North Carolina Increase Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Increase Dividend - Resolution Form - Corporate Resolutions?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast selection of legal document templates that you can download or create.

By using the website, you can access thousands of forms for business and personal use, categorized by types, states, or keywords. You can find the latest versions of documents such as the North Carolina Increase Dividend - Resolution Form - Corporate Resolutions in just a few minutes.

If you already have a monthly subscription, Log In to retrieve the North Carolina Increase Dividend - Resolution Form - Corporate Resolutions from the US Legal Forms library. The Download button will be visible on each form you view. You can access all previously attained forms in the My documents section of your account.

Process the payment. Use a Visa or Mastercard or PayPal account to complete the transaction.

Select the format and

Every template you added to your account is permanent and never expires. Therefore, if you wish to download or print an additional copy, simply visit the My documents area and click on the form you need.

Access the North Carolina Increase Dividend - Resolution Form - Corporate Resolutions with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that satisfy your business or personal requirements and specifications.

- Ensure you have selected the correct form for your area/county.

- Review the Review button to examine the form's content.

- Look through the form summary to confirm you have picked the right form.

- If the form does not meet your needs, use the Search field at the top of the page to find the appropriate one.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then choose your preferred payment plan and provide your details to create an account.

Form popularity

FAQ

The tax rate for the CD-405 in North Carolina involves the franchise tax, calculated based on the higher of your company's net worth or the minimum franchise tax amount. It’s essential to take into account various factors like gross receipts and assets. When planning for taxes, especially dividends, using the North Carolina Increase Dividend - Resolution Form - Corporate Resolutions can help streamline the process.

Yes, North Carolina recognizes the Federal S Corporation election, allowing qualifying corporations to avoid double taxation. S Corporations in NC must comply with both state and federal tax regulations, which can affect dividend distributions. Utilizing the North Carolina Increase Dividend - Resolution Form - Corporate Resolutions can ensure proper management of interest and compliance with state laws.

The North Carolina state tax rate for individuals is currently set at a flat rate of 5.25%. Corporations and LLCs also have specific tax obligations based on their revenue and activities in the state. Understanding these rates is crucial when preparing to file taxes and can be influenced by decisions made using the North Carolina Increase Dividend - Resolution Form - Corporate Resolutions.

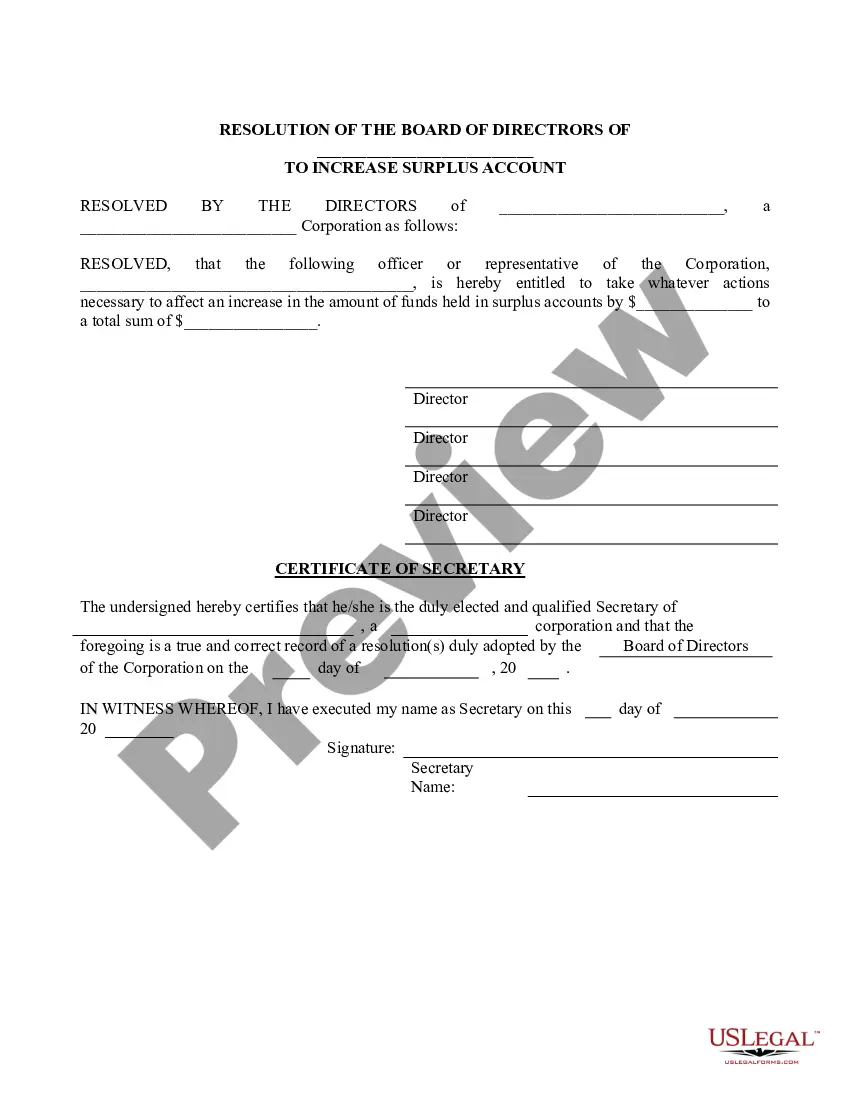

Writing a corporate resolution requires a clear statement of the decision being made, along with the date and signatures of the appropriate officers. The resolution should detail the specifics of the action, such as approving the North Carolina Increase Dividend - Resolution Form - Corporate Resolutions. This formal documentation is vital for maintaining legal records and guiding corporate governance.

To calculate the North Carolina franchise tax, you must determine your corporation’s net worth or the amount of your total assets in the state. The tax is calculated based on the higher of these values or a minimum tax amount established by the state. Using the North Carolina Increase Dividend - Resolution Form - Corporate Resolutions can help clarify your business’s financial strategy regarding dividends and tax implications.

The North Carolina CD-405 form has specific deadlines for filing, and extensions may be available under certain circumstances. These extensions can provide additional time for businesses to file their franchise tax returns. It's important to stay updated, as the North Carolina Increase Dividend - Resolution Form - Corporate Resolutions may impact any financial decisions during this period.

In North Carolina, LLCs are typically subject to a state income tax rate of 3% on their net income. Additionally, businesses must consider other taxes like the franchise tax. The North Carolina Increase Dividend - Resolution Form - Corporate Resolutions can be essential in managing distributions and ensuring compliance with tax regulations.

A good example of a resolution might involve a decision to increase dividends for shareholders, as documented in the North Carolina Increase Dividend - Resolution Form - Corporate Resolutions. This template can guide corporations in formalizing their decisions, detailing the amounts, times, and mechanisms of dividend distribution.

Drafting a resolution involves outlining the specific decision, including details like the voting process and authorizations required. Clearly define the scope and implications of the resolution. Using the North Carolina Increase Dividend - Resolution Form - Corporate Resolutions can help ensure accuracy and adherence to legal requirements.

To write a letter of resolution, start with an introductory paragraph that states the purpose of the document. Subsequently, clearly articulate the resolution and any necessary details regarding implementation. Leveraging the North Carolina Increase Dividend - Resolution Form - Corporate Resolutions can streamline your writing process and provide clarity.