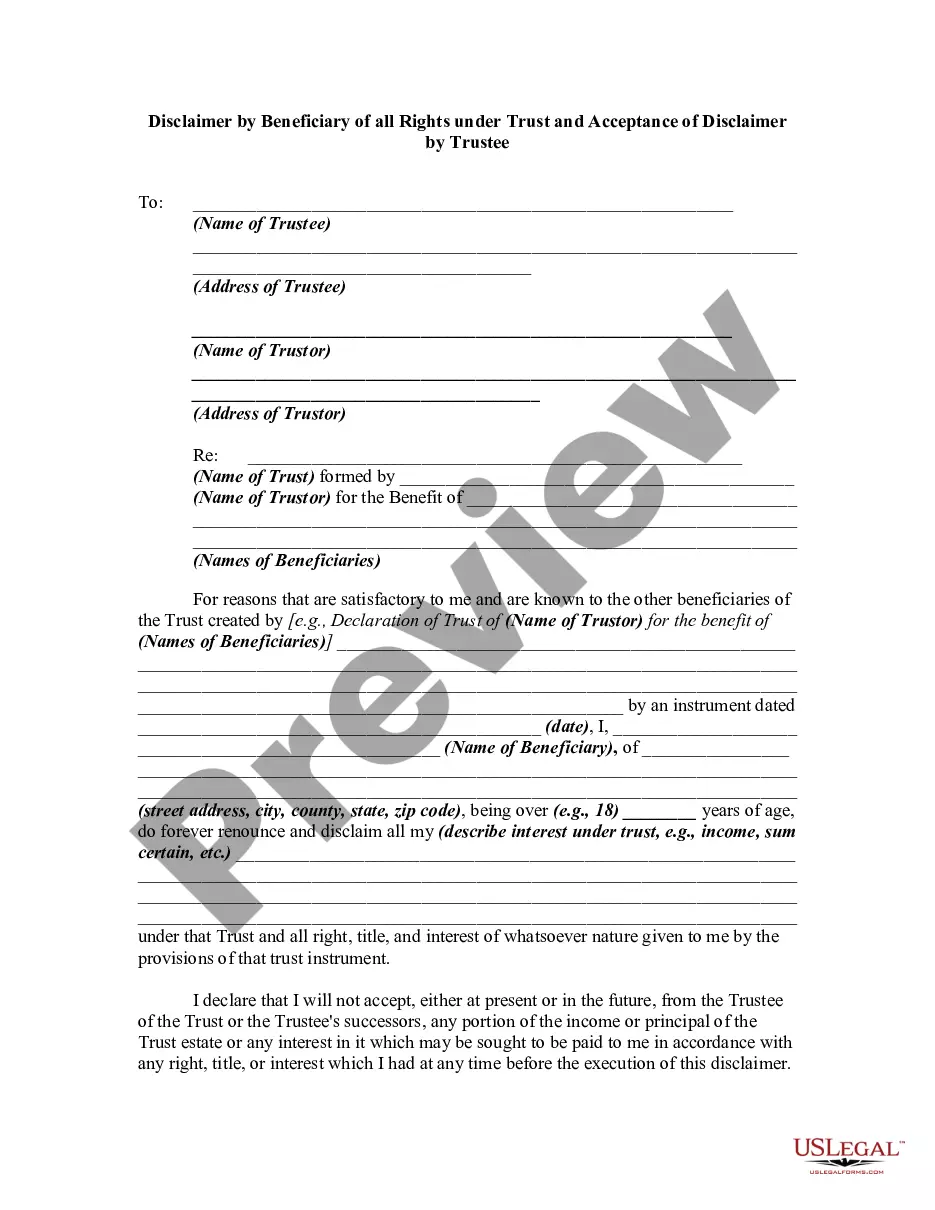

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept of an estate which has been conveyed to him. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

North Carolina Disclaimer by Beneficiary of all Rights in Trust

Description

How to fill out Disclaimer By Beneficiary Of All Rights In Trust?

Locating the appropriate legal document template may pose challenges.

Clearly, there are numerous layouts available online, but how will you find the legal form you require.

