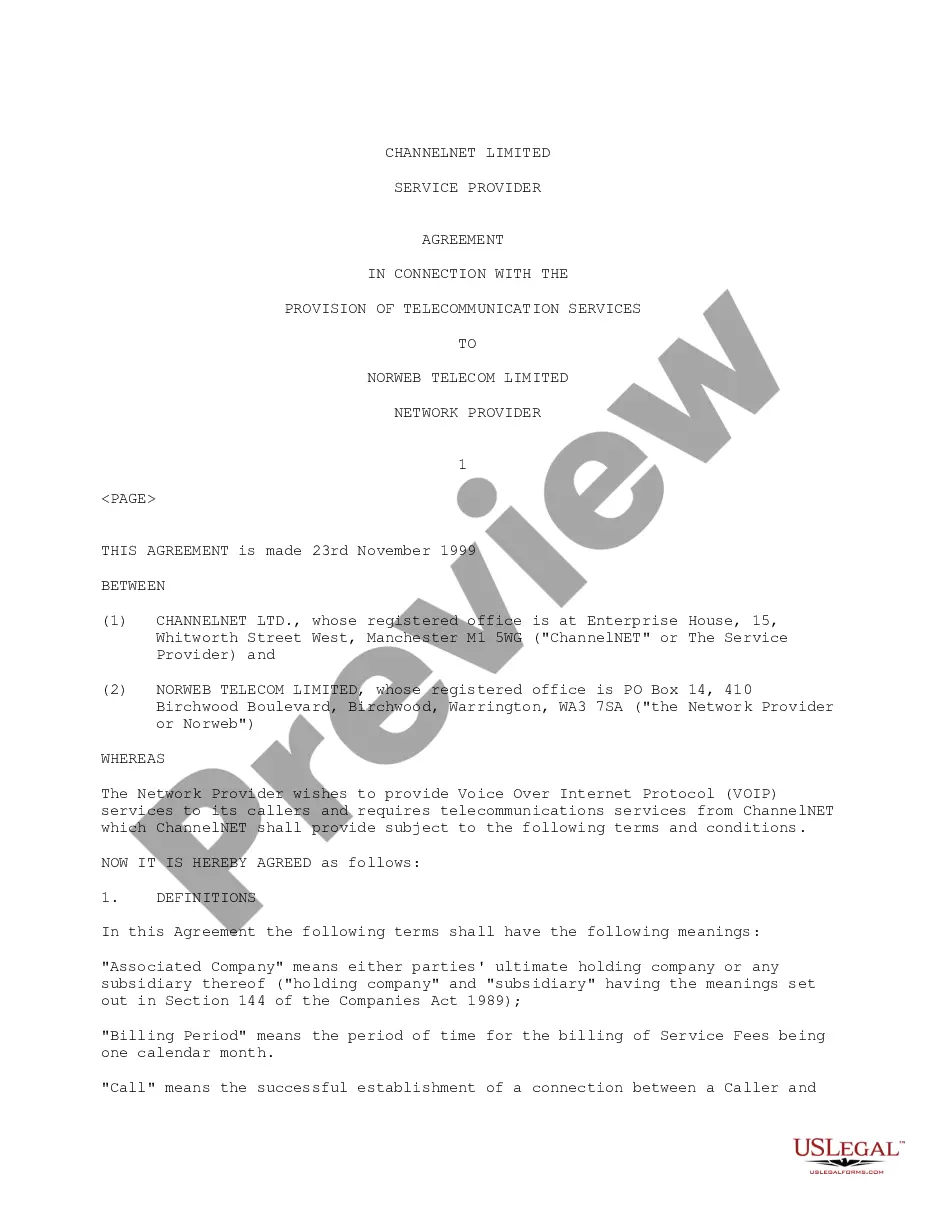

Liquidated damages may be incorporated as a clause in an agreement when the parties to the agreement agree to the payment of a certain sum as a fixed and agreed upon payment for doing or not doing certain things particularly mentioned in the agreement. It is the amount of money specified in a contract to be awarded in the event that the agreement is violated, often when the actual damages are difficult to determine with specificity.

