An independent contractor is a person or business who performs services for another person pursuant to an agreement and who is not subject to the other's control, or right to control, the manner and means of performing the services. The exact nature of

North Carolina Contract with Self-Employed Independent Contractor with Covenant Not to Compete

Description

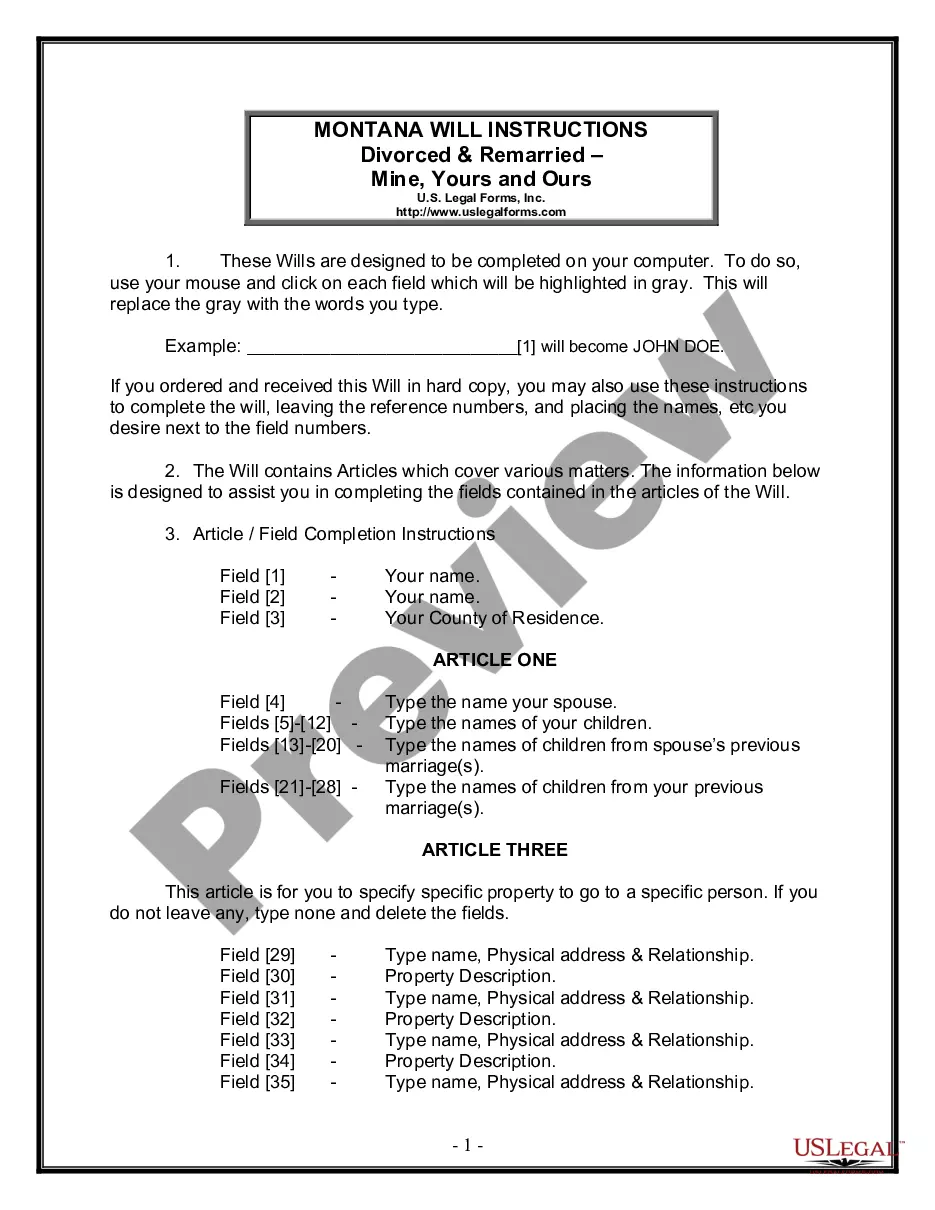

How to fill out Contract With Self-Employed Independent Contractor With Covenant Not To Compete?

Locating the appropriate legal document format can be a challenge. Of course, there are many templates accessible online, but how do you find the legal form you need? Utilize the US Legal Forms website.

The platform offers a plethora of templates, including the North Carolina Contract with Self-Employed Independent Contractor with Covenant Not to Compete, that can serve both business and personal purposes.

All the documents are verified by experts and comply with federal and state regulations.