Utilize the US Legal Forms website. This service provides thousands of templates, including the North Carolina Disclaimer by Beneficiary of all Rights in Trust, suitable for both business and personal needs.

If the form does not meet your needs, use the Search box to find the appropriate form. Once you are confident that the form is suitable, click the Acquire now button to obtain the form. Select the pricing plan you desire and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card. Choose the document format and download the legal document template to your device. Complete, edit, print, and sign the received North Carolina Disclaimer by Beneficiary of all Rights in Trust. US Legal Forms is the largest library of legal forms where you can find numerous document templates. Use this service to obtain professionally crafted documents that adhere to state regulations.

- All the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to access the North Carolina Disclaimer by Beneficiary of all Rights in Trust.

- Use your account to search for the legal forms you may have purchased previously.

- Visit the My documents tab of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, below are simple steps you can follow.

- First, ensure you have chosen the correct form for your city/region. You can view the form using the Preview button and read the form summary to confirm it is suitable for you.

Form popularity

FAQ

Disclaimer trusts can present challenges, such as the potential for complications in trust administration and tax implications. Beneficiaries may face difficulties if the language in the disclaimer does not comply with legal standards. Addressing these potential issues early ensures a smooth process, beneficial under the North Carolina Disclaimer by Beneficiary of all Rights in Trust.

Yes, you can disclaim an inheritance in North Carolina by following the state’s prescribed process for disclaimers. You need to create a formal disclaimer document that meets certain criteria. This is a crucial aspect of managing your inheritance rights under the North Carolina Disclaimer by Beneficiary of all Rights in Trust.

Absolutely, a beneficiary of a trust has the right to disclaim their inheritance. This process involves submitting a disclaimer that formally renounces their interest in the trust assets. It is wise to follow the North Carolina Disclaimer by Beneficiary of all Rights in Trust to optimize the transfer of those benefits to alternate beneficiaries.

In North Carolina, the time limit for disclaiming inheritance is generally nine months from the date of death or the transfer of the property. Adhering to this timeline is crucial to ensure your rights are properly waived. Remember, timely action aligns with the North Carolina Disclaimer by Beneficiary of all Rights in Trust provisions, offering you legal protection.

You can refuse to be a beneficiary of a trust by formally disclaiming your rights to the trust assets. This process requires a legal disclaimer that communicates your intent to renounce any benefits. Following the North Carolina Disclaimer by Beneficiary of all Rights in Trust ensures that your refusal is respected within the trust framework.

Yes, a beneficiary can renounce an interest in a trust by formally disclaiming their rights. This process typically involves drafting a disclaimer that specifies their withdrawal from the trust benefits. This act benefits other beneficiaries and is supported by the regulations surrounding the North Carolina Disclaimer by Beneficiary of all Rights in Trust.

Yes, a trust beneficiary can disclaim inheritance rights as long as they follow the proper legal procedures. This involves creating a formal disclaimer document that renounces their rights to the trust assets. This action facilitates efficient distribution among remaining beneficiaries, aligning with the principles underlying the North Carolina Disclaimer by Beneficiary of all Rights in Trust.

Disclaiming an inheritance begins by reviewing the trust documents and understanding your rights. In North Carolina, you should prepare a disclaimer that outlines your desire to reject the inheritance, ensuring it is signed and dated. Submit this disclaimer to the trust administrator or executor, allowing for a clear transfer of rights to other beneficiaries under the North Carolina Disclaimer by Beneficiary of all Rights in Trust.

To use a trust disclaimer effectively, you must formally document your decision not to accept certain trust benefits. In North Carolina, a beneficiary can execute a written disclaimer that clearly states their intention to renounce rights in the trust. This allows the benefits to pass to alternate beneficiaries without any tax implications, making it an essential tool when managing your inheritance.

To write a disclaimer example, begin with identifying the relevant trust or property, include your name as the disclaiming beneficiary, and clearly express your intent to refuse the inheritance. Make sure to close with your signature and date. For accurate guidance, consider using templates available on US Legal Forms to create a precise North Carolina Disclaimer by Beneficiary of all Rights in Trust.