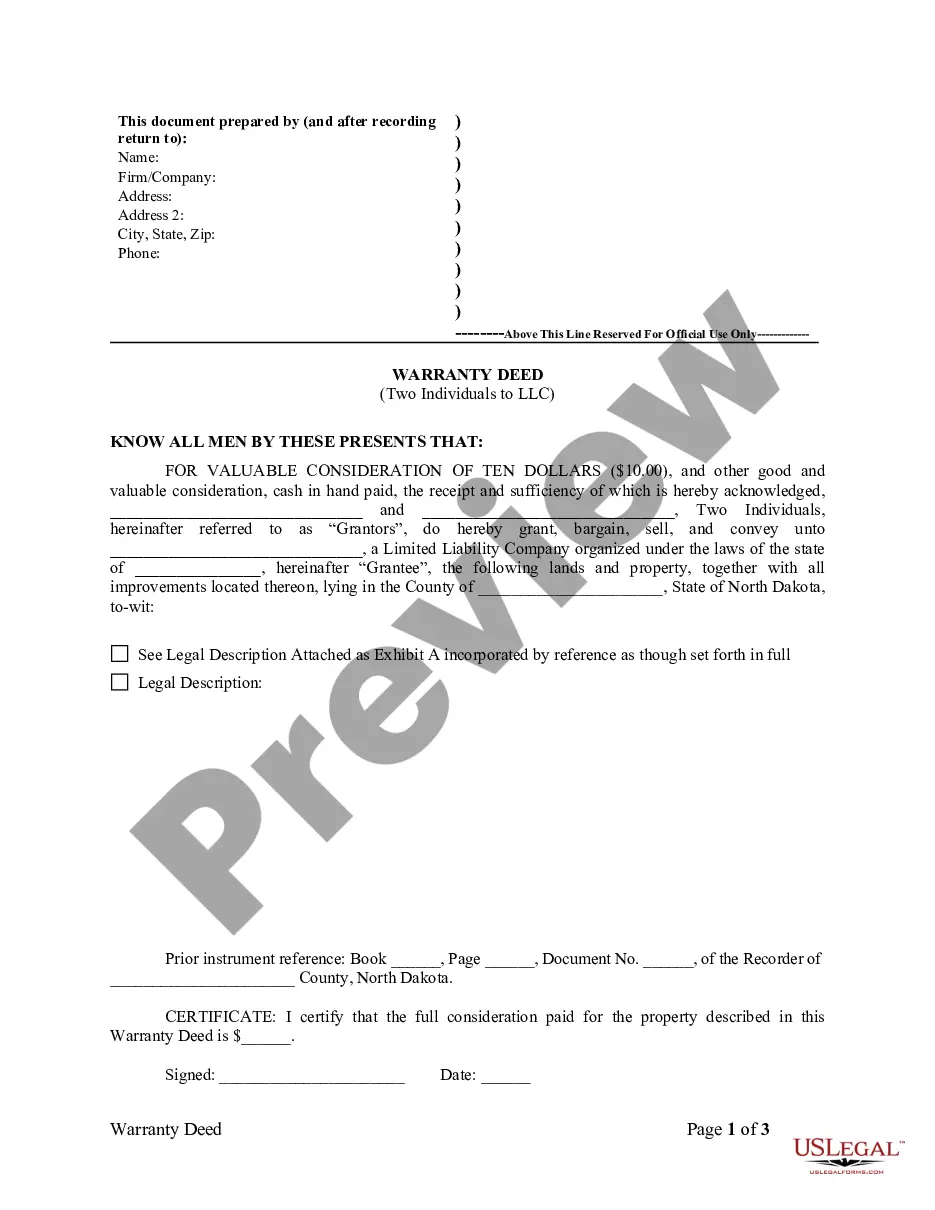

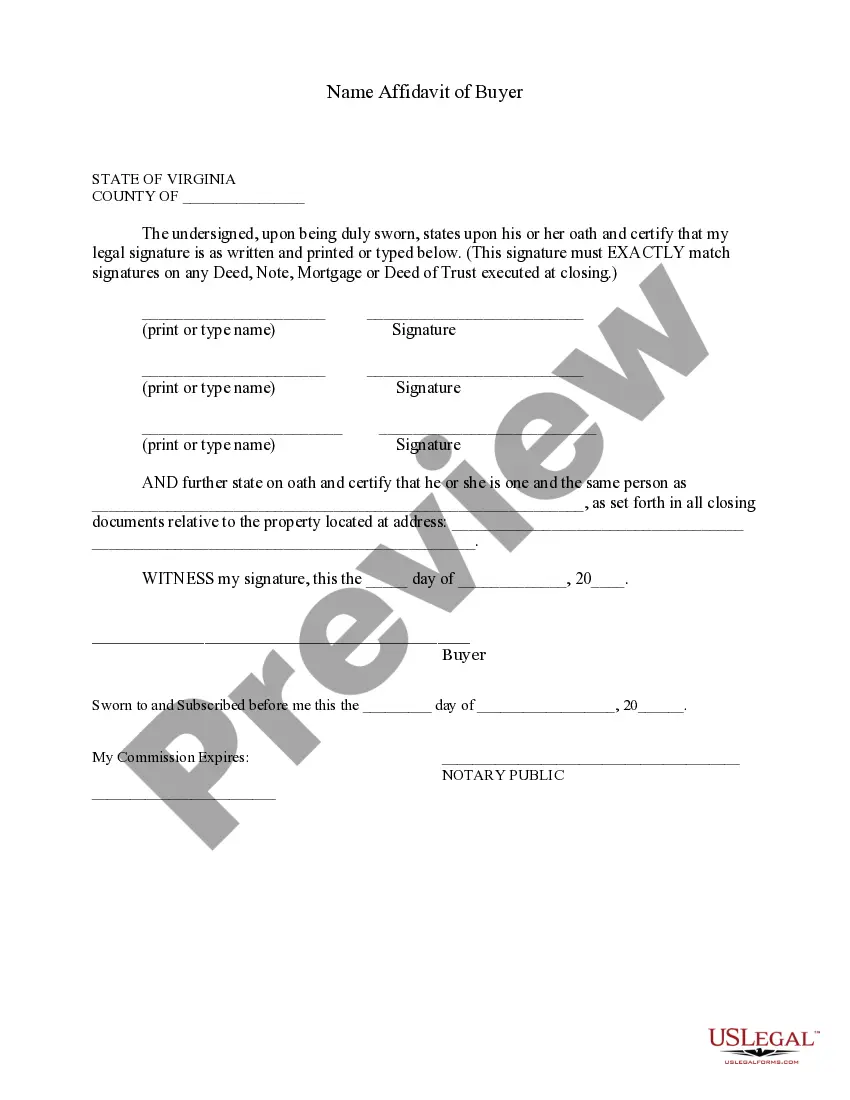

North Carolina Owner Financing Contract for Home: A Comprehensive Guide If you are considering purchasing a home in North Carolina and exploring alternative financing options, an Owner Financing Contract may be worth considering. Owner financing, also known as seller financing or the installment sale, allows the buyer to bypass traditional lending institutions and instead arrange financing directly with the seller. This provides a flexible payment structure, where the buyer makes regular payments to the seller, often over a set period of time, until the property is fully paid. In North Carolina, Owner Financing Contracts for homes follow specific guidelines to ensure legal and fair transactions. These contracts are designed to protect both the buyer and the seller, outlining the terms and conditions of the agreement. Let's take a closer look at some relevant keywords and different types of North Carolina Owner Financing Contracts for homes: 1. North Carolina Owner Financing: This refers to the practice of financing real estate transactions directly between the buyer and seller, without the involvement of a traditional lender. 2. Installment Sale Agreement: Another term commonly used for Owner Financing Contracts, highlighting the payment structure where the buyer pays the seller in regular installments. 3. Promissory Note: A crucial part of an owner financing agreement, this document specifies the loan terms, including interest rate, payment schedule, consequences of default, and repayment period. 