In a compilation engagement, the accountant presents in the form of financial statements information that is the representation of management (owners) without undertaking to express any assurance on the statements. In other words, using management's records, the accountant creates financial statements without gathering evidence or opining about the validity of those underlying records. Because compiled financial statements provide the reader no assurance regarding the statements, they represent the lowest level of financial statement service accountants can provide to their clients. Accordingly, standards governing compilation engagements require that financial statements presented by the accountant to the client or third parties must at least be compiled.

North Carolina Report from Review of Financial Statements and Compilation by Accounting Firm

Description

How to fill out Report From Review Of Financial Statements And Compilation By Accounting Firm?

Are you currently in a situation where you require documents for either business or personal use on a near-daily basis.

There are numerous legal document templates available online, but finding ones you can rely on is challenging.

US Legal Forms provides thousands of form templates, such as the North Carolina Report from Review of Financial Statements and Compilation by Accounting Firm, which can be tailored to meet state and federal requirements.

Once you find the appropriate form, click Get now.

Choose the pricing plan you want, enter the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the North Carolina Report from Review of Financial Statements and Compilation by Accounting Firm template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/area.

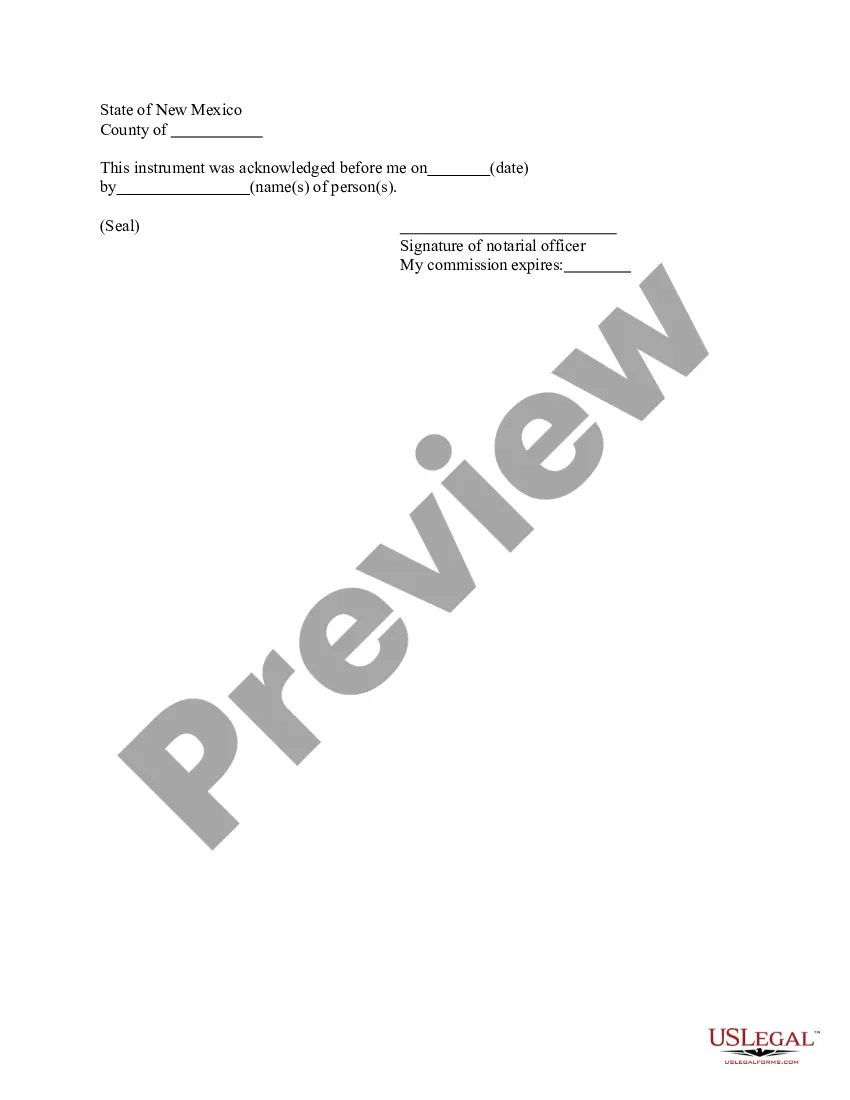

- Use the Preview button to review the form.

