North Carolina Promissory Note - Satisfaction and Release

Description

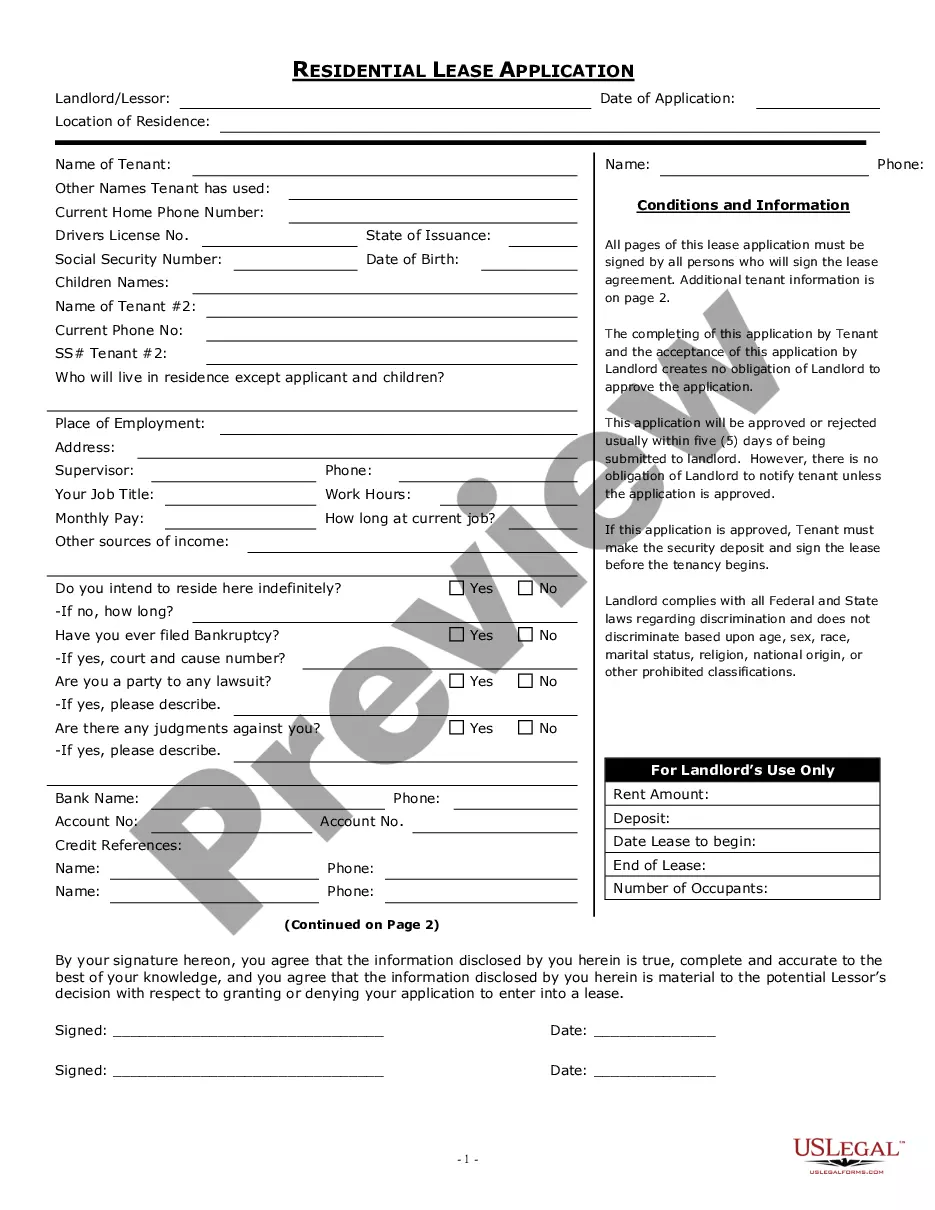

How to fill out Promissory Note - Satisfaction And Release?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a diverse selection of legal document formats that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the most recent forms such as the North Carolina Promissory Note - Satisfaction and Release in no time.

If you already have an account, Log In and download the North Carolina Promissory Note - Satisfaction and Release from the US Legal Forms library. The Download button will appear on each document you view. You can access all previously saved forms within the My documents section of your account.

Complete the transaction. Use a credit card or PayPal account to finalize the purchase.

Choose the format and download the form to your device. Edit. Complete, modify, print, and sign the saved North Carolina Promissory Note - Satisfaction and Release. Each template you add to your account has no expiration date and is yours indefinitely. Thus, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the North Carolina Promissory Note - Satisfaction and Release with US Legal Forms, the most comprehensive library of legal document formats. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs.

- Ensure you have selected the correct form for your city/county.

- Click the Preview button to review the content of the form.

- Check the form details to confirm that you have chosen the right document.

- If the form does not meet your needs, use the Search field at the top of the page to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Acquire now button.

- Next, select the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

To get a promissory note, you can either draft one yourself or use a template from a reputable service like USLegalForms. Ensure that it meets the legal standards for North Carolina Promissory Note - Satisfaction and Release, so your agreement remains valid and enforceable. With proper guidance, you can create a robust document that protects both parties involved.

If you lose your promissory note, it is essential to notify your lender immediately. They can provide you with the necessary steps to replace it and ensure your obligations are accurately recognized. Using a service like USLegalForms can assist you in recreating your North Carolina Promissory Note - Satisfaction and Release, streamlining the resolution process.

Your master promissory note may be available through the lender that issued it. Often, educational institutions or financial agencies maintain records of such notes. If you need help locating it, USLegalForms can guide you through the process of obtaining the North Carolina Promissory Note - Satisfaction and Release quickly and efficiently.

