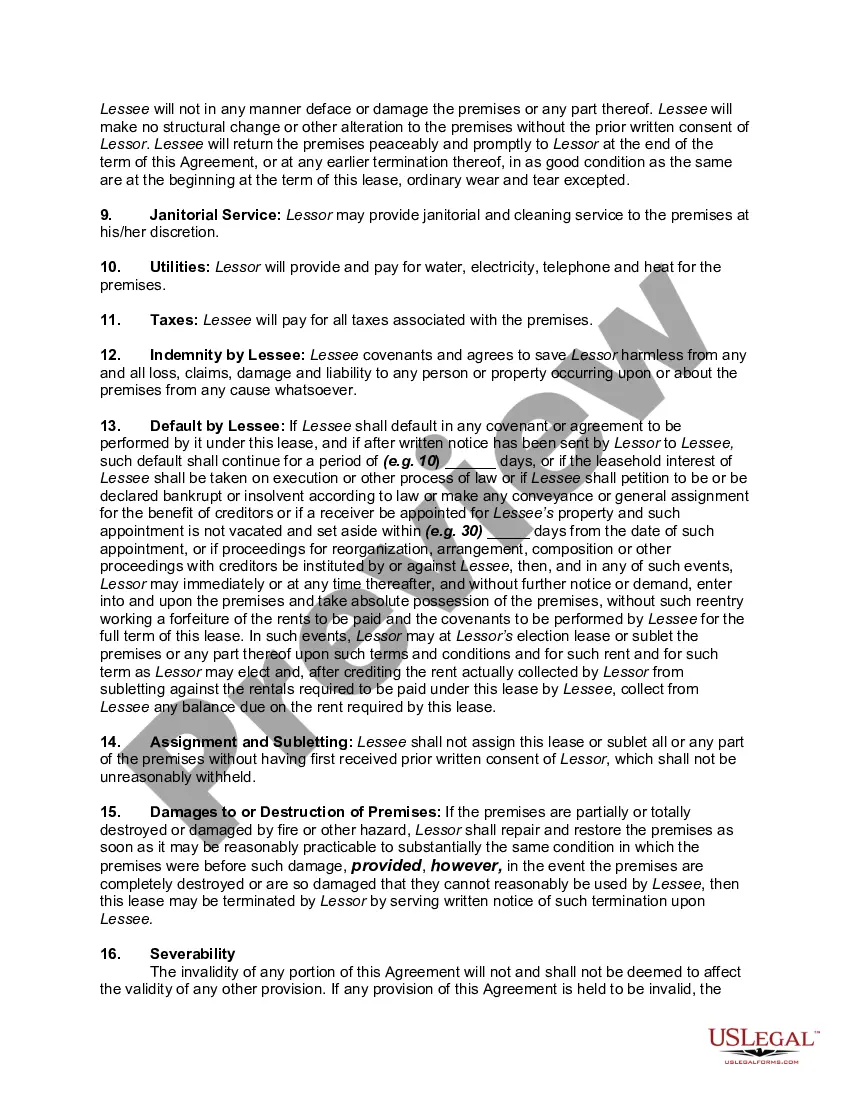

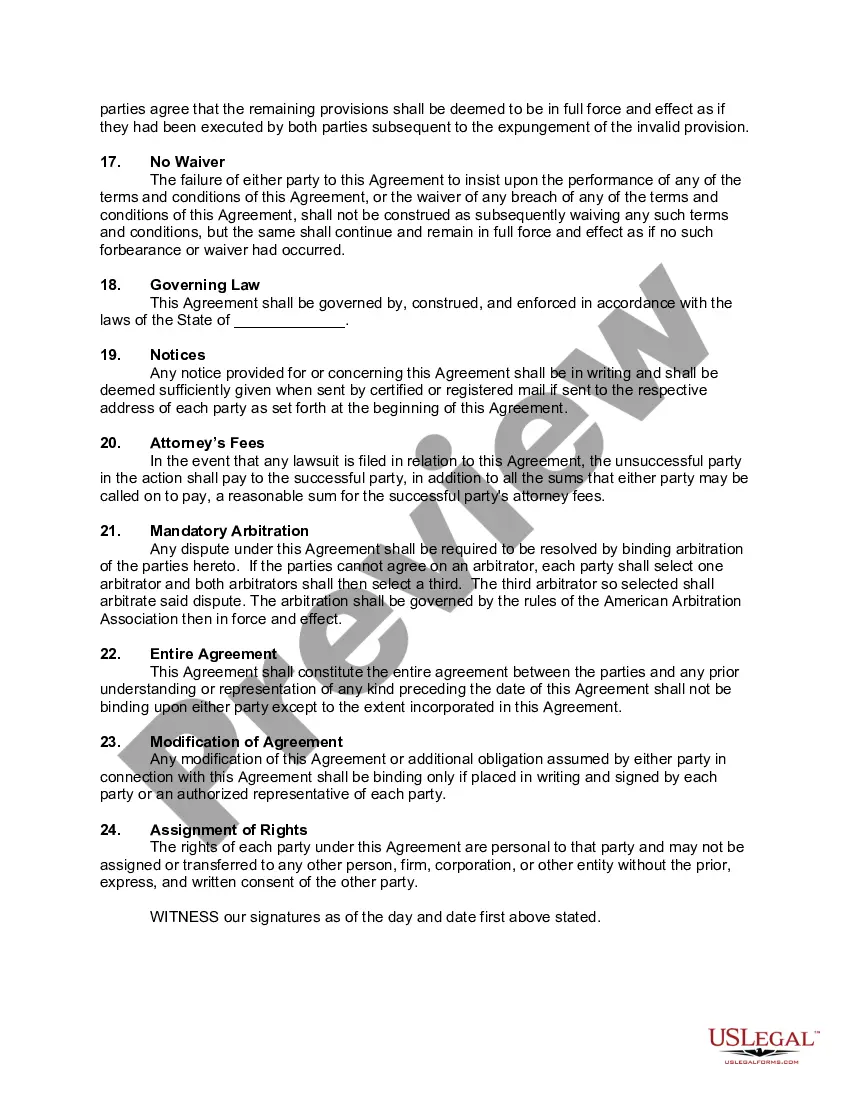

A booth rental agreement for hair stylists in North Carolina outlines the terms between salon owners and independent stylists renting a space to operate their business. This agreement specifies rental fees, responsibilities, and services included, ensuring both parties understand their rights and obligations. By having a clear North Carolina Hair Salon Booth or Chair Rental Agreement, stylists can focus on providing excellent services, while salon owners maintain control over their premises.

Booth renters usually file their income using Schedule C (Form 1040) to report business income and expenses. This form is specifically designed for self-employed individuals, making it suitable for those entering a North Carolina Hair Salon Booth or Chair Rental Agreement. Keep detailed records of all income and expenses to facilitate accurate reporting and maximize potential tax benefits.

You can create your own lease agreement for renting a booth or chair as a stylist, but it’s crucial to ensure it covers all necessary elements. A well-drafted North Carolina Hair Salon Booth or Chair Rental Agreement should address payment terms, responsibilities, and any specific rules of the salon. However, consider using templates or services like uslegalforms to ensure your agreement meets legal standards and protects your interests.

Yes, booth rent can typically be considered a tax write-off for the self-employed stylists operating under a North Carolina Hair Salon Booth or Chair Rental Agreement. This means you can deduct rental costs as business expenses on your tax return. It’s wise to consult a tax professional to ensure you maximize your deductions and stay compliant with IRS regulations.

