A corporation is an artificial person that is created by governmental action. The corporation exists in the eyes of the law as a person, separate and distinct from the persons who own the corporation (i.e., the stockholders). This means that the property of the corporation is not owned by the stockholders, but by the corporation. Debts of the corporation are debts of this artificial person, and not of the persons running the corporation or owning shares of stock in it. The shareholders cannot normally be sued as to corporate liabilities. However, in this guaranty, the stockholders of a corporation are personally guaranteeing the debt of the corporation in which they own shares.

North Carolina Continuing Guaranty of Business Indebtedness By Corporate Stockholders

Description

How to fill out Continuing Guaranty Of Business Indebtedness By Corporate Stockholders?

You have the ability to dedicate time online searching for the official document template that meets the legal requirements of your state and federal regulations.

US Legal Forms offers a vast array of legal documents that have been vetted by professionals.

You can conveniently download or print the North Carolina Continuing Guaranty of Business Indebtedness By Corporate Stockholders from our platform.

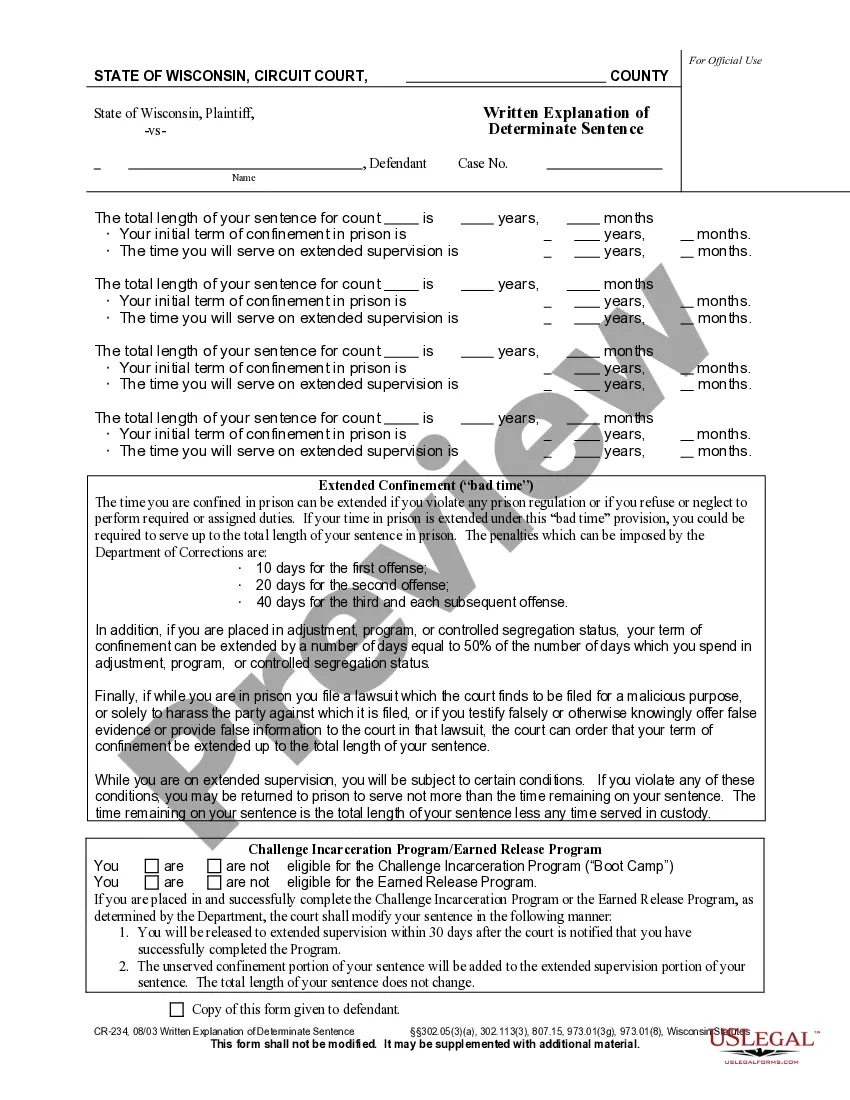

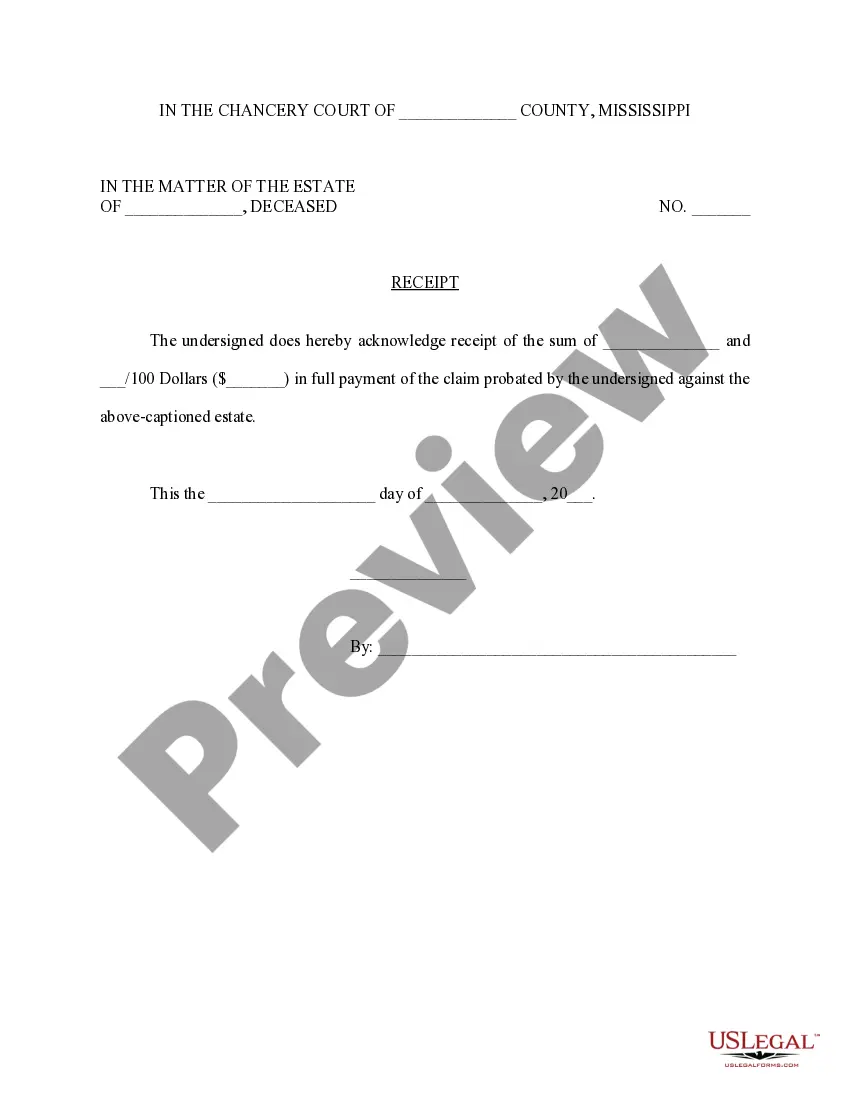

If available, utilize the Preview option to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Obtain option.

- Subsequently, you can fill out, modify, print, or sign the North Carolina Continuing Guaranty of Business Indebtedness By Corporate Stockholders.

- Every legal document template you acquire is yours permanently.

- To obtain an additional copy of a purchased form, visit the My documents tab and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- Firstly, ensure that you have selected the correct document template for your chosen county/town.

- Review the document description to confirm you have selected the appropriate form.

Form popularity

FAQ

Limitations of a personal guarantee typically revolve around the extent of liability and the scope of obligations covered. Personal guarantees may not protect the guarantor if the business incurs additional debts beyond what was anticipated. Understanding these limitations is crucial for any stockholder involved in the North Carolina Continuing Guaranty of Business Indebtedness.

A corporate guarantor is an individual or entity that agrees to take on the financial responsibilities of a corporation's debt if the company defaults. In many cases, stockholders may serve as guarantors in the North Carolina Continuing Guaranty of Business Indebtedness By Corporate Stockholders. This role is significant for minimizing lending risks.