To obtain your North Carolina Promissory Note - Satisfaction and Release, you should first check with your lender or financial institution. They typically maintain the original document and can provide you with a copy upon request. If you used a service like USLegalForms, you might also find your note in your account or by contacting customer support for assistance.

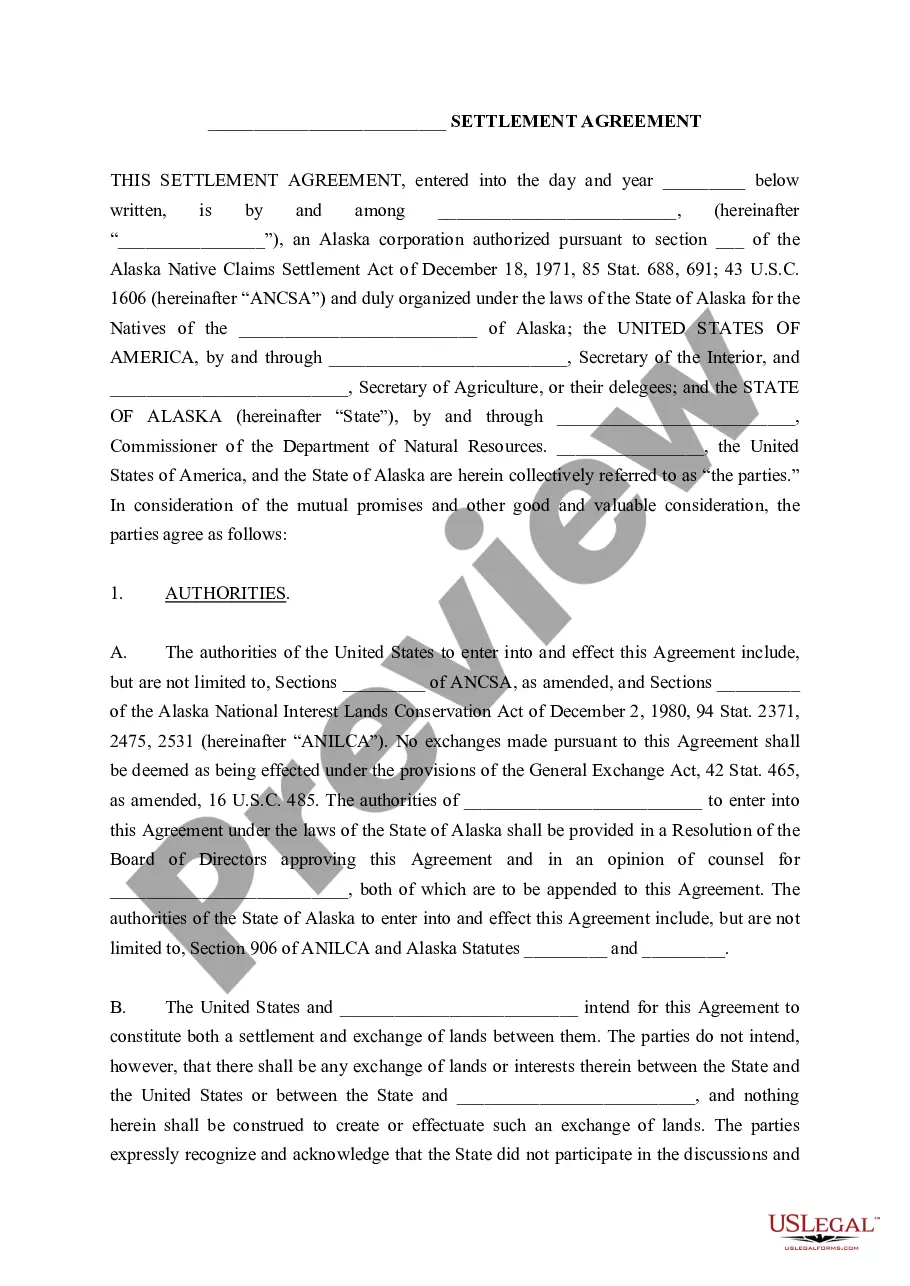

Terminating a promissory note involves officially concluding the agreement before its maturity date. You may need to negotiate with the lender, possibly agreeing on a lump sum payment to settle the debt early. Using US Legal Forms can guide you through the process, ensuring that you complete all necessary documentation for a seamless termination of your North Carolina Promissory Note - Satisfaction and Release.

Discharging a promissory note means you have fulfilled all payment obligations. You can confirm this by obtaining a discharge document from the lender, which legally confirms that the debt is settled. In North Carolina, ensuring that this discharge is documented can prevent any future claims against you related to the promissory note.

In North Carolina, a debt can become uncollectible after a six-year statute of limitations expires. This typically starts from the date of the last payment or the date of default. However, various factors can affect this timeline. Utilizing services like uslegalforms can help clarify your situation regarding North Carolina Promissory Note - Satisfaction and Release, ensuring you are well-informed about your obligations and rights.

In North Carolina, a promissory note remains valid for a period of three years from the date of default. After this period, the creditor may face challenges in enforcing the note. It's important to note that the details of the note, including any agreements about satisfaction and release, can influence this timeframe. To ensure you understand your rights fully, consider exploring resources on North Carolina Promissory Note - Satisfaction and Release.

In North Carolina, most contracts do not need to be notarized to be enforceable. However, certain types of contracts, such as those involving real estate transactions, may require notarization. If you are drafting a North Carolina Promissory Note - Satisfaction and Release, consider getting it notarized for added security.

Yes, a promissory note is a legally binding document that outlines the borrower's promise to repay a specified amount to the lender. This agreement holds up in court, provided it meets the legal requirements of North Carolina. Understanding this aspect is essential for individuals involved in creating a North Carolina Promissory Note - Satisfaction and Release.