A deed in lieu of foreclosure is a method sometimes used by a lienholder on property to avoid a lengthy and expensive foreclosure process, with a deed in lieu of foreclosure a foreclosing lienholder agrees to have the ownership interest transferred to the bank/lienholder as payment in full. The debtor basically deeds the property to the bank instead of them paying for foreclosure proceedings. Therefore, if a debtor fails to make mortgage payments and the bank is about to foreclose on the property, the deed in lieu of foreclosure is an option that chooses to give the bank ownership of the property rather than having the bank use the legal process of foreclosure.

North Carolina Offer by Borrower of Deed in Lieu of Foreclosure

Description

How to fill out Offer By Borrower Of Deed In Lieu Of Foreclosure?

US Legal Forms - one of several most significant libraries of legitimate kinds in the USA - provides a wide array of legitimate papers templates you may download or printing. While using website, you can get a large number of kinds for organization and specific reasons, sorted by categories, says, or search phrases.You will find the most recent types of kinds much like the North Carolina Offer by Borrower of Deed in Lieu of Foreclosure in seconds.

If you already possess a membership, log in and download North Carolina Offer by Borrower of Deed in Lieu of Foreclosure through the US Legal Forms local library. The Down load key will show up on each develop you view. You gain access to all in the past acquired kinds inside the My Forms tab of your own bank account.

If you wish to use US Legal Forms the very first time, allow me to share straightforward guidelines to help you started off:

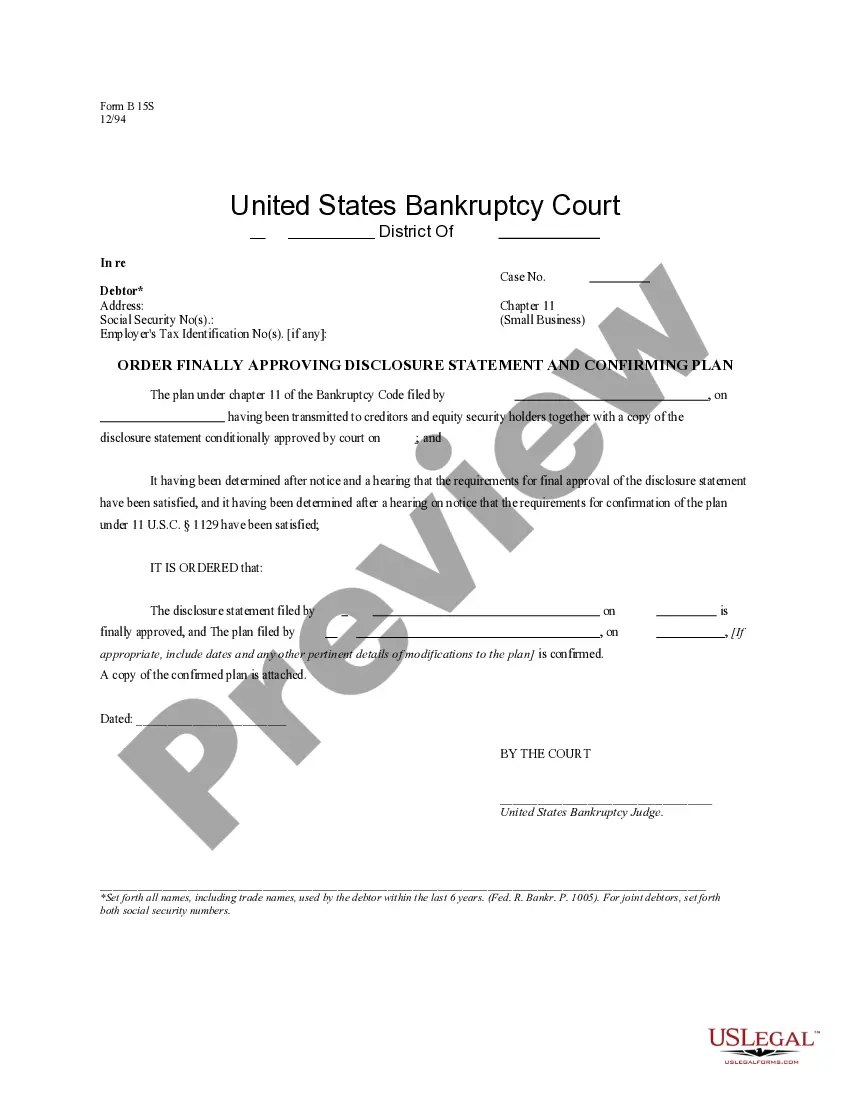

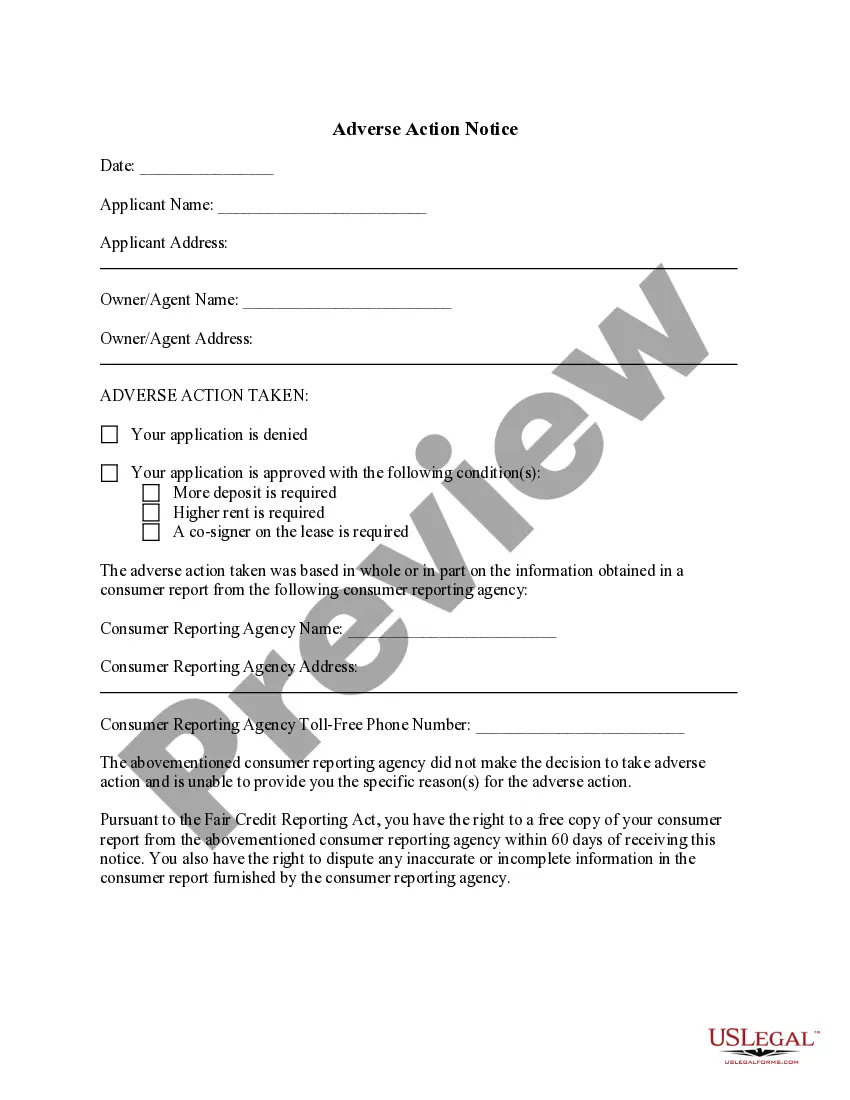

- Be sure you have picked out the best develop for the town/state. Select the Preview key to examine the form`s content. Browse the develop outline to ensure that you have chosen the right develop.

- In the event the develop does not fit your specifications, take advantage of the Lookup industry at the top of the display screen to find the one which does.

- Should you be satisfied with the shape, validate your decision by clicking the Buy now key. Then, pick the pricing program you like and offer your qualifications to sign up to have an bank account.

- Process the purchase. Use your charge card or PayPal bank account to perform the purchase.

- Pick the formatting and download the shape in your device.

- Make modifications. Fill out, modify and printing and indication the acquired North Carolina Offer by Borrower of Deed in Lieu of Foreclosure.

Each design you included with your account does not have an expiration time and it is yours forever. So, if you wish to download or printing one more version, just visit the My Forms segment and click on around the develop you need.

Gain access to the North Carolina Offer by Borrower of Deed in Lieu of Foreclosure with US Legal Forms, the most considerable local library of legitimate papers templates. Use a large number of specialist and express-distinct templates that satisfy your organization or specific requirements and specifications.

Form popularity

FAQ

The purchaser has no responsibility because the purchaser receives the property title without the mortgage and junior liens. What is a major disadvantage to lenders of accepting a deed in lieu of foreclosure? The lender takes the real estate subject to all junior liens.

A deed in lieu of foreclosure can release you from your mortgage responsibilities and allow you to avoid a foreclosure on your credit report. When you hand over the deed, the lender releases their lien on the property. This allows the lender to recoup some of the losses without forcing you into foreclosure.

Disadvantages to Lender A lender should also hesitate before accepting a lieu deed where there are outstanding subordinate liens or judgments against the property. In such a situation, the lender will have to foreclose its mortgage, with the attendant expense and time involved to obtain clear title.

A Deed in Lieu does not clear second (or even third) mortgages, and therefore will not allow the lender to take clear title to the property. (These are sometimes referred to as junior liens.) And if the Deed in Lieu is accepted, the secondary lender may come after you for the deficiency.

Disadvantages of a deed in lieu of foreclosure You will have to surrender your home sooner. You may not pursue alternative mortgage relief options, like a loan modification, that could be a better option. You'll likely lose any equity in the property you might have.

Drawbacks Of A Deed In Lieu No guarantee of acceptance: Your lender isn't obligated to accept your deed in lieu of foreclosure. Your credit will still take a hit: While a deed in lieu arrangement won't harm your credit as drastically as a foreclosure, you can still expect your score to drop.

By accepting a deed in lieu of foreclosure, lenders may take possession of the property sooner and keep it in better condition. The lender may be more likely to approve a request for a deed in lieu on a home in good condition so they can sell the property quickly and at a fair market rate.

A deed in lieu of foreclosure is the process of when a homeowner transfers the deed of their home to the lender, without the legal process of a foreclosure.