4. Purchase Agreement: The main contract outlining the terms of the home sale, including the purchase price, down payment (if any), and details about the property being sold. 5. Deed of Trust: A legal document that secures the seller's interest in the property until the buyer completes all payments, acting as collateral for the owner financing agreement. Types of North Carolina Owner Financing Contracts for Homes: 1. Straight Note: This is the simplest type of owner financing contract, where the buyer makes regular installment payments consisting of principal and interest. 2. Balloon Payment: Some owner financing contracts require the buyer to make regular smaller payments over a set period, with a larger final payment (balloon payment) at the end of the term. 3. Land Contract: Also known as a contract for deed or bond for deed, this type of agreement allows the buyer to occupy and use the property while making regular payments. The seller retains legal title until the buyer pays off the agreed-upon amount. 4. Lease Option Agreement: In this scenario, the buyer first enters into a lease agreement with the seller. The agreement includes an option for the buyer to purchase the property within a specified timeframe, providing flexibility and time to arrange suitable financing. 5. Wraparound Mortgage: This type of contract allows the buyer to assume the seller's existing mortgage while adding a second mortgage to cover the remaining purchase price. The buyer makes payments to the original lender, who then pays the seller the agreed-upon amount. Note: It is essential to consult with a real estate attorney or professional familiar with North Carolina real estate laws and regulations to ensure compliance with legal requirements and protection of your rights. By understanding the different types of North Carolina Owner Financing Contracts for homes and their associated keywords, you can make informed decisions and explore alternative financing options that work best for your unique circumstances. Remember to conduct thorough research and seek professional advice before entering into any owner financing contracts.

