North Carolina Multistate Promissory Note - Secured

Description

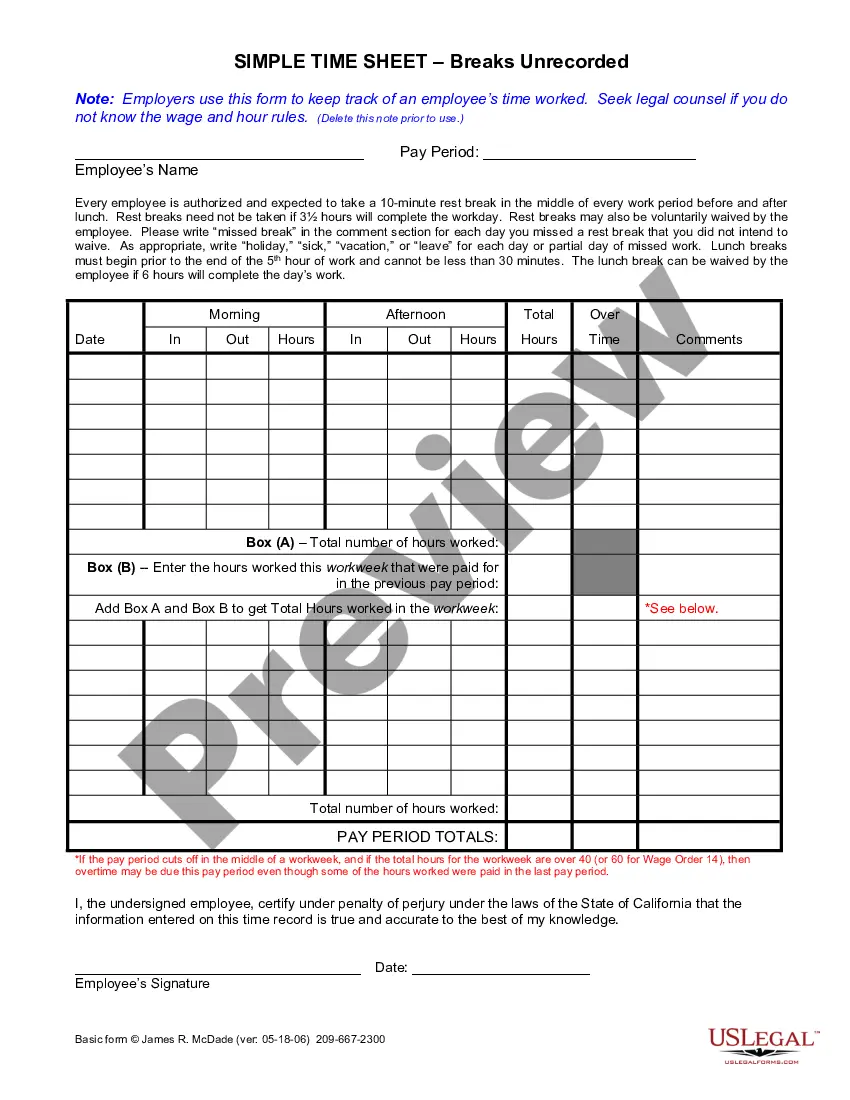

How to fill out Multistate Promissory Note - Secured?

If you wish to download, retrieve, or print legal document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search tool to find the documents you need.

Numerous templates for business and personal purposes are categorized by states and keywords.

Every legal document template you procure is yours indefinitely.

You retain access to all forms you have saved in your account. Visit the My documents section and select a form to print or download again. Stay competitive and download, and print the North Carolina Multistate Promissory Note - Secured with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to acquire the North Carolina Multistate Promissory Note - Secured with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Obtain button to access the North Carolina Multistate Promissory Note - Secured.

- You can also view forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview function to examine the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Lookup area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you want, click the Get now button. Choose your pricing plan and enter your information to register for an account.

- Step 5. Process the payment. You can utilize your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the North Carolina Multistate Promissory Note - Secured.

Form popularity

FAQ

A promissory note may be considered invalid if it lacks essential information, is not signed by the parties involved, or if it involves illegal terms. Additionally, if a North Carolina Multistate Promissory Note - Secured does not comply with state laws, it may not hold up in court. Ensuring all requirements are met can save you from potential issues.

To make a promissory note enforceable, you must adhere to the legal requirements set forth in your state. This includes having the document in writing, clearly defining the payment terms, and obtaining signatures from both parties. Particularly with a North Carolina Multistate Promissory Note - Secured, following local regulations bolsters its enforceability.

To ensure a promissory note is valid, it must include essential elements such as the amount owed, the interest rate, and the payment terms. Additionally, both the borrower and lender must sign the note for it to hold legal weight. For a North Carolina Multistate Promissory Note - Secured, following the state's guidelines is crucial for validity.

Not all promissory notes have collateral, but a North Carolina Multistate Promissory Note - Secured typically does. The inclusion of collateral enhances security for the lender. By defining the collateral within the document, both parties understand what is at stake.

A promissory note can exist with or without collateral. When a promissory note is secured, it typically includes collateral to protect the lender. In the case of a North Carolina Multistate Promissory Note - Secured, specifying collateral is essential as it provides a clear fallback for the lender in case of default.

The two types of security instruments commonly used are mortgages and deeds of trust. In the context of the North Carolina Multistate Promissory Note - Secured, understanding these instruments can help borrowers choose the right path for their financing needs. Each type comes with its own rights and responsibilities, impacting how transactions are executed and secured.

Yes, a mortgage-backed security is indeed a debt instrument. It is created by bundling multiple mortgages together, allowing investors to buy shares in this package. In relation to the North Carolina Multistate Promissory Note - Secured, understanding how these securities work can provide insights into how your real estate investments might be leveraged in the broader financial market.

Filling out a promissory demand note requires similar details as a standard promissory note but with an emphasis on the demand for immediate payment. You'll need to include the names and addresses of both parties, the amount owed, and any stipulations regarding immediate repayment. For the North Carolina Multistate Promissory Note - Secured, ensure you specify the conditions under which you may demand payment.

Yes, there is a widely accepted format for promissory notes that includes key components like the date, parties involved, principal amount, interest rate, repayment schedule, and any governing laws. When utilizing the North Carolina Multistate Promissory Note - Secured, it is crucial to follow this established format to ensure legal enforceability and clarity in your agreement.

To write a promissory note, start by titling the document. Clearly state the names of the parties involved, followed by the amount owed and the terms of repayment, including the interest rate. Make reference to the North Carolina Multistate Promissory Note - Secured specifications if collateral is involved, as this strengthens the agreement and clarity.