No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

North Carolina Rejection of Claim and Report of Experience with Debtor

Description

How to fill out Rejection Of Claim And Report Of Experience With Debtor?

Selecting the ideal authorized document template can be challenging. Certainly, there are numerous templates accessible on the web, but how do you locate the authorized form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the North Carolina Rejection of Claim and Report of Experience with Debtor, that can be utilized for business and personal purposes.

All forms are reviewed by experts and comply with state and federal regulations.

Once you are certain the form is correct, click the Buy now button to get the form. Choose the payment plan you would like and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the authorized document template to your device. Complete, modify, print, and sign the received North Carolina Rejection of Claim and Report of Experience with Debtor. US Legal Forms is the largest collection of legal forms where you can find a variety of document templates. Take advantage of the service to download properly crafted documents that comply with state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the North Carolina Rejection of Claim and Report of Experience with Debtor.

- Use your account to search for the legal forms you have previously purchased.

- Go to the My documents tab of your account and get another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions that you should follow.

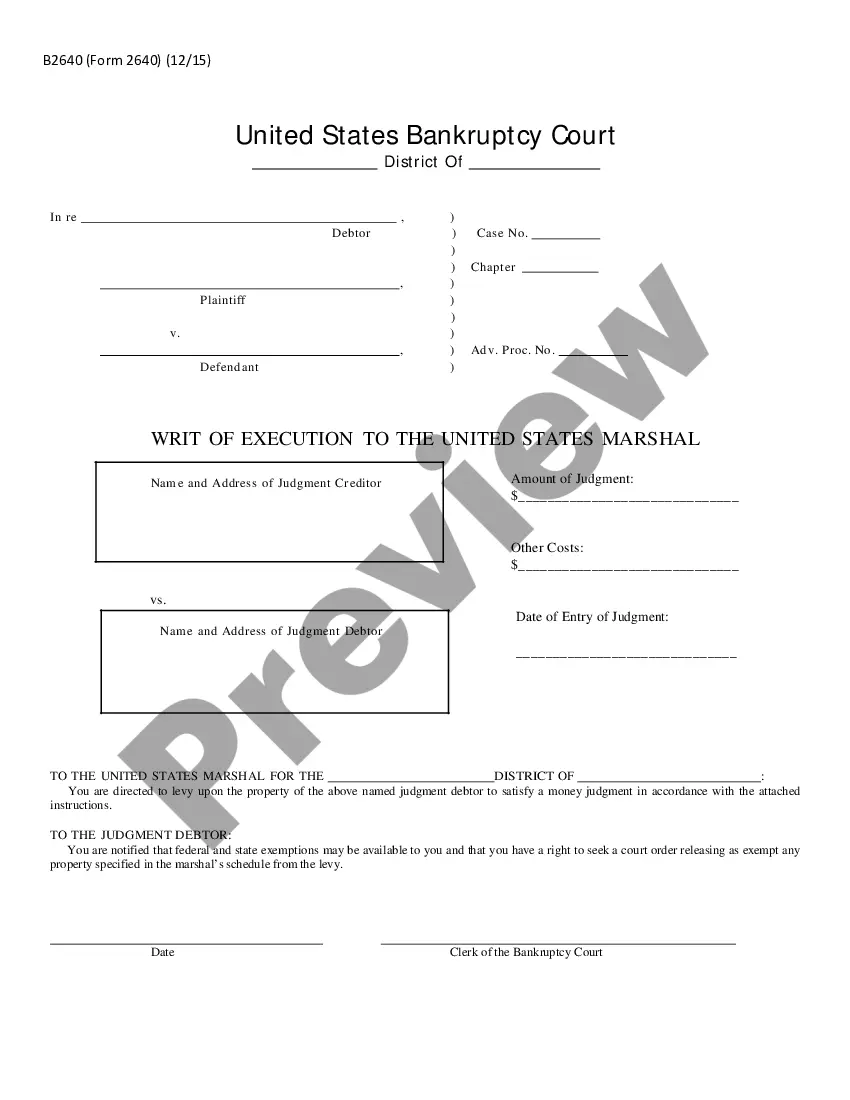

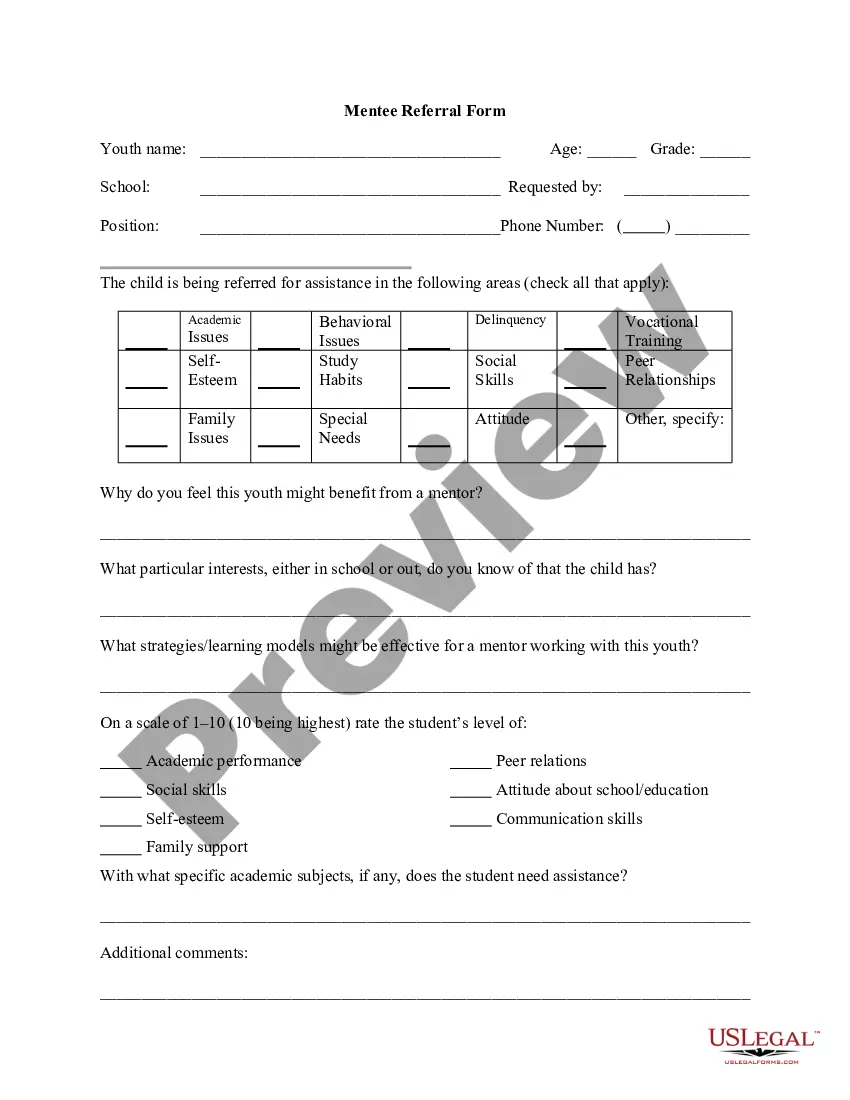

- First, ensure you have selected the correct form for your city/region. You can review the form using the Preview button and examine the form outline to confirm this is indeed the right one for you.

- If the form does not meet your needs, use the Search field to find the appropriate form.

Form popularity

FAQ

The statute of limitations on debt collection after death in North Carolina generally follows the same timelines as consumer debt. For most debts, this period is three years, but some debts may have different statutes. Understanding the North Carolina Rejection of Claim and Report of Experience with Debtor can provide you with essential insights into how these limitations may impact creditors and heirs alike.

In North Carolina, debt collection efforts can continue after a person's death, typically for a period of three years. However, this can vary based on the type of debt and whether the estate is probated. The North Carolina Rejection of Claim and Report of Experience with Debtor can guide you through this process, ensuring that you understand your rights and obligations regarding the decedent's financial affairs.

Creditors can pursue claims against an estate for up to three years after the death of the debtor. However, this period can vary, especially if you have filed a timely claim that has been rejected. Familiarity with the North Carolina Rejection of Claim and Report of Experience with Debtor is important in navigating these time limits. For clarity and support, consider using uslegalforms to ensure all necessary steps are taken within the designated time.