North Carolina Owner Financing Contract for Home

Description

How to fill out North Carolina Owner Financing Contract For Home?

You can dedicate hours online attempting to discover the legal document template that meets the national and state standards you require.

US Legal Forms offers a vast array of legal forms that can be reviewed by experts.

You can effortlessly download or print the North Carolina Owner Financing Agreement for Home from your platform.

Initially, confirm that you have selected the correct document template for your preferred area/city. Review the form description to ensure you have chosen the appropriate version. If available, utilize the Review option to inspect the document template as well.

- If you already possess a US Legal Forms account, you may sign in and then select the Download option.

- Subsequently, you can complete, amend, print, or sign the North Carolina Owner Financing Agreement for Home.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of any purchased form, navigate to the My documents section and select the corresponding option.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

In North Carolina, owner financing allows the seller to provide financing directly to the buyer instead of using a traditional lender. This method can offer flexibility in payment terms, interest rates, and down payment options, making it appealing for both parties. The North Carolina Owner Financing Contract for Home should outline all terms, including payment schedule and responsibilities, ensuring clarity and protection for everyone involved.

When writing a finance contract, you need to identify the parties involved, detail the items or services being financed, and lay out payment terms. Include clauses that outline consequences for non-payment and rights of each party. The North Carolina Owner Financing Contract for Home needs to balance clarity with legal compliance, and platforms like UsLegalForms offer valuable resources to assist in crafting a precise and effective agreement.

Reporting owner financing on taxes in North Carolina involves both the buyer and seller. The seller must report interest income on their tax return, while the buyer may be eligible for mortgage interest deductions. It's important to maintain accurate records of payments made under the North Carolina Owner Financing Contract for Home. Consulting a tax advisor can help both parties navigate their specific obligations and optimize tax outcomes.

Typical terms for owner financing in North Carolina can vary, but they usually include a 10% to 20% down payment and an interest rate that may be slightly higher than conventional loans. The repayment period often ranges from three to five years, followed by a balloon payment. Each contract should be customized to meet the needs of both the buyer and seller. For guidance on drafting these specific terms, uslegalforms can be a valuable resource.

In North Carolina, the seller typically sets up the owner financing. This arrangement allows the seller to act as the lender, offering the buyer a flexible payment plan. Both parties can negotiate the terms outlined in the North Carolina Owner Financing Contract for Home. Using a legal platform like uslegalforms can simplify this process and ensure that all essential documents are correctly prepared.

In the context of owner financing, there usually isn't a traditional lender involved, so they do not hold the deed. Instead, the seller retains the deed while the buyer fulfills their payment obligations. This alternative can suit buyers who may not qualify for conventional loans. If you consider a North Carolina Owner Financing Contract for Home, you might find this feature beneficial in your home-buying journey.

If a buyer defaults on owner financing, the seller typically has the right to repossess the property. This process can be similar to foreclosure, but it depends on the terms laid out in the North Carolina Owner Financing Contract for Home. The seller might have the option to negotiate a payment plan or take other actions to recover losses. Clear communication and understanding of the agreement can help prevent such situations.

In seller financing, the seller retains ownership of the deed until the buyer pays off the financing agreement. This means the seller has a claim to the property while allowing the buyer to live in the home. Such a structure can create security for the seller while still providing the buyer a path to homeownership. When using a North Carolina Owner Financing Contract for Home, it is crucial for both parties to comprehend the deed's status.

One downside of owner financing is that it can involve higher interest rates compared to traditional mortgages. This situation sometimes arises because sellers may want to mitigate their risk. Additionally, if a buyer defaults, the seller has the burden of dealing with potential foreclosure. Understanding the terms in a North Carolina Owner Financing Contract for Home can help buyers and sellers navigate these concerns effectively.