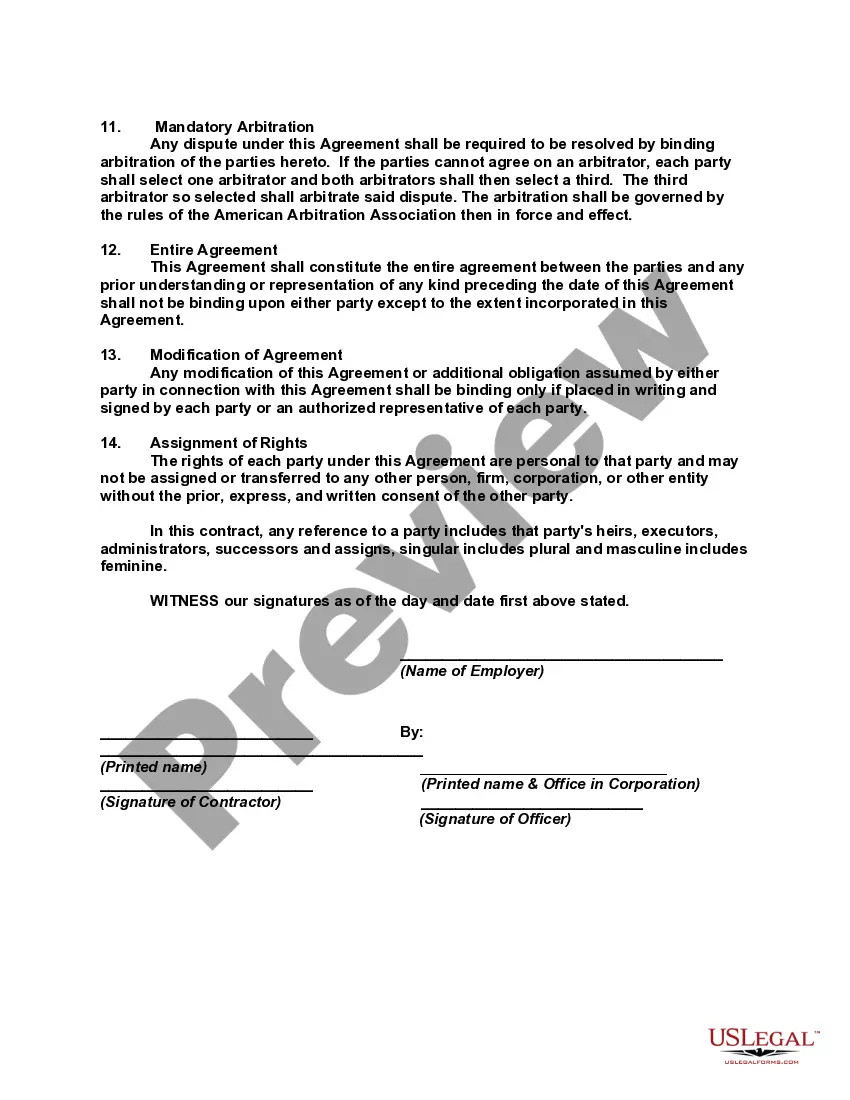

Once you are confident that the document is suitable, click the Buy Now button to acquire the form. Select your preferred pricing plan and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Choose the file format and download the legal document to your device. Finally, complete, review, print, and sign the obtained North Carolina Contract with Self-Employed Independent Contractor with Covenant Not to Compete. US Legal Forms is the largest collection of legal documents where you can find a variety of document templates. Use the service to obtain professionally crafted paperwork that adheres to state regulations.

- If you are already registered, sign in to your account and click the Download button to obtain the North Carolina Contract with Self-Employed Independent Contractor with Covenant Not to Compete.

- Utilize your account to explore the legal forms you have previously obtained.

- Visit the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are some straightforward steps to follow.

- First, ensure you have selected the correct form for your city/region. You can preview the document using the Review button and check the document summary to confirm its suitability for you.

- If the document does not meet your requirements, use the Search field to find the correct form.