In North Carolina, you typically have three years to file a lawsuit against an estate, beginning from the date of the rejection of your claim. The timeline is essential to ensure that you protect your rights as a creditor. If you have received a North Carolina Rejection of Claim and Report of Experience with Debtor, it is wise to act promptly. Seeking assistance through platforms like uslegalforms can guide you through the legal process effectively.

In North Carolina, creditors generally have a period of 12 months from the date of the death to present their claims against an estate. If a notice to creditors is published, this timeframe may be shortened to 90 days from the date of publication. Understanding the North Carolina Rejection of Claim and Report of Experience with Debtor is crucial for both creditors and estate administrators. Utilizing this information can help ensure that all claims are addressed in a timely manner.

Yes, you can file a lawsuit against an estate if your claim is denied or not resolved satisfactorily. However, it's essential to ensure that you follow the correct legal procedures and filing timelines specified by North Carolina law. Understanding the implications of the North Carolina Rejection of Claim and Report of Experience with Debtor can guide you through this process effectively.

Creditors often learn about an estate through public notices published in local newspapers or court filings. Additionally, they may receive direct communication from personal representatives handling the estate. Staying informed about the North Carolina Rejection of Claim and Report of Experience with Debtor can enhance a creditor's awareness of active estates and any potential claims.

To make a claim against an estate in North Carolina, gather relevant documents that support your claim, then prepare a written statement detailing the amount owed. Submit this statement to the personal representative of the estate. Familiarizing yourself with the North Carolina Rejection of Claim and Report of Experience with Debtor process can help ensure your claim is considered.

In North Carolina, creditors typically have a period of three months from the date of the first publication of the estate notice to file their claims. This timeframe is crucial to note, as late submissions may result in rejection of the claim. Understanding the North Carolina Rejection of Claim and Report of Experience with Debtor guidelines can help creditors ensure their claims are filed correctly and timely.

To file a claim against an estate in North Carolina, a creditor must submit the claim in writing to the executor or administrator of the estate. The claim should clearly state the amount owed and the basis for the claim. Following North Carolina law regarding the rejection of claims ensures creditors navigate the process effectively. Utilizing resources like US Legal Forms can simplify this process for you.