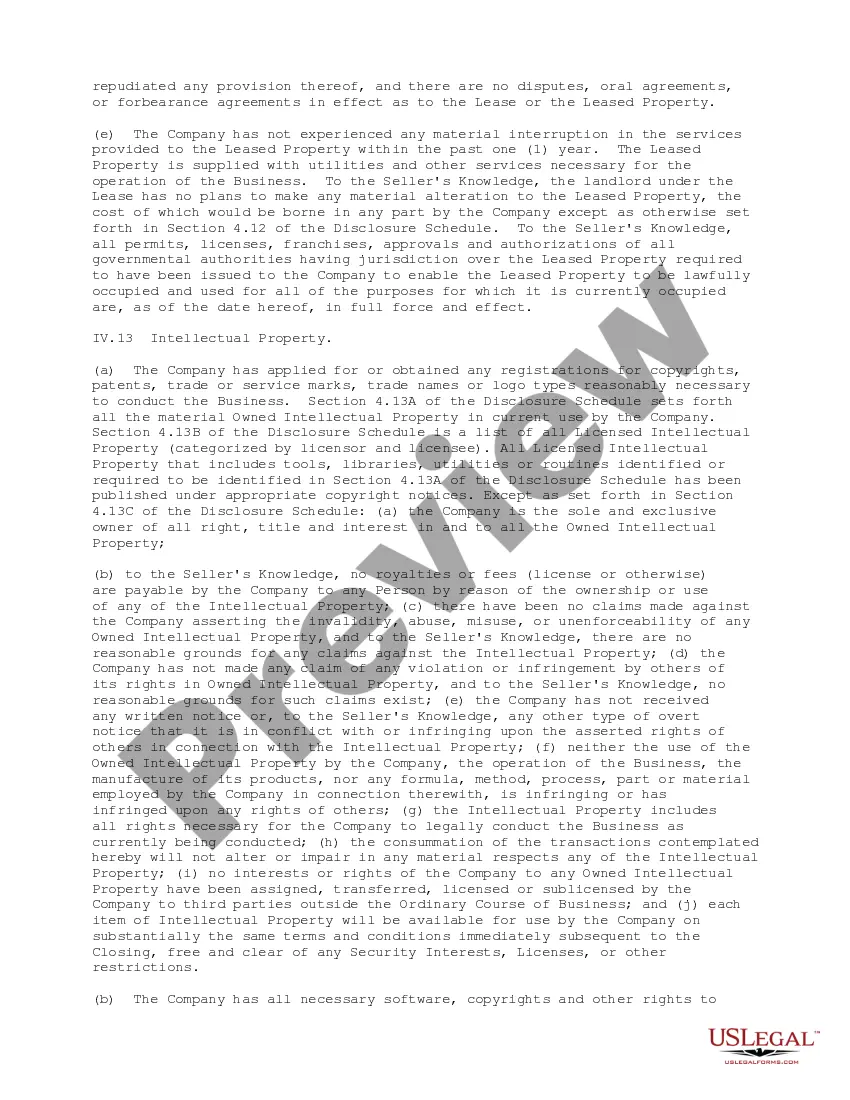

Illinois Sample Stock Purchase Agreement between The American Education Corporation and Andrew K. Gardner

Description

How to fill out Sample Stock Purchase Agreement Between The American Education Corporation And Andrew K. Gardner?

If you wish to complete, obtain, or print legitimate papers themes, use US Legal Forms, the most important selection of legitimate varieties, that can be found on the web. Make use of the site`s basic and handy research to obtain the papers you want. Numerous themes for organization and specific reasons are categorized by categories and suggests, or keywords. Use US Legal Forms to obtain the Illinois Sample Stock Purchase Agreement between The American Education Corporation and Andrew K. Gardner in just a few clicks.

When you are currently a US Legal Forms buyer, log in for your accounts and click on the Down load option to get the Illinois Sample Stock Purchase Agreement between The American Education Corporation and Andrew K. Gardner. You can even access varieties you formerly acquired within the My Forms tab of your own accounts.

If you are using US Legal Forms the first time, follow the instructions below:

- Step 1. Ensure you have selected the shape for that proper metropolis/country.

- Step 2. Use the Review choice to look over the form`s content. Do not forget to read through the outline.

- Step 3. When you are not satisfied with all the develop, use the Research area near the top of the monitor to discover other models in the legitimate develop format.

- Step 4. When you have identified the shape you want, go through the Acquire now option. Select the pricing prepare you prefer and add your references to register on an accounts.

- Step 5. Process the purchase. You may use your bank card or PayPal accounts to complete the purchase.

- Step 6. Choose the structure in the legitimate develop and obtain it on your system.

- Step 7. Total, revise and print or sign the Illinois Sample Stock Purchase Agreement between The American Education Corporation and Andrew K. Gardner.

Each and every legitimate papers format you acquire is the one you have for a long time. You might have acces to each and every develop you acquired inside your acccount. Go through the My Forms area and select a develop to print or obtain once more.

Be competitive and obtain, and print the Illinois Sample Stock Purchase Agreement between The American Education Corporation and Andrew K. Gardner with US Legal Forms. There are many specialist and status-specific varieties you can use for your personal organization or specific needs.

Form popularity

FAQ

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

A Share Purchase Agreement generally includes information about: The person selling the shares. The person buying the shares. The number of shares being sold and their value. The company the shares are being transferred from. The number of shares being sold and their value.

Understanding Stock Purchase Agreements The basic terms of the deal are the seller's and buyer's legal names, the number of stocks being purchased and at what price, and the closing date.

It details specific information about the stock transfer, including warranties, dispute resolution measures, allocation of costs, etc. It is a binding agreement that ensures the stock transfer will proceed. The buyer and seller can review the agreement and get a clear understanding of the transaction in advance.

A SPA should specify the sale price for the shares, specify the currency and timescale for the sale, and list any other conditions like staged payments. Usually, payment is made in cash, although sometimes the buyer may offer the seller some of its shares, or issue loan notes to the seller.

This means that the Seller is entitled to the cash on the balance sheet on the closing date of the transaction, and that the Seller is responsible for debts owed by the company (defined as Indebtedness).

A purchase agreement is the final document used to transfer a property from the seller to the buyer, while a purchase and sale agreement specifies the terms of the transaction. Parties will sign a purchase agreement after both parties have complied with the terms of the purchase and sale agreement.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

Here are 11 things to include in a stock purchase agreement. Buyer and Seller Information. The stock purchase agreement opens with an introduction of the buyer and seller. ... Transaction Date and Time. ... Value of Shares. ... Number of Shares Being Sold. ... Representations and Warranties. ... Payment Terms. ... Due Diligence. ... Indemnification.

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.