North Carolina Secured Promissory Note

Description

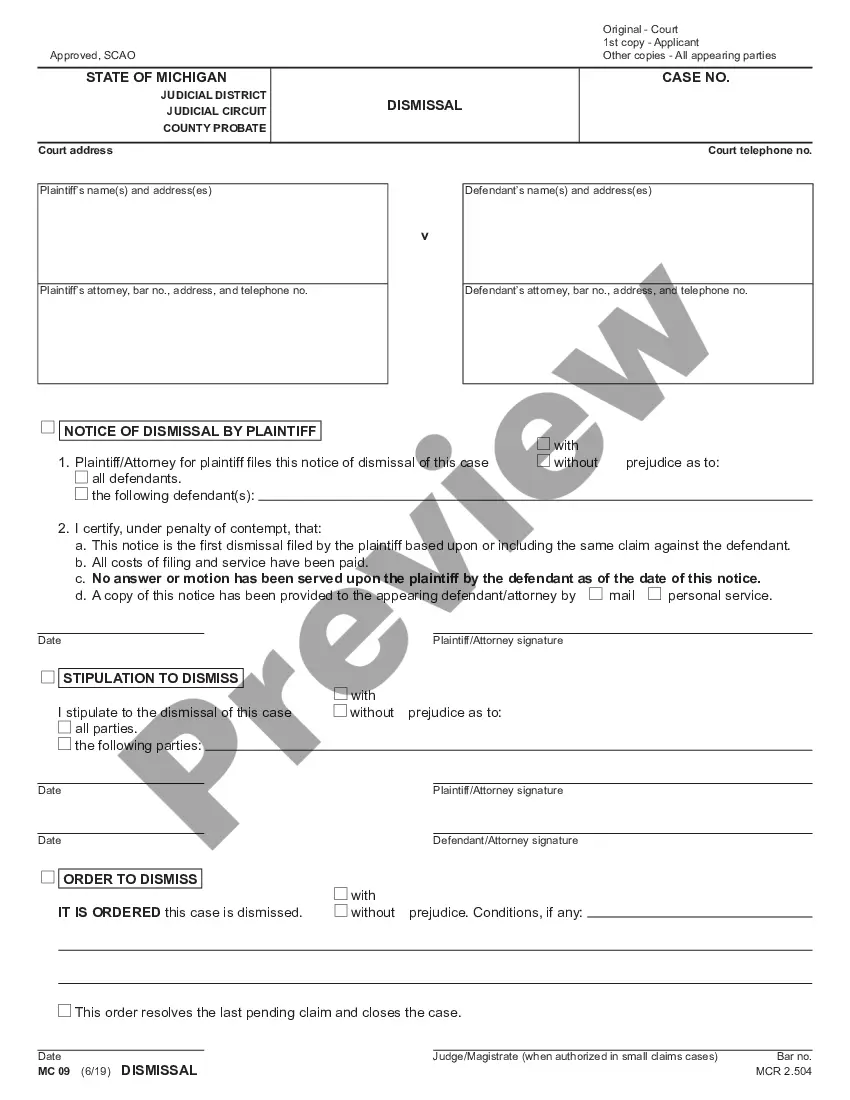

How to fill out Secured Promissory Note?

US Legal Forms - one of the largest collections of legal documents in the United States - provides an extensive selection of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal use, categorized by type, state, or key terms.

You can find the most recent editions of forms such as the North Carolina Secured Promissory Note in mere seconds.

Review the form summary to ensure you have chosen the appropriate one.

If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you already possess a monthly subscription, Log In to download the North Carolina Secured Promissory Note from the US Legal Forms library.

- The Download button will be visible on every form you view.

- You have access to all previously saved forms under the My documents section of your account.

- If you wish to use US Legal Forms for the first time, here are straightforward instructions to get you started.

- Verify that you have selected the correct form for your city/region.

- Click the Preview button to review the content of the form.

Form popularity

FAQ

If your North Carolina Secured Promissory Note is lost, it is important to notify the lender immediately. They may require you to provide a sworn statement regarding the loss. In some cases, lenders may issue a replacement note or request a legal process to confirm the terms of the original note.

To obtain your North Carolina Secured Promissory Note, start by contacting the lender or financial institution that issued it. They will guide you through their process for issuing or retrieving a promissory note. Additionally, you may use platforms like US Legal Forms to create a new note if necessary.

The main difference lies in collateral. A North Carolina Secured Promissory Note requires the borrower to pledge an asset as security, while an unsecured note does not involve collateral. This distinction impacts the risk level for lenders, with secured notes generally presenting a lower risk.

A North Carolina Secured Promissory Note can have disadvantages, such as the requirement for collateral, which may limit borrowing options. Additionally, if the borrower defaults, they risk losing the asset tied to the note. It is important to understand these risks before entering into a secured agreement.

Yes, a North Carolina Secured Promissory Note is specifically backed by collateral. This means that if the borrower fails to repay, the lender can claim the specified asset. This arrangement helps protect the lender's investment, making secured promissory notes a safer option when compared to unsecured notes.

An assignment of promissory notes does not have to be notarized, but doing so can help solidify its validity. Notarization provides a written record that may be beneficial in case of disputes regarding the assignment. Consider discussing notarization with your lender to determine the best practice for your North Carolina Secured Promissory Note.

To fill out a promissory note, start with the date and the names of the lender and borrower. Clearly specify the amount to be repaid, the interest rate, and the payment schedule. Lastly, ensure both parties sign the note, and consider using a reliable service like USLegalForms for an easy, comprehensive format that meets legal requirements.

A promissory note may be invalid if it lacks essential elements such as a clear amount, proper signatures, or if the terms are ambiguous. Additionally, if the parties involved did not have the legal capacity to enter into the agreement or if it involves illegal consideration, the note's validity can be compromised. It's crucial to consult templates from USLegalForms to keep it compliant.

Yes, a promissory note can still be legal without notarization. While notarization adds credibility and can help in legal situations, the note's enforceability primarily depends on its contents and whether both parties agree to the terms. For a North Carolina Secured Promissory Note, just ensure that all critical elements are present and clearly articulated.

In North Carolina, a secured promissory note does not necessarily need to be notarized to be valid. However, notarization can provide an extra layer of authenticity and may be required by lenders for added security. Moreover, if you are using the note for legal proceedings, it’s prudent to have it notarized to avoid disputes about its validity.