Common loopholes in personal guarantees may include vague language or missing disclosures about the consequences. Additionally, failing to provide adequate time for review before signing could weaken the enforceability of such guarantees. Understanding these loopholes can empower stockholders in North Carolina and protect them from potential pitfalls.

Defending against a personal guarantee involves showing that the terms of the guarantee were unfair or misleading. You may need to present evidence that your obligations were overstated or enforced improperly. Utilizing legal support can clarify your position under the North Carolina Continuing Guaranty of Business Indebtedness By Corporate Stockholders.

Yes, there are avenues to potentially escape a personal guarantee. Negotiating with creditors or establishing a release agreement can provide options for withdrawal. If you find yourself navigating these waters, legal guidance can help identify the best strategies related to the North Carolina Continuing Guaranty of Business Indebtedness By Corporate Stockholders.

To invalidate a personal guarantee, one must demonstrate that it was signed under duress, fraud, or significant misunderstanding. Evidence showing a lack of intent or capacity to guarantee the debt can also be helpful. It is advised to consult legal assistance, especially when dealing with the North Carolina Continuing Guaranty of Business Indebtedness By Corporate Stockholders.

A personal guarantee of corporate debt is a promise by an individual to repay a company's debts if the business fails to do so. It directly ties the individual's personal finances to the company's obligations. In North Carolina, stockholders may provide guarantees to secure business loans or credit, making it crucial for them to understand the implications.

A guarantee of corporate debt is a commitment made by an individual or entity to cover a company's outstanding financial obligations. In the context of North Carolina Continuing Guaranty of Business Indebtedness By Corporate Stockholders, this often involves stockholders agreeing to be responsible for company debts. This form of guarantee can provide reassurance to lenders and improve the company's creditworthiness.

A guarantor in a company can be a shareholder, executive, or another stakeholder that signs the guaranty to secure the company's obligations. In light of the North Carolina Continuing Guaranty of Business Indebtedness By Corporate Stockholders, these individuals play a key part in ensuring the business's financial commitments are met. Their involvement often leads to enhanced trust from financial institutions.

A guarantor may be any individual or business entity that agrees to assume the financial risk associated with another party's debt. Within North Carolina Continuing Guaranty of Business Indebtedness By Corporate Stockholders, typical guarantors include business owners, shareholders, or even affiliated companies. Their role is vital in establishing credibility with potential lenders.