Form popularity

FAQ

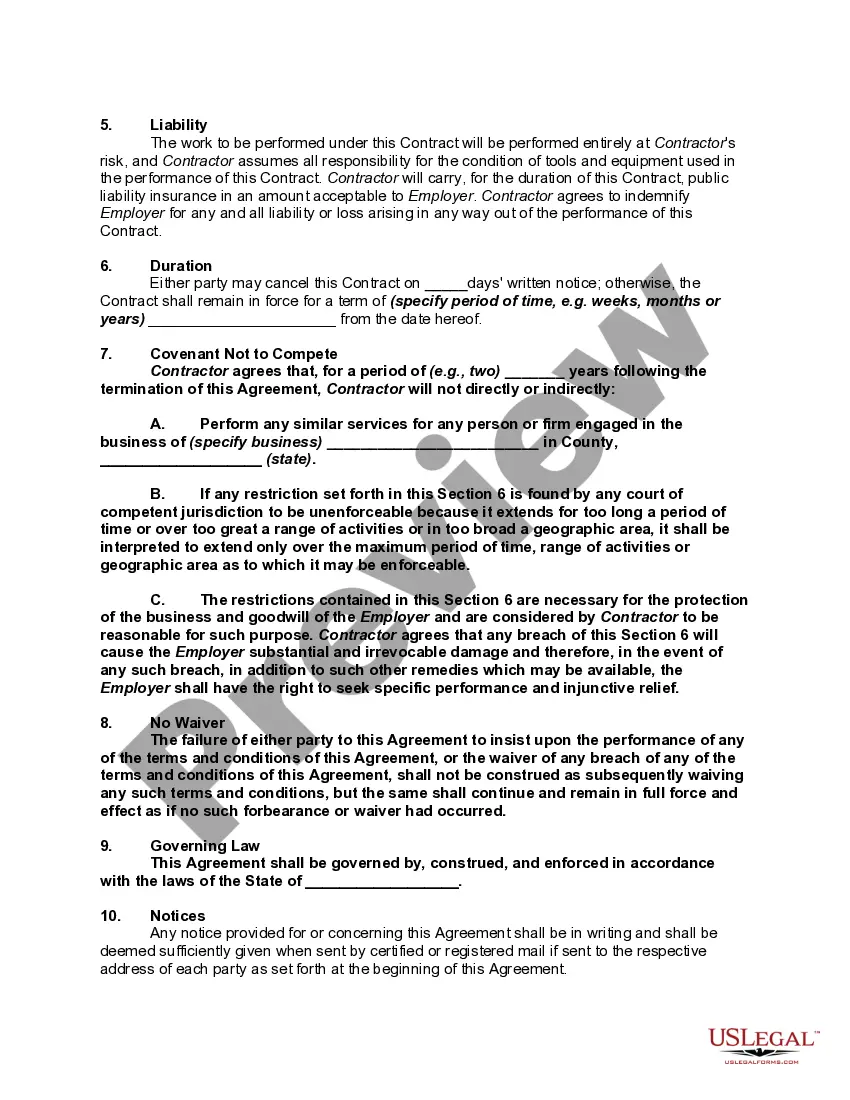

Yes, North Carolina does allow non-compete agreements under certain conditions. To be enforceable, these agreements must be reasonable in terms of duration, geographic area, and the scope of restricted activities. This means that if you're considering a North Carolina Contract with Self-Employed Independent Contractor with Covenant Not to Compete, you should ensure it clearly outlines these elements to protect your interests. Additionally, using reliable platforms like US Legal Forms can help you create a compliant and effective contract tailored to your needs.

Yes, independent contractors can include a non-compete clause in their agreements. In North Carolina, these clauses must also adhere to the same principles of reasonableness and protection of business interests as those for employees. The agreement should clearly outline the terms and conditions applicable to the independent contractor. Our platform provides tools to help you craft a North Carolina Contract with Self-Employed Independent Contractor with Covenant Not to Compete that accurately reflects your needs.

A covenant not to compete can be deemed unenforceable if it does not meet the legal criteria established by North Carolina courts. This includes being overly broad in terms of duration, geographic scope, or the nature of the restrictions. If an agreement restricts an individual's ability to work unreasonably, it may not hold up in court. To ensure enforceability, use our platform when drafting your North Carolina Contract with Self-Employed Independent Contractor with Covenant Not to Compete.

Employee non-compete agreements are enforceable in North Carolina, provided they meet legal standards. These agreements must be reasonable and protect legitimate business interests without being overly demanding. Courts apply a case-by-case analysis to determine enforceability. For a comprehensive understanding and to draft your own North Carolina Contract with Self-Employed Independent Contractor with Covenant Not to Compete, consider using our resources.

Yes, North Carolina does enforce non-compete agreements, but with certain limitations. The agreements must be reasonable in time, area, and the activities they restrict to be deemed enforceable. Courts will also consider whether the agreement is necessary to protect business interests. Our platform can assist you in creating a solid North Carolina Contract with Self-Employed Independent Contractor with Covenant Not to Compete that aligns with state laws.

Generally, covenants not to compete can be enforceable, but their effectiveness hinges on specific factors. In North Carolina, the enforcement depends on whether the terms are fair and protect a legitimate interest without being overly restrictive. The courts evaluate each case individually, focusing on reasonableness. Utilizing our service can help you draft a North Carolina Contract with Self-Employed Independent Contractor with Covenant Not to Compete that meets these legal standards.

Yes, a covenant not to compete can be enforceable in an employment contract under certain conditions. In North Carolina, these agreements must be reasonable in duration, geographic area, and the scope of the activity restricted. Courts will analyze whether the agreement protects legitimate business interests while ensuring it does not unduly restrict an employee's ability to earn a living. For a clear understanding of this process, consider using our platform for a North Carolina Contract with Self-Employed Independent Contractor with Covenant Not to Compete.

Yes, non-compete clauses can be enforceable against independent contractors in North Carolina, but they must meet specific legal standards. The restrictions should be reasonable in scope, duration, and geographic area. If you are using a North Carolina Contract with a Self-Employed Independent Contractor with Covenant Not to Compete, it is crucial to draft it carefully. Consulting a legal expert through platforms like US Legal Forms can help ensure your agreement is valid.

Several factors can void a noncompete agreement in North Carolina. If the terms are too broad in geographic scope or time duration, a court may find the agreement unenforceable. In addition, if the agreement places unreasonable limitations on the contractor's ability to earn a living, it may also be invalidated. Reviewing your North Carolina Contract with a Self-Employed Independent Contractor with Covenant Not to Compete can prevent these issues.

In North Carolina, the noncompete ban can indeed apply to contractors. This means that if you have a North Carolina Contract with a Self-Employed Independent Contractor with Covenant Not to Compete, you need to be aware of the specific terms. It's essential to ensure the contractor understands the restrictions laid out in the agreement. If the terms are deemed unreasonable, they may not be enforceable.