North Carolina Declaration of Cash Gift with Condition

Description

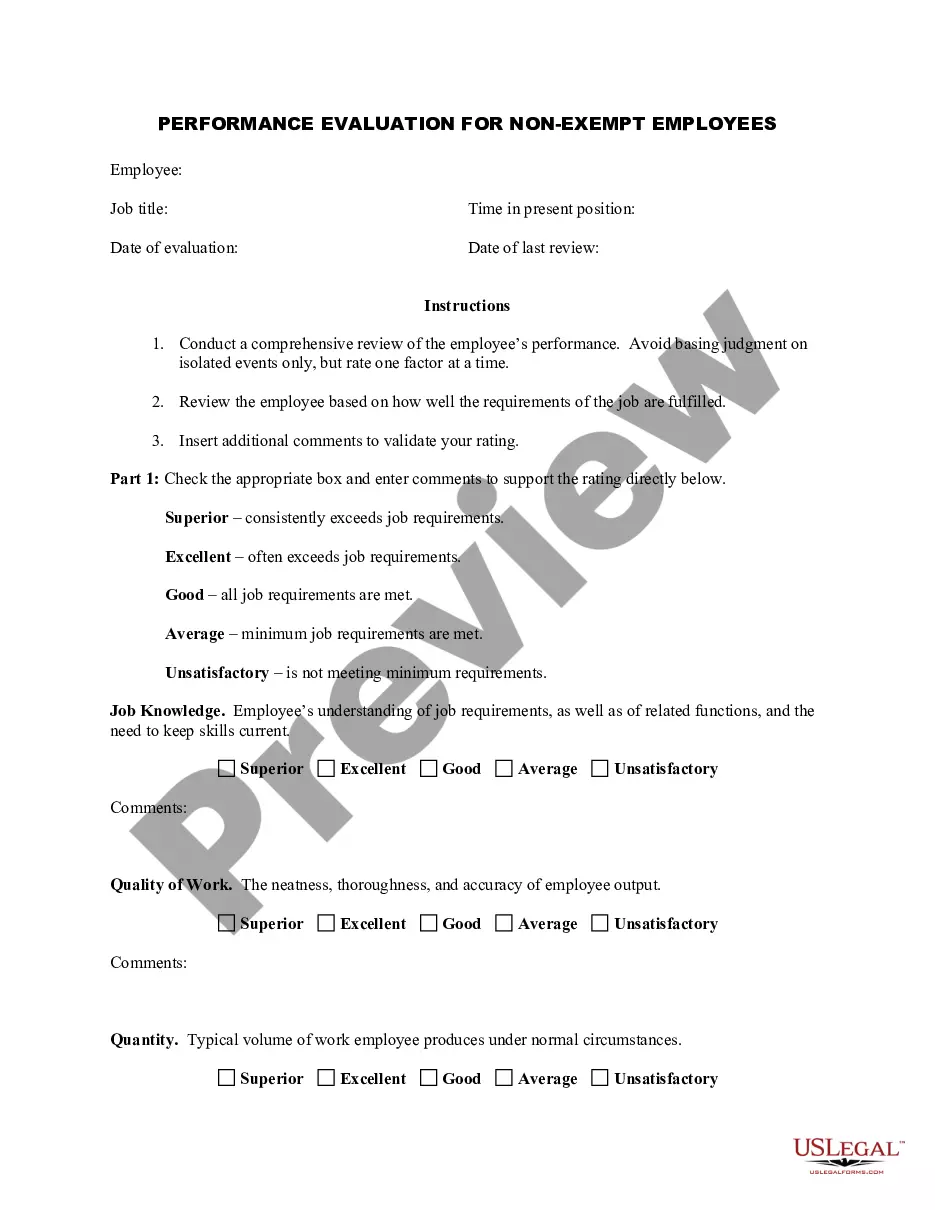

How to fill out Declaration Of Cash Gift With Condition?

