North Carolina Letter to Creditors notifying them of Identity Theft

Description

How to fill out Letter To Creditors Notifying Them Of Identity Theft?

Are you currently in a placement that you need to have documents for either company or personal reasons almost every day time? There are a variety of authorized record web templates available online, but getting versions you can rely on is not effortless. US Legal Forms offers a huge number of form web templates, much like the North Carolina Letter to Creditors notifying them of Identity Theft, that are created to satisfy state and federal demands.

Should you be presently knowledgeable about US Legal Forms site and get your account, just log in. After that, you may acquire the North Carolina Letter to Creditors notifying them of Identity Theft design.

Should you not provide an account and wish to begin using US Legal Forms, adopt these measures:

- Discover the form you will need and ensure it is for the appropriate area/state.

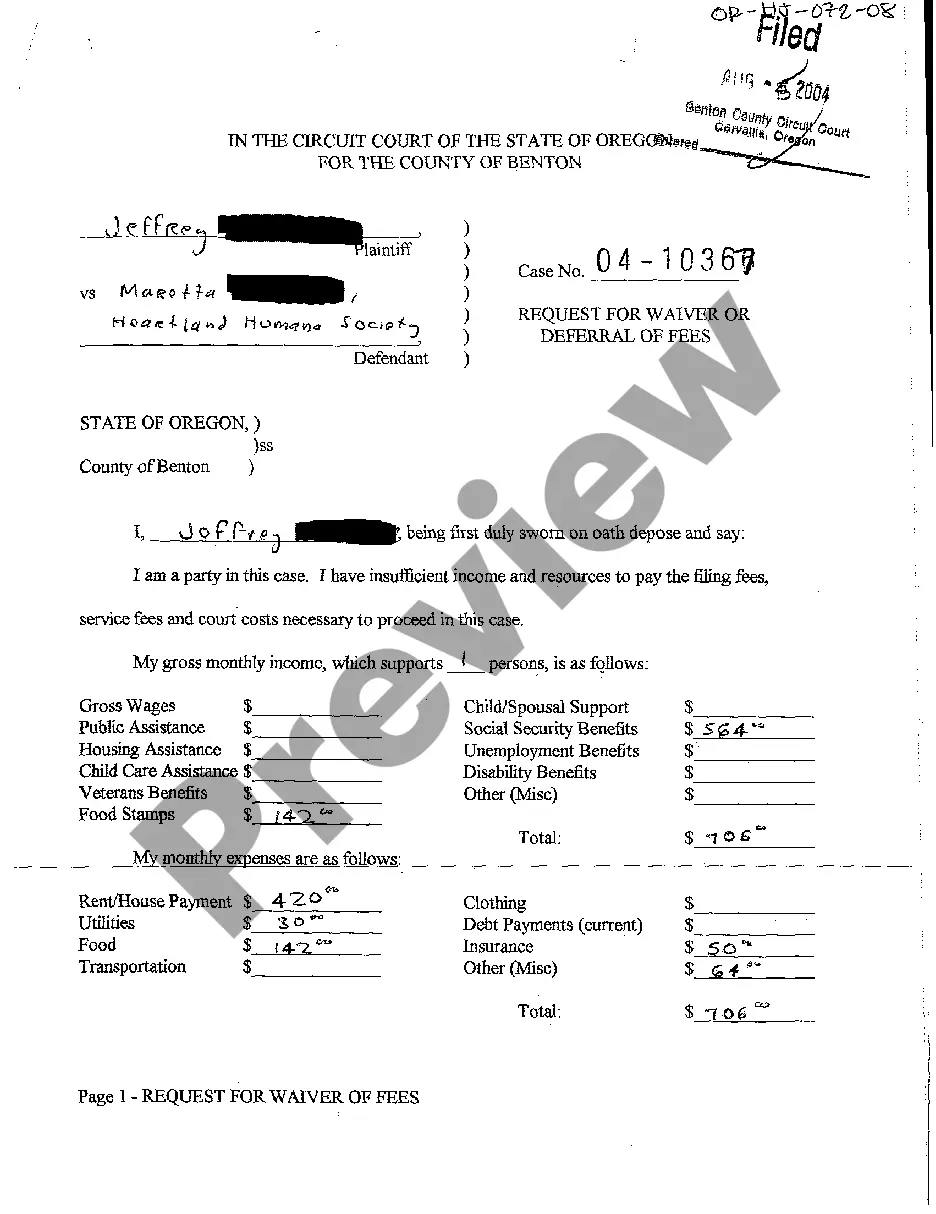

- Use the Preview switch to check the shape.

- Read the outline to ensure that you have selected the correct form.

- When the form is not what you`re searching for, take advantage of the Research industry to discover the form that meets your requirements and demands.

- When you get the appropriate form, click Buy now.

- Pick the costs strategy you would like, complete the necessary information to create your account, and purchase your order with your PayPal or bank card.

- Select a convenient file structure and acquire your backup.

Discover all of the record web templates you have bought in the My Forms food selection. You can obtain a additional backup of North Carolina Letter to Creditors notifying them of Identity Theft anytime, if possible. Just click the essential form to acquire or printing the record design.

Use US Legal Forms, probably the most substantial collection of authorized forms, to save lots of efforts and steer clear of faults. The services offers appropriately made authorized record web templates that can be used for an array of reasons. Make your account on US Legal Forms and start making your life easier.

Form popularity

FAQ

Sample dispute letter to credit reporting agencies: [RE: Your Account Number (if known)] Dear Sir or Madam: I am a victim of identity theft and I write to dispute certain information in my file resulting from the crime. I have circled the items I dispute on the attached copy of the report I received.

Asked by: Mr. Jillian Rau | Last update: February 9, 2022 Score: 4.1/5 (71 votes) Section 623 of the FRCA allows you to dispute any inaccurate information on your credit report directly with the original creditor, as long as you've already completed the process with the credit bureau.

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

I am a victim of identity theft, and I did not make [this/these] charge(s). I request that you remove the fraudulent charge(s) and any related finance charge and other charges from my account, send me an updated and accurate statement, and close the account (if applicable).

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.

Dispute Credit Fraud With Your Lenders Call any affected companies where fraud has occurred. Contact your credit card company and cancel all affected cards. Place a fraud alert with all three credit bureaus. Dispute incorrect information on your credit report. Close any other new accounts opened in your name.