North Carolina Checklist for Remedying Identity Theft of Deceased Persons

Description

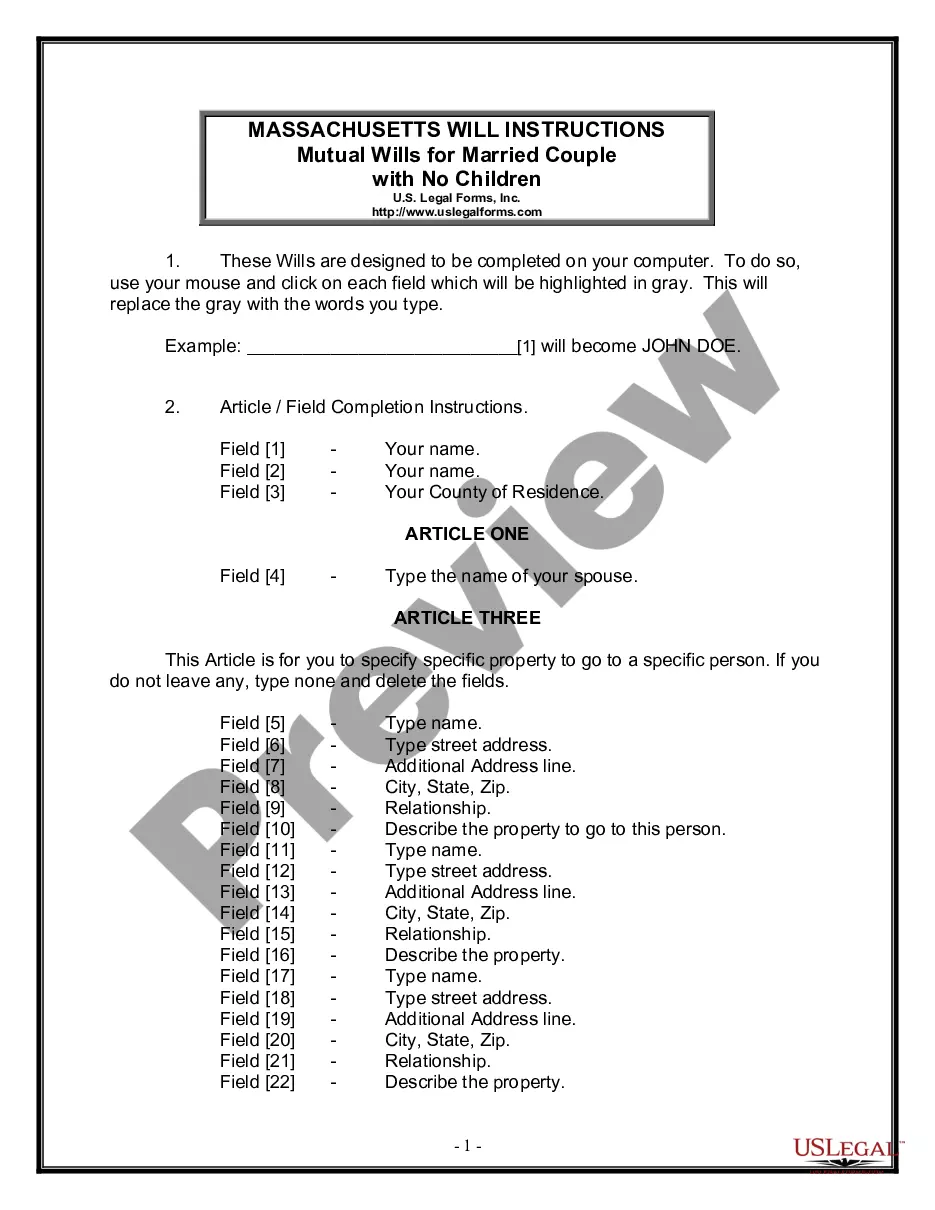

How to fill out Checklist For Remedying Identity Theft Of Deceased Persons?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal document templates that you can obtain or create.

Using the website, you can find thousands of forms for business and personal use, organized by categories, states, or keywords. You can locate the latest documents such as the North Carolina Checklist for Addressing Identity Theft of Deceased Individuals within moments.

If you already have a subscription, Log In and obtain the North Carolina Checklist for Addressing Identity Theft of Deceased Individuals from the US Legal Forms library. The Download button will appear on each form you view. You have access to all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase. Choose the format and download the form onto your device. Make edits. Fill in, modify, print, and sign the downloaded North Carolina Checklist for Addressing Identity Theft of Deceased Individuals.

Every template you add to your account has no expiration date and is yours permanently. Thus, to download or create another version, simply go to the My documents section and click on the form you desire. Access the North Carolina Checklist for Addressing Identity Theft of Deceased Individuals with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

- Ensure you have selected the correct form for your area/county.

- Click the Preview button to check the content of the form.

- Review the form description to confirm that you have chosen the correct form.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

File a police report Family identity theft is not okay; it's still a crime. If you're a victim, and there is substantial damage, going to the police might be the only way to get reimbursement. You can also help ensure this doesn't happen to someone else. Visit a local law enforcement office to file a police report.

Check the box on line A if you received a refund check in your name and your deceased spouse's name. You can return the joint-name check with Form 1310 to your local IRS office or the service center where you mailed your return. A new check will be issued in your name and mailed to you.

Steps for Victims of Identity Theft or Fraud Place a fraud alert on your credit report. Close out accounts that have been tampered with or opened fraudulently. Report the identity theft to the Federal Trade Commission. File a report with your local police department.

Deceased family member identity theft, also known as ghosting, occurs when someone uses the personal information of a deceased person to commit fraud. This can include opening new credit accounts, applying for loans or making other financial transactions in the deceased person's name.

Identity theft can victimize the dead. An identity thief's use of a deceased person's Social Security number may create problems for family members. This type of identity theft also victimizes merchants, banks, and other businesses that provide goods and services to the thief.

Submit the following with your information request as proof that you're authorized to receive deceased person's information: The full name of the deceased, their last address and Social Security Number. A copy of the death certificate. Either: A copy of Letters of Testamentary approved by the court or.

Identity Theft of a Deceased Person Identity thieves can get personal information about deceased individuals by reading obituaries, stealing death certificates, or searching genealogy websites that sometimes provide death records from the Social Security Death Index.

Send a written notice to all financial institutions where the deceased had an account instructing them to close all individual accounts and remove the deceased's name from joint accounts: As soon as you receive the certified copies of the death certificate, send a letter and a certified copy to each of the financial ...

Visit .irs.gov/lp60. .irs.gov and search key word ?deceased.? .irs.gov/forms-pubs or call 800-TAX-FORM (800-829-3676). If you need assistance, please don't hesitate to contact us.