Are you presently located in a location that requires you to have documentation for both business or personal operations almost every time.

There are numerous legal document templates available online, but locating ones you can trust is not easy.

US Legal Forms provides thousands of form templates, such as the North Carolina Declaration of Cash Gift with Condition, which are designed to comply with state and federal regulations.

Utilize US Legal Forms, the most comprehensive collection of legal documents, to save time and avoid mistakes.

The service offers professionally created legal document templates that you can use for a variety of purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- After that, you can download the North Carolina Declaration of Cash Gift with Condition template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the form you need and ensure it is for the correct city/state.

- Utilize the Preview option to examine the form.

- Review the description to ensure you have selected the correct form.

- If the form is not what you are seeking, use the Lookup field to find the form that suits your needs and requirements.

- Once you find the right form, click on Buy now.

- Choose the pricing plan you desire, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

- Select a convenient file format and download your copy.

- Find all of the document templates you have purchased in the My documents menu. You can obtain another copy of the North Carolina Declaration of Cash Gift with Condition at any time, if needed. Simply select the required form to download or print the document template.

Form popularity

FAQ

To transfer a property title to a family member in North Carolina, you need to execute a deed, such as a quitclaim deed. This document should include the names of both the giver and the recipient, as well as a clear description of the property. After preparing the deed, you must sign it in the presence of a notary public. Finally, you should file the deed with your county's register of deeds to make the transfer official.

To successfully acquire property through a completed gift in North Carolina, you must meet the requirements of intent, delivery, and acceptance. Ensure the donor clearly communicates their intention, deliver the property or a declaration, and confirm that the recipient accepts the gift without reservations. Utilizing resources like US Legal Forms can help you navigate these requirements and ensure everything is set up correctly.

A completed gift in North Carolina requires intent, delivery, and acceptance. The donor must intend to give the gift, it must be delivered to the recipient, and the recipient must accept it. Fulfilling these requirements ensures that the gift is legally binding, preventing any future disputes regarding ownership.

To establish a valid gift in North Carolina, three critical elements must be present: the intent of the donor to give, delivery of the gift, and acceptance by the recipient. The donor must clearly express their intent to make the gift, which should be communicated effectively. Delivery can be physical, constructive, or symbolic, and the recipient must accept the gift to complete the transaction.

You do not pay tax on a cash gift, but you may pay tax on any income that arises from the gift for example bank interest. You are entitled to receive income in your own right no matter what age you are. You also have your own personal allowance to set against your taxable income and your own set of tax bands.

In 2020, a gift of $15,000 or less in a calendar year doesn't even count. If a couple makes a gift from joint property, the IRS considers the gift to be given half from each. Mom and Dad can give $30,000 with no worries. A couple can also give an additional gift of up to $15,000 to each son-in-law or daughter-in-law.

For 2018, 2019, 2020 and 2021, the annual exclusion is $15,000. For 2022, the annual exclusion is $16,000.

Do I need to declare cash gifts to HMRC? You don't need to inform HMRC of any small cash gifts you make, these are gifts under £250. You'll also not be required to declare any gifts made using your yearly A£3,000 annual exemption. Anything over these amounts may be subject to tax and will need to be declared to HMRC.

North Carolina repealed its gift tax, but you may still owe gift taxes at the federal level. However, you have an annual gift tax exclusion of $15,000 for your 2021 returns or $16,000 for your 2022 tax returns. You can gift this amount to any number of persons without worrying about the IRS.

You can gift up to $14,000 to any single individual in a year without have to report the gift on a gift tax return. If your gift is greater than $14,000 then you are required to file a Form 709 Gift Tax Return with the IRS.