- Check the details to make sure you have selected the correct form.

- If the form is not what you're looking for, use the Lookup field to find the form that suits your needs.

Form popularity

FAQ

No, a compilation is not the same as a review. While both are services provided by accounting firms, a compilation offers no assurance regarding the financial statements, whereas a review provides limited assurance. Understanding this distinction can be critical for businesses when deciding how to present their financial information. If you are looking for more insights into this topic, resources related to the North Carolina Report from Review of Financial Statements and Compilation by Accounting Firm can serve as a guide.

The primary difference between a CPA review and a compilation lies in the level of assurance provided. A CPA review includes analytical procedures and inquiries, giving a limited level of assurance to users of the financial statements. On the other hand, a compilation presents financial statements without any assurance. This differentiation is important when considering the North Carolina Report from Review of Financial Statements and Compilation by Accounting Firm, as it affects how stakeholders perceive the reliability of the information.

An audit report provides a higher level of assurance compared to a review report, as it includes a thorough examination of an organization’s financial statements and internal controls. In contrast, a review report offers limited assurance through analytical procedures and inquiries. This distinction is crucial when considering the North Carolina Report from Review of Financial Statements and Compilation by Accounting Firm, as it affects the level of confidence users can have in the financial reports. Understanding these differences can guide businesses in choosing the right service.

Yes, a CPA can perform a compilation without undergoing a peer review. However, this ability depends on the rules set by the American Institute of Certified Public Accountants (AICPA) and state regulations. In North Carolina, the compilation of financial statements is a service that does not require a peer review, as long as it is completed in accordance with the proper standards. You can find more information about this process in relation to the North Carolina Report from Review of Financial Statements and Compilation by Accounting Firm.

Yes, renewing your LLC in North Carolina each year is essential to maintain compliance with state regulations. This process includes filing an annual report and updating any changes to your business status. Incorporating a North Carolina Report from Review of Financial Statements and Compilation by Accounting Firm can help ensure you stay in good standing while meeting your annual requirements.

Yes, a CPA can prepare personal financial statements for individuals. These statements often include assets, liabilities, and net worth, providing a comprehensive insight into your financial health. When looking for a North Carolina Report from Review of Financial Statements and Compilation by Accounting Firm, consider leveraging a CPA's expertise for personal finance management.

Businesses registered in North Carolina, including corporations and LLCs, must file an annual report. This requirement helps maintain the good standing of your business within the state. Keeping your North Carolina Report from Review of Financial Statements and Compilation by Accounting Firm in good order can support your reporting obligations.

Only licensed CPAs are authorized to perform a review of financial statements. This professional review ensures that your financial documents comply with the relevant accounting standards. For a thorough evaluation, consider obtaining a North Carolina Report from Review of Financial Statements and Compilation by Accounting Firm to ensure accuracy and reliability.

Yes, a Certified Public Accountant (CPA) is qualified to prepare and review financial statements. They possess the necessary skills and knowledge to ensure these documents meet accounting standards. Engaging a CPA for a North Carolina Report from Review of Financial Statements and Compilation by Accounting Firm can enhance the credibility of your financial reports.

A compilation report can be prepared by licensed accountants, including both CPAs and qualified non-CPAs, who have experience in financial statements. It is crucial for the preparer to understand the specific guidelines and expectations for compiling financial data. The North Carolina Report from Review of Financial Statements and Compilation by Accounting Firm can be prepared by qualified individuals familiar with local regulations. To ensure accuracy and compliance, many businesses turn to UsLegalForms for assistance.