US Legal Forms - among the greatest libraries of lawful varieties in America - provides a wide range of lawful document themes you can acquire or produce. Making use of the site, you will get a large number of varieties for business and personal functions, categorized by types, suggests, or keywords and phrases.You can find the latest types of varieties much like the North Carolina Retail Installment Contract and Security Agreement in seconds.

If you have a subscription, log in and acquire North Carolina Retail Installment Contract and Security Agreement from your US Legal Forms local library. The Download switch will appear on every single type you look at. You gain access to all earlier downloaded varieties in the My Forms tab of your accounts.

If you wish to use US Legal Forms initially, allow me to share easy recommendations to obtain started out:

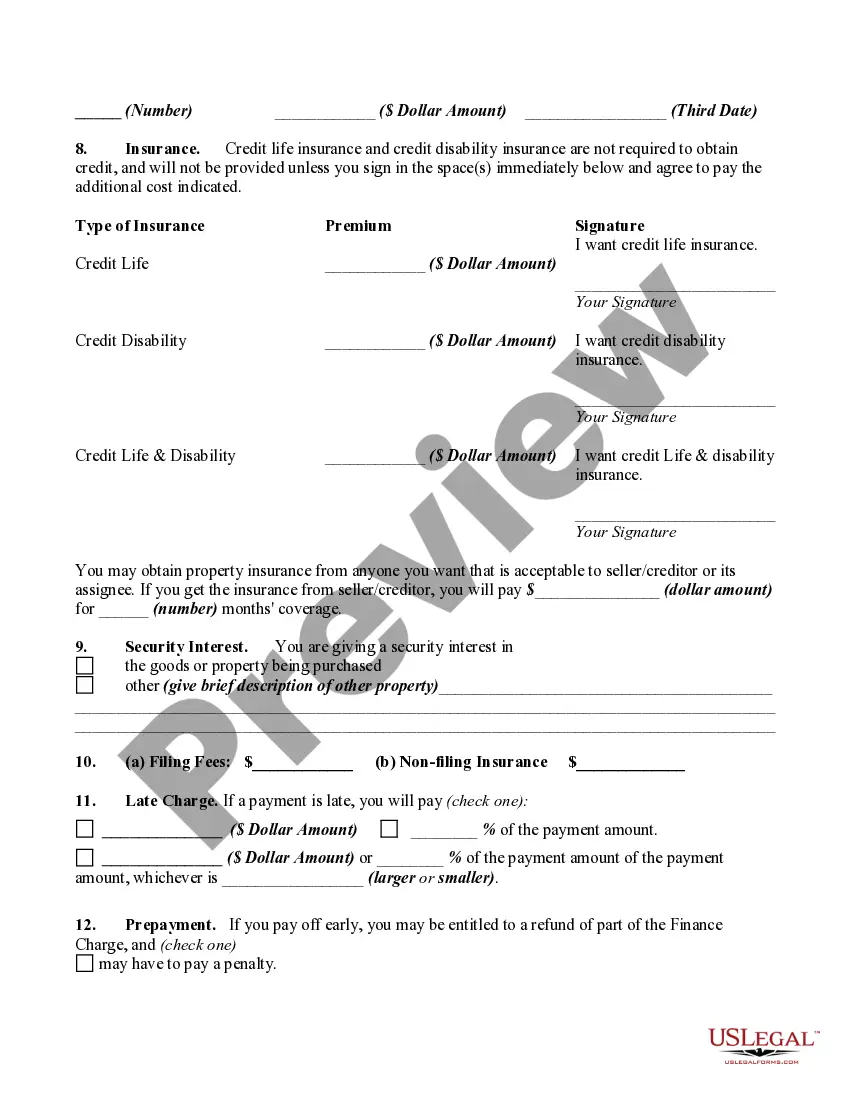

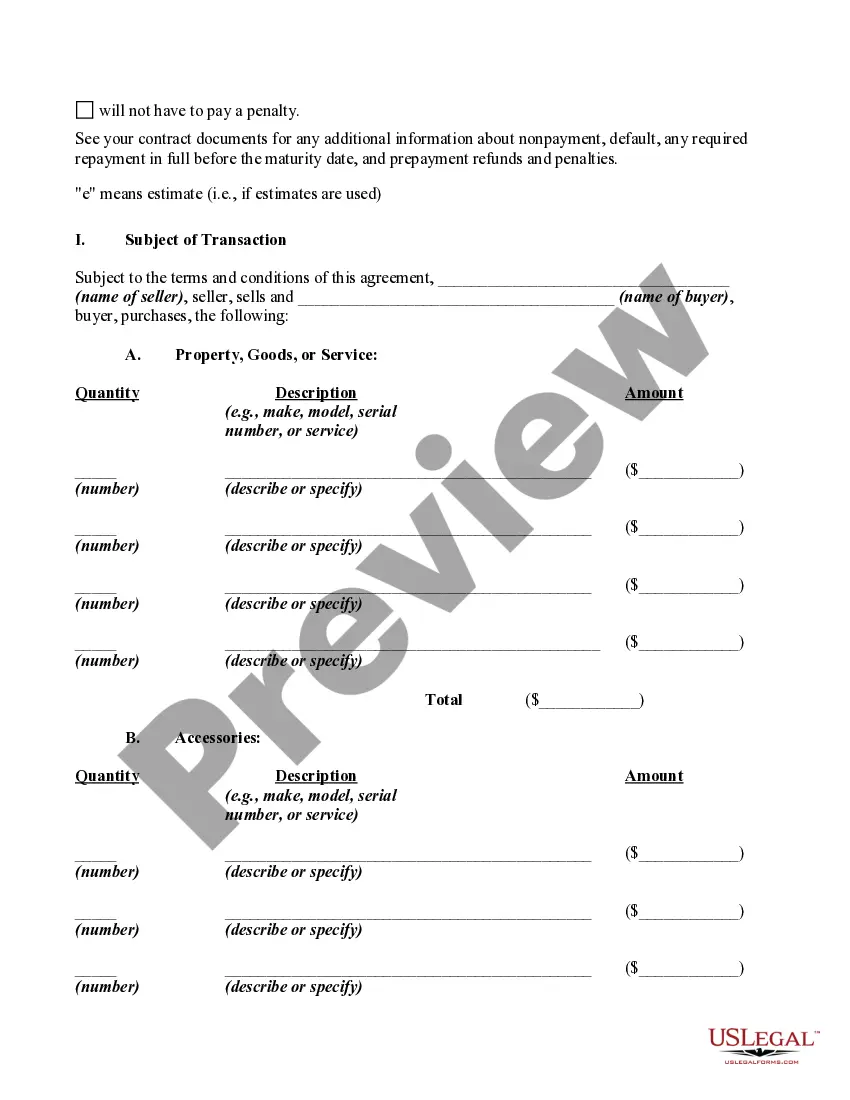

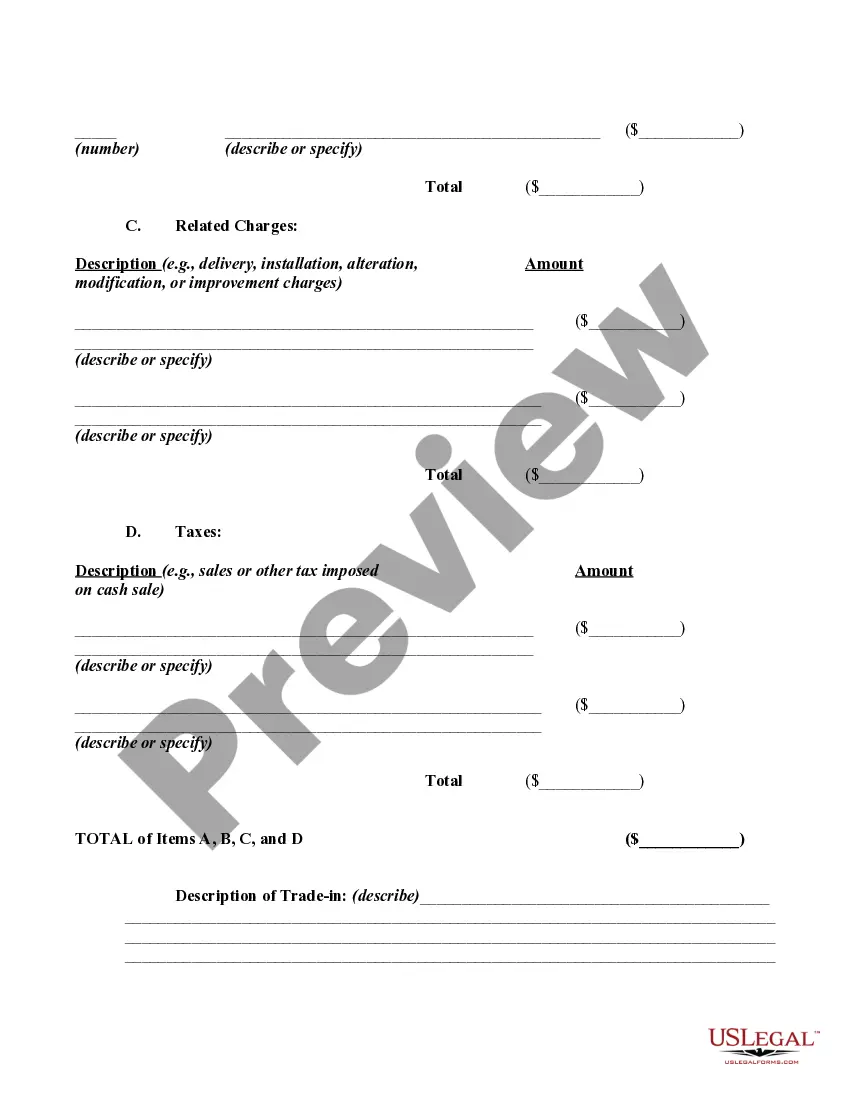

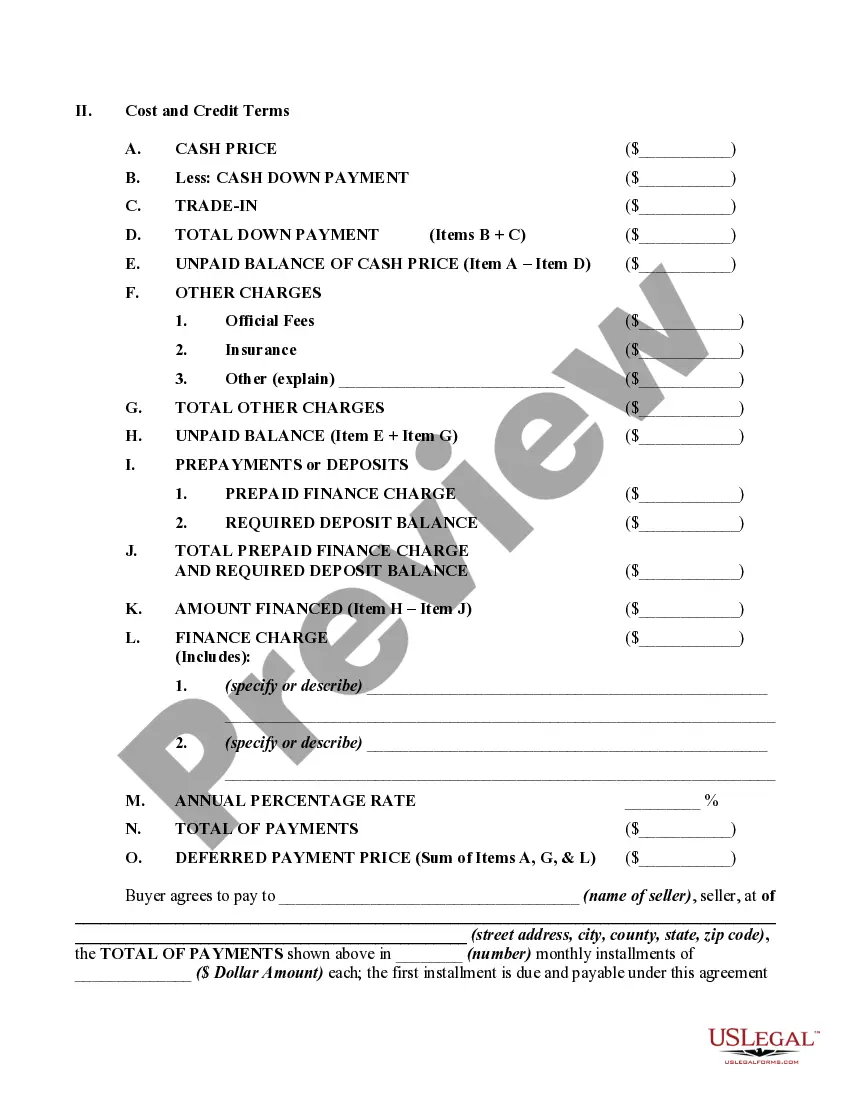

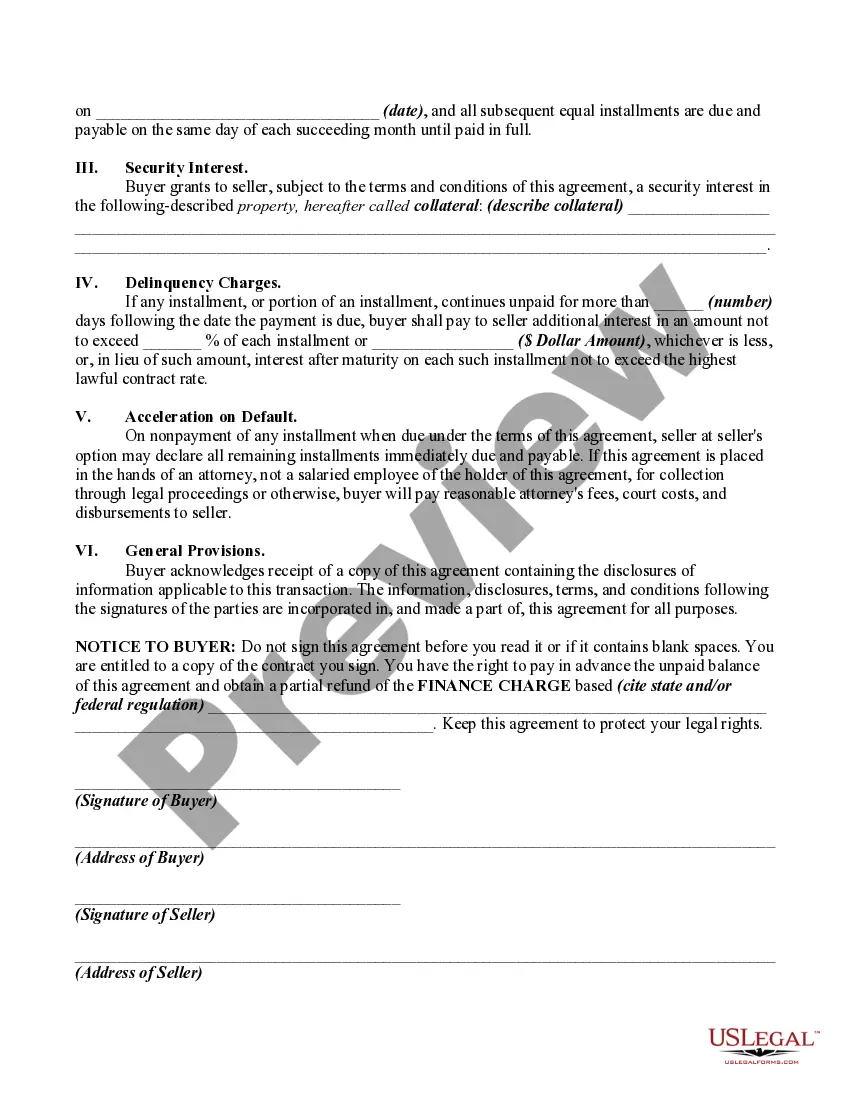

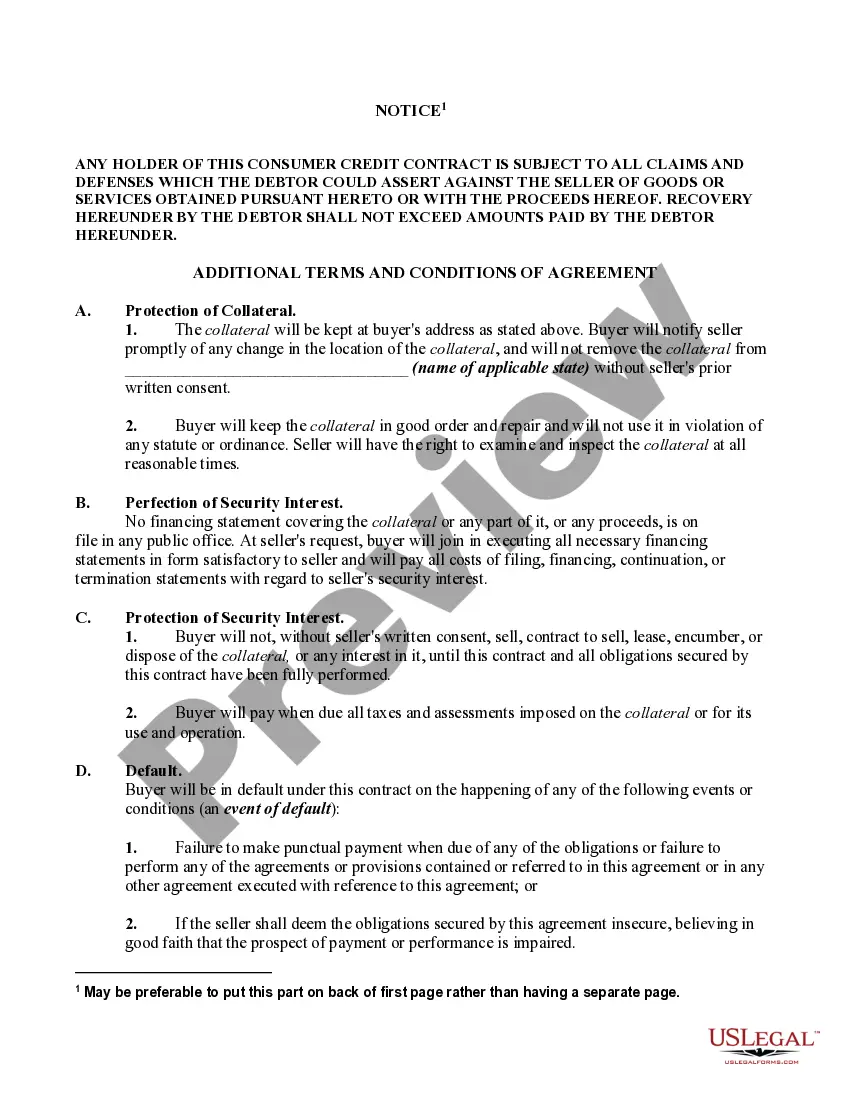

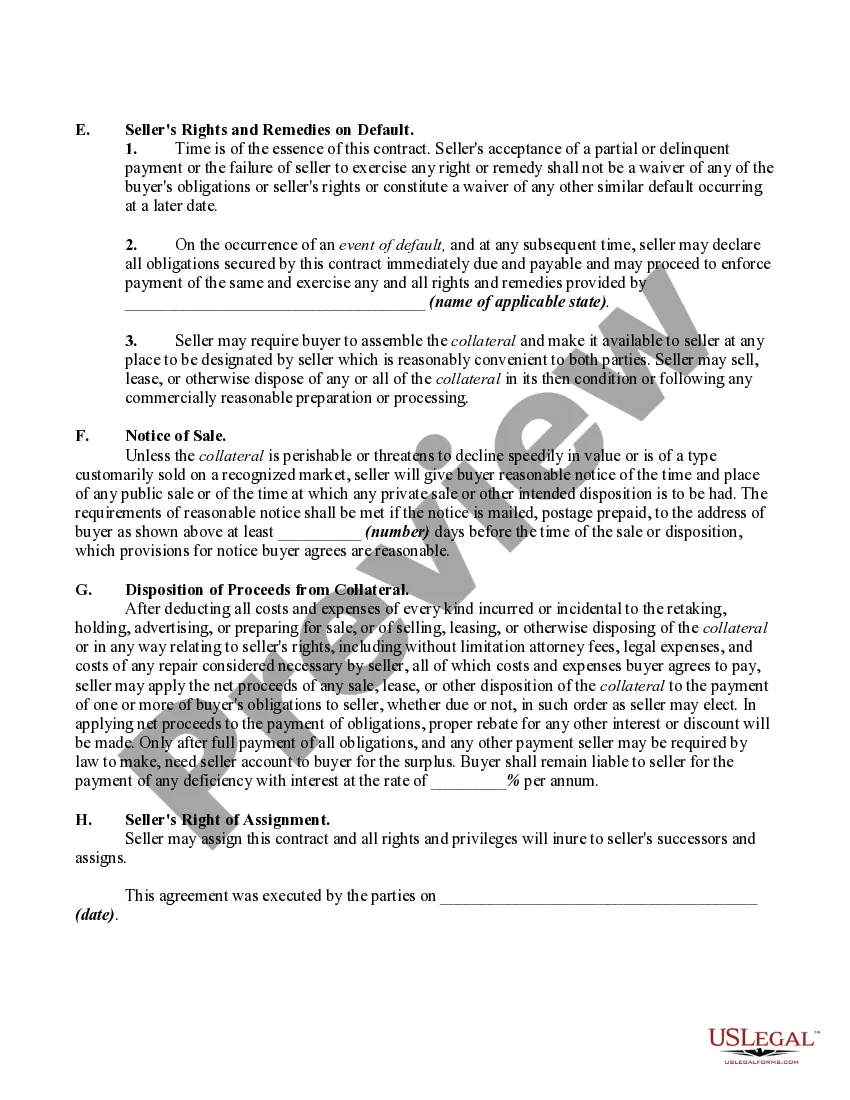

- Make sure you have picked the correct type for your town/state. Click on the Review switch to check the form`s information. Browse the type description to actually have chosen the appropriate type.

- When the type doesn`t suit your demands, take advantage of the Search field on top of the monitor to get the one that does.

- In case you are satisfied with the form, verify your option by visiting the Get now switch. Then, opt for the rates prepare you like and supply your qualifications to sign up for the accounts.

- Process the transaction. Utilize your charge card or PayPal accounts to accomplish the transaction.

- Select the file format and acquire the form on the system.

- Make adjustments. Load, change and produce and sign the downloaded North Carolina Retail Installment Contract and Security Agreement.

Each and every format you included with your account lacks an expiration particular date and is also yours for a long time. So, if you wish to acquire or produce one more duplicate, just visit the My Forms area and click on the type you will need.

Gain access to the North Carolina Retail Installment Contract and Security Agreement with US Legal Forms, by far the most considerable local library of lawful document themes. Use a large number of skilled and express-distinct themes that meet up with your company or personal demands and demands.