While you don't necessarily need an LLC to begin your rental business, forming one can provide legal protection and tax advantages. An LLC helps separate your personal assets from your business liabilities, which is particularly important in the North Carolina Hair Salon Booth or Chair Rental Agreement context. Additionally, LLCs can give your business a more professional appearance, making it easier to attract clients or renters.

While it is not a strict requirement, forming an LLC can provide many benefits for those engaging in booth rental. An LLC helps protect your personal assets and offers a level of liability protection. If you are entering into a North Carolina Hair Salon Booth or Chair Rental Agreement, establishing an LLC can enhance your professionalism and credibility. Consider consulting a legal expert for guidance tailored to your situation.

Certain states have strict regulations regarding booth rental arrangements, making them either discouraged or illegal. Currently, California is known for its prohibitions on booth rental models under specific conditions. If you're considering a North Carolina Hair Salon Booth or Chair Rental Agreement, ensure you are informed about the legal landscape of your state. Research is crucial when navigating these agreements.

Yes, a salon owner can terminate a booth renter's agreement under certain circumstances. The North Carolina Hair Salon Booth or Chair Rental Agreement typically outlines the conditions and notice requirements for termination. It is essential for both parties to understand these terms to avoid potential disputes. Always consult the agreement and seek legal advice if needed.

Establishing an LLC is not a requirement for booth renters, but it can provide valuable protections. Forming an LLC can safeguard your personal assets in case of business liabilities. If you choose to operate under a North Carolina Hair Salon Booth or Chair Rental Agreement, consult a legal professional to understand the benefits of setting up an LLC. This decision can enhance your business credibility and financial organization.